Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate CIMB bank rate sensitive assets. Calculate CIMB bank rate sensitive liabilities. Calculate the change in CIMB's profit if interest to decrease from 8% to

Calculate CIMB bank rate sensitive assets.

Calculate CIMB bank rate sensitive liabilities.

Calculate the change in CIMB's profit if interest to decrease from 8% to 6%

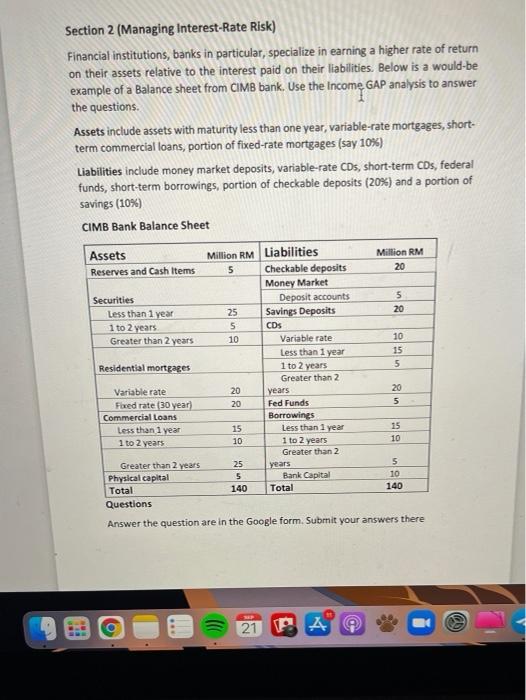

Section 2 (Managing Interest-Rate Risk) Financial institutions, banks in particular, specialize in earning a higher rate of return on their assets relative to the interest paid on their liabilities. Below is a would-be example of a Balance sheet from CIMB bank. Use the Income GAP analysis to answer the questions. Assets include assets with maturity less than one year, variable-rate mortgages, short- term commercial loans, portion of fixed-rate mortgages (say 10%) Liabilities include money market deposits, variable-rate CDs, short-term CDs, federal funds, short-term borrowings, portion of checkable deposits (20%) and a portion of savings (10%) CIMB Bank Balance Sheet Assets Reserves and Cash Items Securities Less than 1 year 1 to 2 years Greater than 2 years Residential mortgages Variable rate Fixed rate (30 year) Commercial Loans Less than 1 year 1 to 2 years Greater than 2 years Million RM Liabilities 5 25 5 10 20 20 15 10 25 5 140 Checkable deposits Money Market Deposit accounts Savings Deposits CDs Variable rate Less than 1 year 1 to 2 years Greater than 2 years Fed Funds Borrowings Less than 1 year 1 to 2 years Greater than 2 years Bank Capital Total SEP 21 F Million RM 20 A 5 20 10 15 5 20 5 Physical capital Total Questions Answer the question are in the Google form. Submit your answers there 15 10 5 10 140

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

aCIMB banks rate sensitive assets would include its variablerate mortgages shortterm commercial loan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started