Answered step by step

Verified Expert Solution

Question

1 Approved Answer

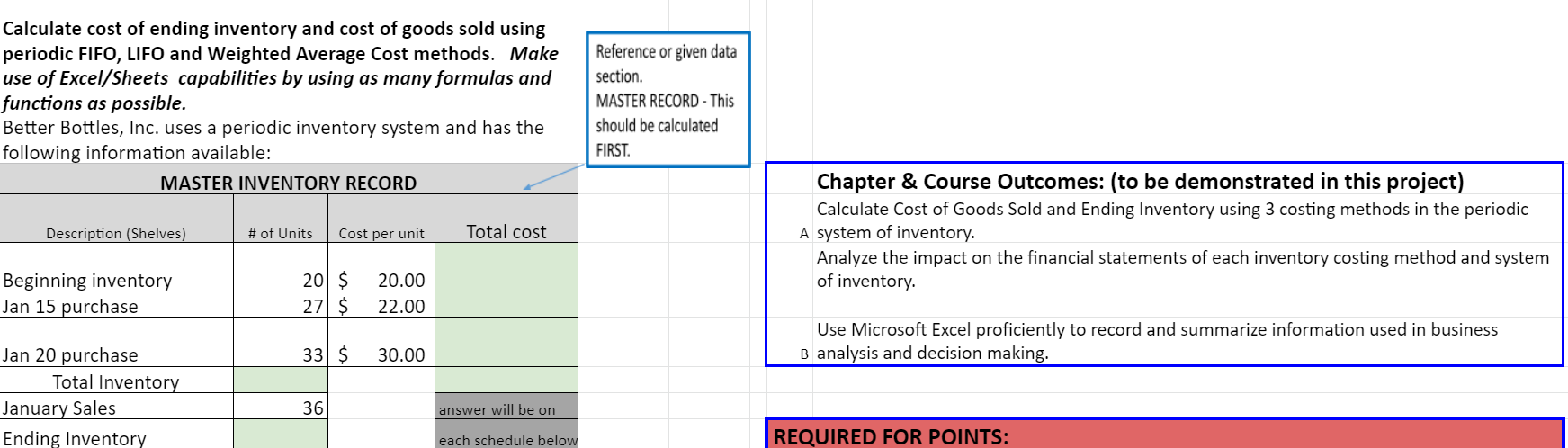

Calculate cost of ending inventory and cost of goods sold using periodic FIFO, LIFO and Weighted Average Cost methods. Make use of Excel/Sheets capabilities by

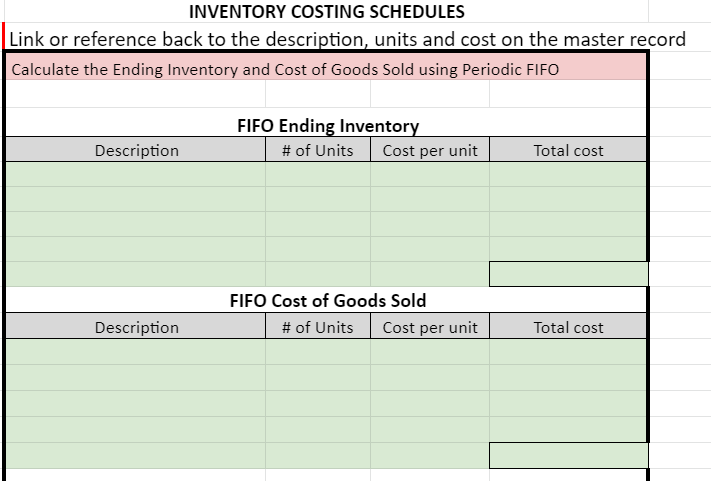

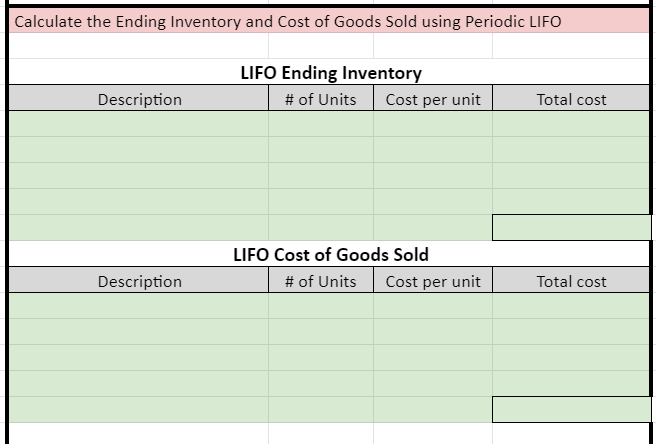

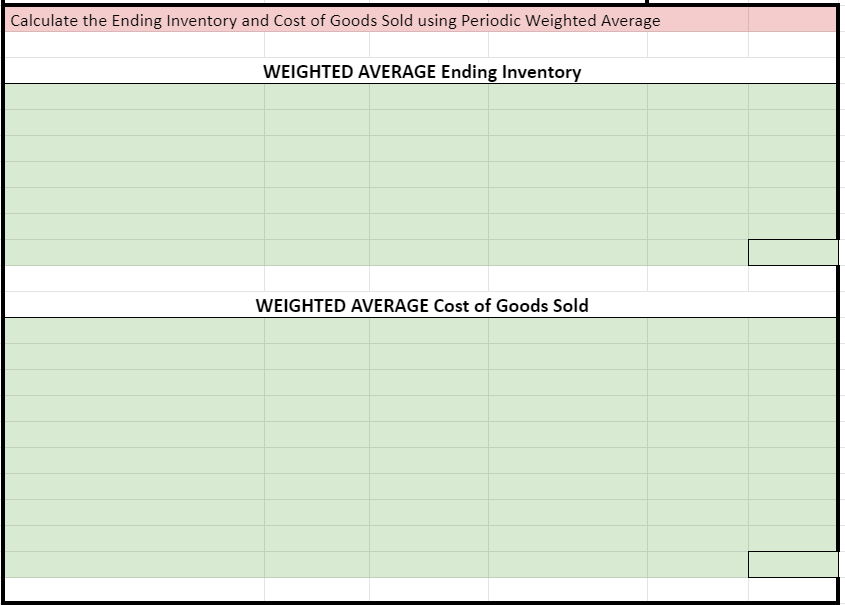

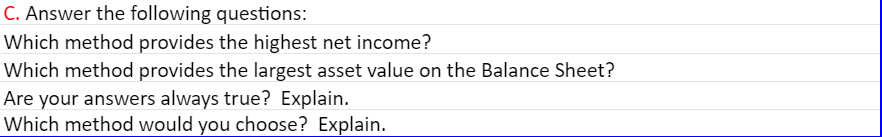

Calculate cost of ending inventory and cost of goods sold using periodic FIFO, LIFO and Weighted Average Cost methods. Make use of Excel/Sheets capabilities by using as many formulas and functions as possible. Better Bottles, Inc. uses a periodic inventory system and has the following information available: MASTER INVENTORY RECORD Reference or given data section. MASTER RECORD - This should be calculated FIRST. Description (Shelves) # of Units Cost per unit Total cost Chapter & Course Outcomes: (to be demonstrated in this project) Calculate Cost of Goods Sold and Ending Inventory using 3 costing methods in the periodic A system of inventory. Analyze the impact on the financial statements of each inventory costing method and system of inventory. Beginning inventory Jan 15 purchase 20 $ 27 $ 20.00 22.00 Use Microsoft Excel proficiently to record and summarize information used in business B analysis and decision making. 33 $ 30.00 Jan 20 purchase Total Inventory January Sales Ending Inventory 36 answer will be on each schedule below REQUIRED FOR POINTS: INVENTORY COSTING SCHEDULES Link or reference back to the description, units and cost on the master record Calculate the Ending Inventory and Cost of Goods Sold using Periodic FIFO FIFO Ending Inventory # of Units Cost per unit Description Total cost FIFO Cost of Goods Sold # of Units Cost per unit Description Total cost Calculate the Ending Inventory and Cost of Goods Sold using Periodic LIFO LIFO Ending Inventory # of Units Cost per unit Description Total cost LIFO Cost of Goods Sold # of Units Cost per unit Description Total cost Calculate the Ending Inventory and Cost of Goods Sold using Periodic Weighted Average WEIGHTED AVERAGE Ending Inventory WEIGHTED AVERAGE Cost of Goods Sold C. Answer the following questions: Which method provides the highest net income? Which method provides the largest asset value on the Balance Sheet? Are your answers always true? Explain. Which method would you choose? Explain. Calculate cost of ending inventory and cost of goods sold using periodic FIFO, LIFO and Weighted Average Cost methods. Make use of Excel/Sheets capabilities by using as many formulas and functions as possible. Better Bottles, Inc. uses a periodic inventory system and has the following information available: MASTER INVENTORY RECORD Reference or given data section. MASTER RECORD - This should be calculated FIRST. Description (Shelves) # of Units Cost per unit Total cost Chapter & Course Outcomes: (to be demonstrated in this project) Calculate Cost of Goods Sold and Ending Inventory using 3 costing methods in the periodic A system of inventory. Analyze the impact on the financial statements of each inventory costing method and system of inventory. Beginning inventory Jan 15 purchase 20 $ 27 $ 20.00 22.00 Use Microsoft Excel proficiently to record and summarize information used in business B analysis and decision making. 33 $ 30.00 Jan 20 purchase Total Inventory January Sales Ending Inventory 36 answer will be on each schedule below REQUIRED FOR POINTS: INVENTORY COSTING SCHEDULES Link or reference back to the description, units and cost on the master record Calculate the Ending Inventory and Cost of Goods Sold using Periodic FIFO FIFO Ending Inventory # of Units Cost per unit Description Total cost FIFO Cost of Goods Sold # of Units Cost per unit Description Total cost Calculate the Ending Inventory and Cost of Goods Sold using Periodic LIFO LIFO Ending Inventory # of Units Cost per unit Description Total cost LIFO Cost of Goods Sold # of Units Cost per unit Description Total cost Calculate the Ending Inventory and Cost of Goods Sold using Periodic Weighted Average WEIGHTED AVERAGE Ending Inventory WEIGHTED AVERAGE Cost of Goods Sold C. Answer the following questions: Which method provides the highest net income? Which method provides the largest asset value on the Balance Sheet? Are your answers always true? Explain. Which method would you choose? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started