Answered step by step

Verified Expert Solution

Question

1 Approved Answer

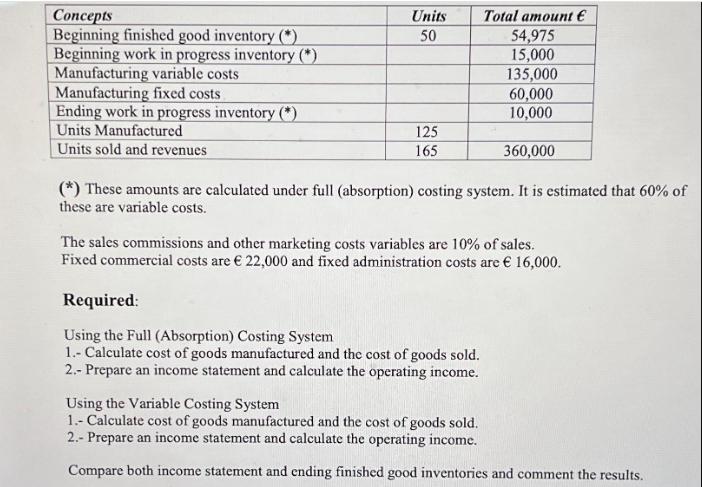

Concepts Beginning finished good inventory (*) Beginning work in progress inventory (*) Manufacturing variable costs Manufacturing fixed costs Ending work in progress inventory (*)

Concepts Beginning finished good inventory (*) Beginning work in progress inventory (*) Manufacturing variable costs Manufacturing fixed costs Ending work in progress inventory (*) Units Manufactured Units sold and revenues Units 50 125 165 Total amount 54,975 15,000 135,000 60,000 10,000 360,000 (*) These amounts are calculated under full (absorption) costing system. It is estimated that 60% of these are variable costs. Required: Using the Full (Absorption) Costing System 1.- Calculate cost of goods manufactured and the cost of goods sold. 2.- Prepare an income statement and calculate the operating income. The sales commissions and other marketing costs variables are 10% of sales. Fixed commercial costs are 22,000 and fixed administration costs are 16,000. Using the Variable Costing System 1.- Calculate cost of goods manufactured and the cost of goods sold. 2.- Prepare an income statement and calculate the operating income. Compare both income statement and ending finished good inventories and comment the results.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the cost of goods manufactured and the cost of goods sold using both Full Absorption Costing System and Variable Costing System well need to follow some standard accounting calculations L...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started