Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate each of the seven ratios for the United States Steel Corporation (X). Show your work X had total revenue for the last 12 months

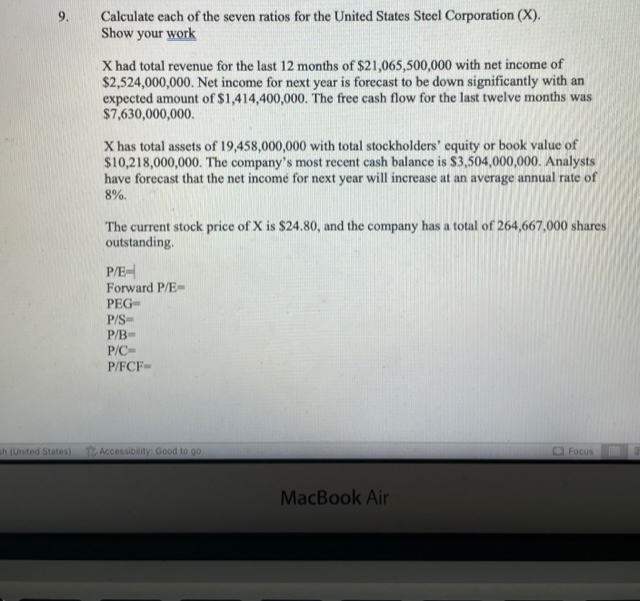

Calculate each of the seven ratios for the United States Steel Corporation (X). Show your work X had total revenue for the last 12 months of $21,065,500,000 with net income of $2,524,000,000. Net income for next year is forecast to be down significantly with an expected amount of $1,414,400,000. The free cash flow for the last twelve months was $7,630,000,000. X has total assets of 19,458,000,000 with total stockholders' equity or book value of $10,218,000,000. The company's most recent cash balance is $3,504,000,000. Analysts have forecast that the net income for next year will increase at an average annual rate of 8%. The current stock price of X is $24.80, and the company has a total of 264,667,000 shares outstanding. P/E= Forward P/E= PEG= P/S= P/B= P/C= P/FCF= Calculate each of the seven ratios for the United States Steel Corporation (X). Show your work X had total revenue for the last 12 months of $21,065,500,000 with net income of $2,524,000,000. Net income for next year is forecast to be down significantly with an expected amount of $1,414,400,000. The free cash flow for the last twelve months was $7,630,000,000. X has total assets of 19,458,000,000 with total stockholders' equity or book value of $10,218,000,000. The company's most recent cash balance is $3,504,000,000. Analysts have forecast that the net income for next year will increase at an average annual rate of 8%. The current stock price of X is $24.80, and the company has a total of 264,667,000 shares outstanding. P/E= Forward P/E= PEG= P/S= P/B= P/C= P/FCF=

Calculate each of the seven ratios for the United States Steel Corporation (X). Show your work X had total revenue for the last 12 months of $21,065,500,000 with net income of $2,524,000,000. Net income for next year is forecast to be down significantly with an expected amount of $1,414,400,000. The free cash flow for the last twelve months was $7,630,000,000. X has total assets of 19,458,000,000 with total stockholders' equity or book value of $10,218,000,000. The company's most recent cash balance is $3,504,000,000. Analysts have forecast that the net income for next year will increase at an average annual rate of 8%. The current stock price of X is $24.80, and the company has a total of 264,667,000 shares outstanding. P/E= Forward P/E= PEG= P/S= P/B= P/C= P/FCF= Calculate each of the seven ratios for the United States Steel Corporation (X). Show your work X had total revenue for the last 12 months of $21,065,500,000 with net income of $2,524,000,000. Net income for next year is forecast to be down significantly with an expected amount of $1,414,400,000. The free cash flow for the last twelve months was $7,630,000,000. X has total assets of 19,458,000,000 with total stockholders' equity or book value of $10,218,000,000. The company's most recent cash balance is $3,504,000,000. Analysts have forecast that the net income for next year will increase at an average annual rate of 8%. The current stock price of X is $24.80, and the company has a total of 264,667,000 shares outstanding. P/E= Forward P/E= PEG= P/S= P/B= P/C= P/FCF= Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started