Question

Calculate EOQ and ROP values for FY2021 based on your forecast from Question 2 and recommendations for their sock supplier and transportation company from Question

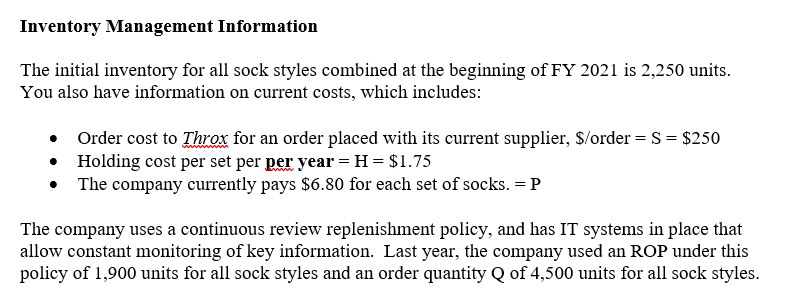

- Calculate EOQ and ROP values for FY2021 based on your forecast from Question 2 and recommendations for their sock supplier and transportation company from Question 4 & 5. (TIP: The selected supplier may change your S and P values.) Give your final answer in full sock sets (ROUND UP to the next whole number). What are the expected costs for inventory management based on your decisions? How does this compare to companys current policy results from their current Q & ROP?

|

| Weight | Current Supplier | Alternative A | Alternative B |

| Unit Price 3-sock set | 0.4 | 6.5 (1.2) | 5.75 (0.4) | 5 (0.8) |

| Order Cost, $/order | 0.1 | 250 (0.3) | 325 (0.1) | 200 (0.2) |

| Defect Rate | 0.3 | 2.8% - (0.9) | 0.5% - (0.3) | 0.5 (0.6) |

| Financial Condition | 0.2 | Good 3 (0.6) | Poor 1 (0.2) | Fair 2- (0.4) |

| Total Score | 1 | 3 | 1 | 2 |

From the scorecard table above, we can see that the current supplier scores the highest out of all options and with the score of 3, should be used by Throx.

|

| Maersk (current) | USA Express (Alternative) |

| Cost of Stock | 100 * 100 = $10000 | 10000 |

| Freight (A) | 1.35 * 100 (units) = $135 | 3.95 * 100 = $395 |

| Damage (B) | 100 (units) * 2.8% * $100 = 280 | 100 * 0.5 * 100 = $50 |

| Blockage (C) | 10000 * 10% * (4/52) = $76.92 | 10000 * 10% * (0.5/52) = $9.61 |

| Total Cost (A + B + C) | $491.92 | $454.61 |

Due to the difference in average time for the period, funds will be blocked between the difference.

USA Express offers a cheaper option, with lower damage rates and transit times. This allows for more leeway between errors and makes the option far better than Maersk.

Forecasting method chosen- Exponential Smoothing (Alpha = 0.8) = 25379 + 0.8 * (29975 25379) = 29055.8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started