Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate Equivalent Units, Unit Costs, and Transferred CostsFIFO Method Gaston Manu- facturing, Inc., operates a plant that produces its own regionally marketed Spicy Steak

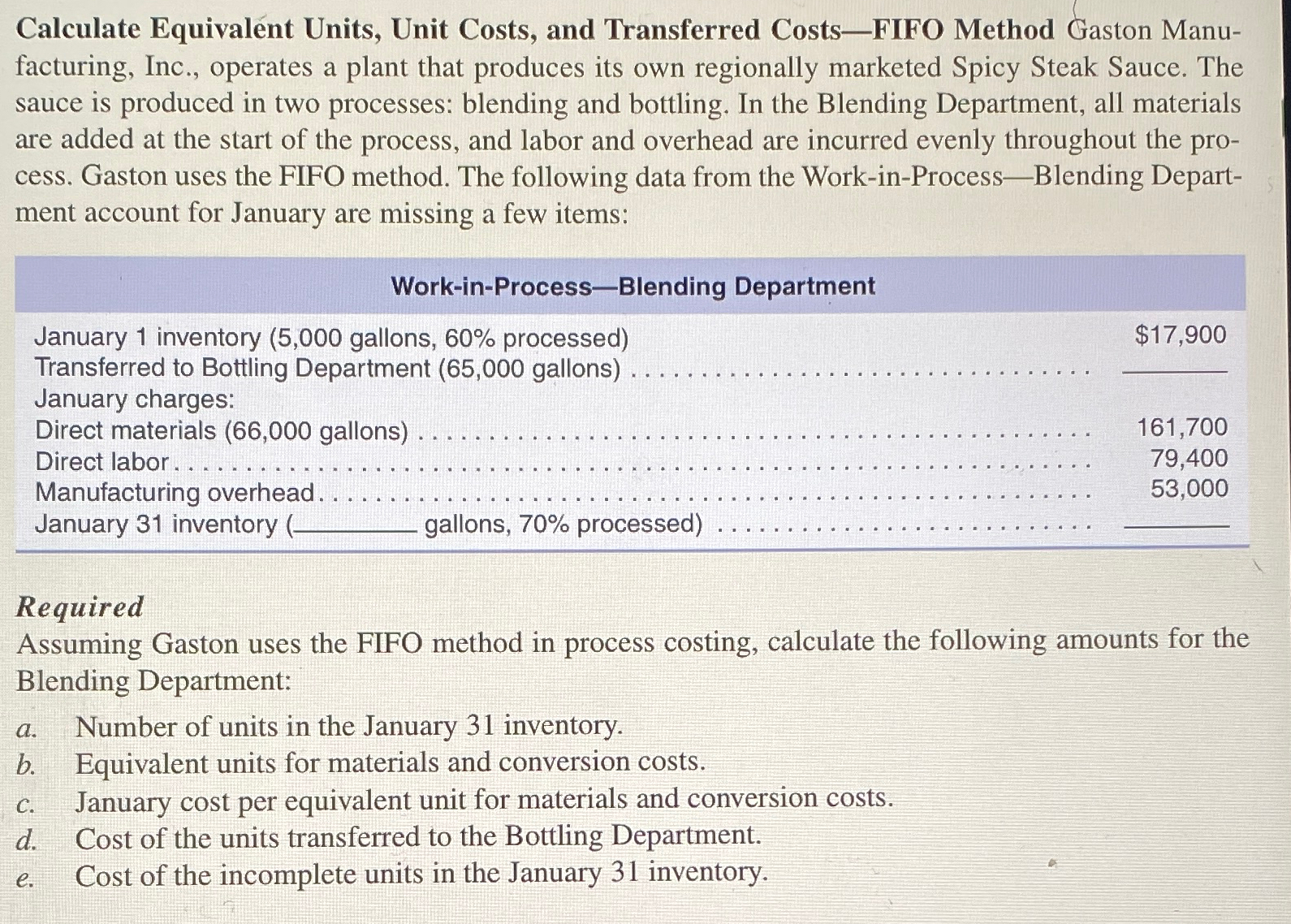

Calculate Equivalent Units, Unit Costs, and Transferred CostsFIFO Method Gaston Manu- facturing, Inc., operates a plant that produces its own regionally marketed Spicy Steak Sauce. The sauce is produced in two processes: blending and bottling. In the Blending Department, all materials are added at the start of the process, and labor and overhead are incurred evenly throughout the pro- cess. Gaston uses the FIFO method. The following data from the Work-in-Process-Blending Depart- ment account for January are missing a few items: Work-in-Process-Blending Department January 1 inventory (5,000 gallons, 60% processed) Transferred to Bottling Department (65,000 gallons) January charges: Direct materials (66,000 gallons). Direct labor.... Manufacturing overhead. January 31 inventory (- gallons, 70% processed) $17,900 161,700 79,400 53,000 Required Assuming Gaston uses the FIFO method in process costing, calculate the following amounts for the Blending Department: a. b. C. d. e. Number of units in the January 31 inventory. Equivalent units for materials and conversion costs. January cost per equivalent unit for materials and conversion costs. Cost of the units transferred to the Bottling Department. Cost of the incomplete units in the January 31 inventory.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the required amounts for Gaston Manufacturing Inc using the FIFO method we will follow these steps a Number of units in the January 31 in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started