Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate expected return for Bond B Mia is considering setting up an investment portfolio. She has $20000 cash on hand and would like to spend

Calculate expected return for Bond B

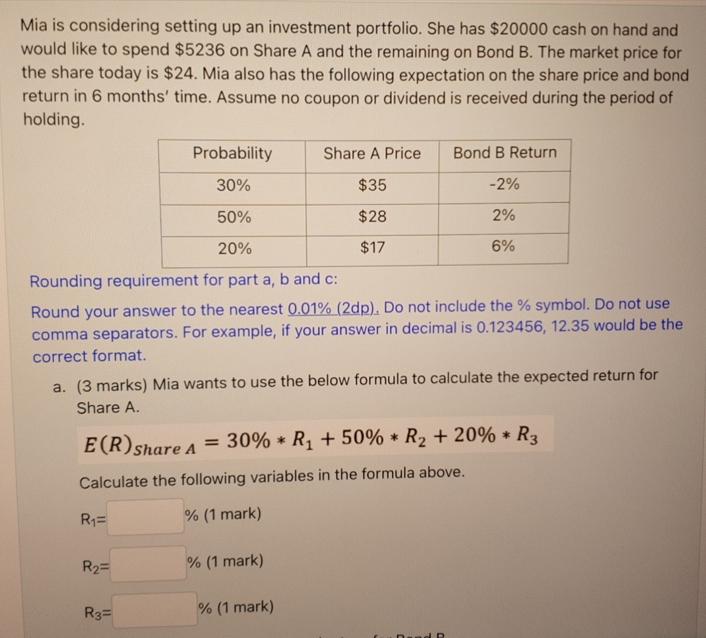

Mia is considering setting up an investment portfolio. She has $20000 cash on hand and would like to spend $5236 on Share A and the remaining on Bond B. The market price for the share today is $24. Mia also has the following expectation on the share price and bond return in 6 months' time. Assume no coupon or dividend is received during the period of holding. Probability 30% 50% 20% Rounding requirement for part a, b and c: Round your answer to the nearest 0.01% (2dp). Do not include the % symbol. Do not use comma separators. For example, if your answer in decimal is 0.123456, 12.35 would be the correct format. a. (3 marks) Mia wants to use the below formula to calculate the expected return for Share A. R= Share A Price $35 $28 $17 E(R) share A = 30% * R + 50% * R + 20% * R3 Calculate the following variables in the formula above. % (1 mark) % (1 mark) R= R3= Bond B Return -2% 2% 6% % (1 mark) P

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Expected return ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started