Answered step by step

Verified Expert Solution

Question

1 Approved Answer

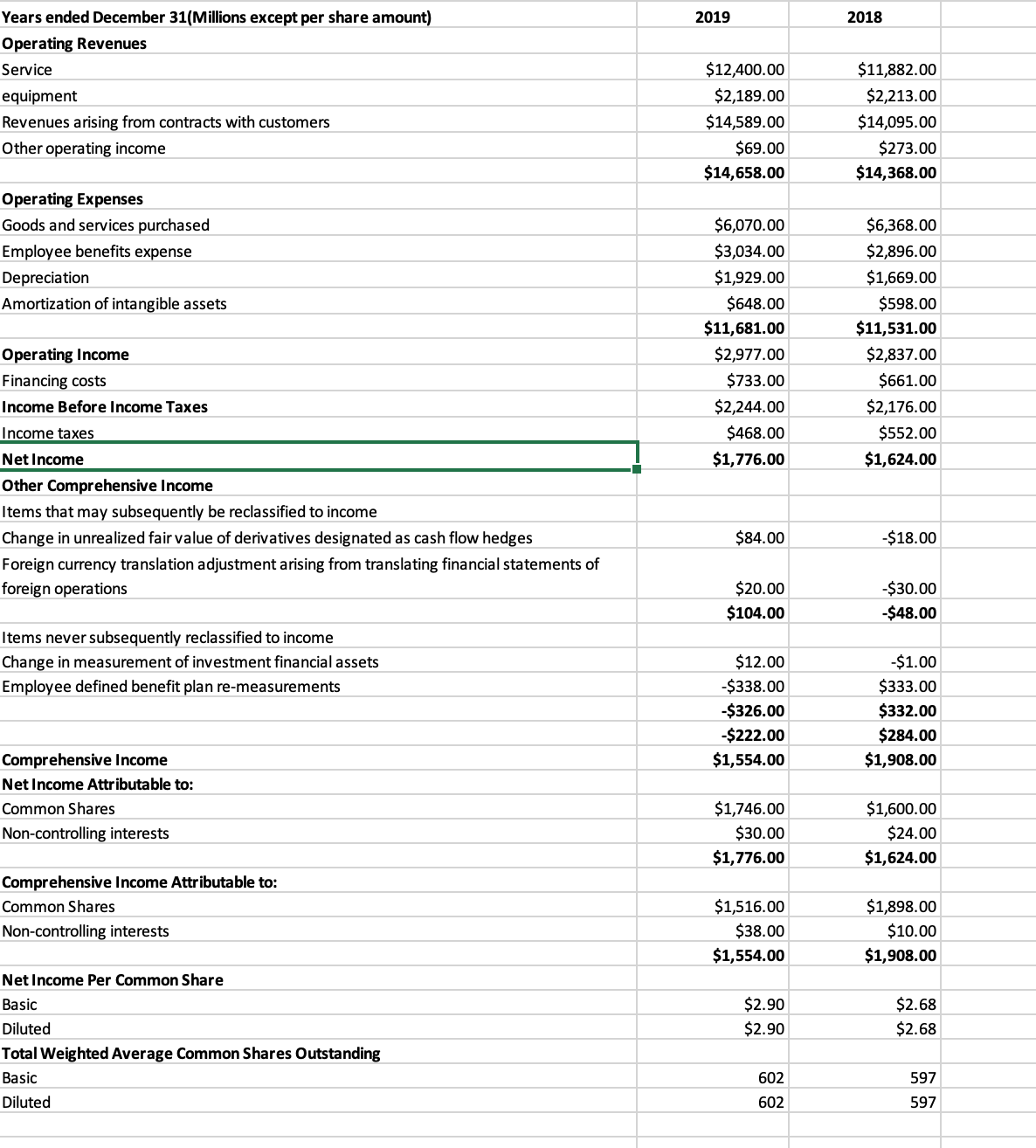

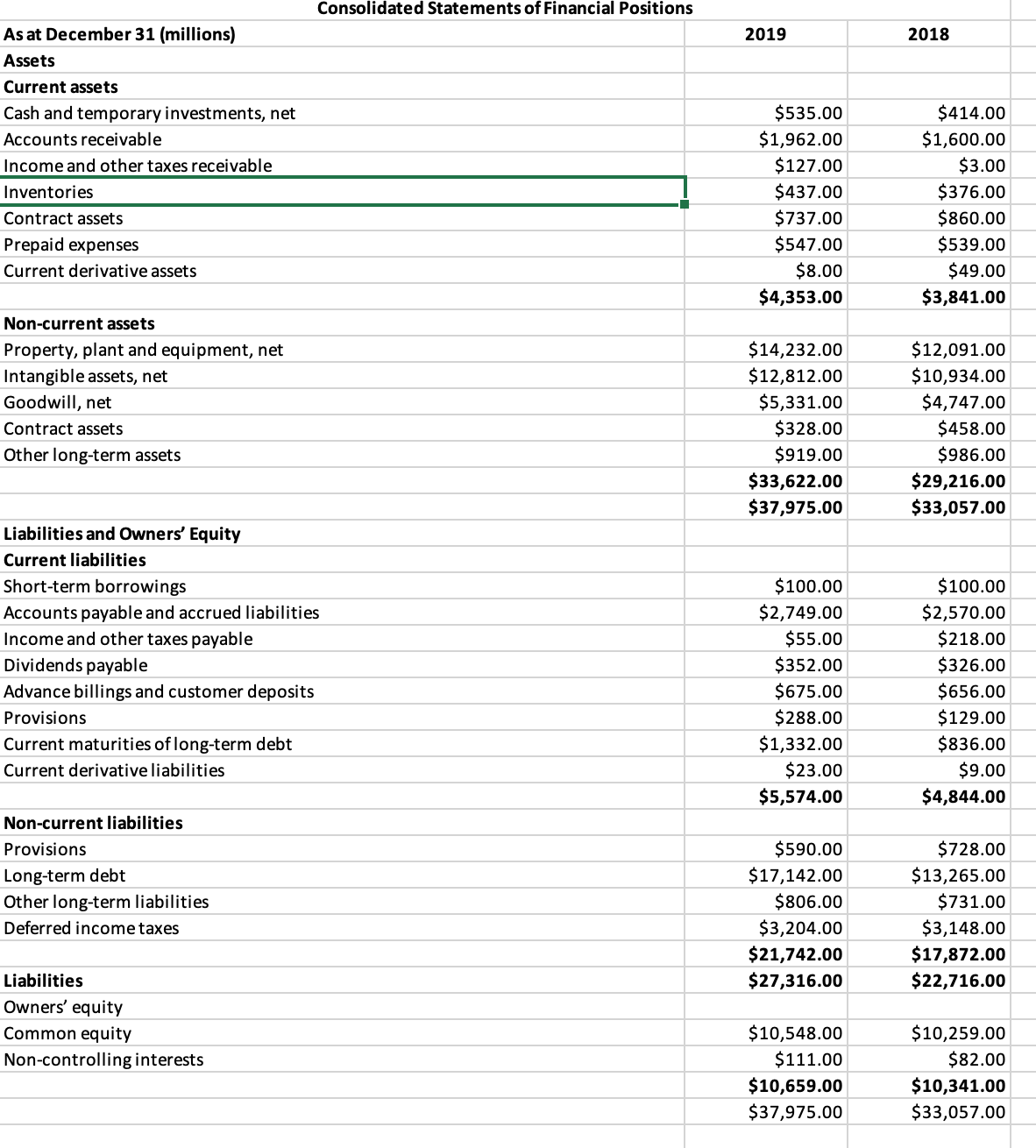

CALCULATE FOLLOWING RATIOS FROM THE STATEMENT Current ratio Quick ratio Inventory turnover Days of inventory on hand Accounts receivable turnover Average collection period Asset turnover

CALCULATE FOLLOWING RATIOS FROM THE STATEMENT

- Current ratio

- Quick ratio

- Inventory turnover

- Days of inventory on hand

- Accounts receivable turnover

- Average collection period

- Asset turnover

- Gross profit margin

- Net profit margin

- Total debt ratio

- Return on assets

- Return on equity

- Interest coverage ratio

Years ended December 31(Millions except per share amount) Operating Revenues Service equipment Revenues arising from contracts with customers Other operating income Operating Expenses Goods and services purchased Employee benefits expense Depreciation Amortization of intangible assets Operating Income Financing costs Income Before Income Taxes Income taxes 2019 $12,400.00 $2,189.00 2018 $11,882.00 $2,213.00 $14,589.00 $14,095.00 $69.00 $273.00 $14,658.00 $14,368.00 $6,070.00 $6,368.00 $3,034.00 $2,896.00 $1,929.00 $1,669.00 $648.00 $598.00 $11,681.00 $11,531.00 $2,977.00 $733.00 $2,837.00 $661.00 $2,176.00 $2,244.00 Net Income $468.00 $1,776.00 $552.00 $1,624.00 Other Comprehensive Income Items that may subsequently be reclassified to income Change in unrealized fair value of derivatives designated as cash flow hedges Foreign currency translation adjustment arising from translating financial statements of $84.00 -$18.00 foreign operations $20.00 -$30.00 $104.00 -$48.00 Items never subsequently reclassified to income Change in measurement of investment financial assets $12.00 -$1.00 Employee defined benefit plan re-measurements -$338.00 $333.00 -$326.00 $332.00 -$222.00 $284.00 Comprehensive Income $1,554.00 $1,908.00 Net Income Attributable to: Common Shares $1,746.00 $1,600.00 Non-controlling interests $30.00 $1,776.00 $24.00 $1,624.00 Comprehensive Income Attributable to: Common Shares $1,516.00 $1,898.00 Non-controlling interests $38.00 $1,554.00 $10.00 $1,908.00 Net Income Per Common Share Basic $2.90 $2.68 Diluted $2.90 $2.68 Total Weighted Average Common Shares Outstanding Basic Diluted 602 597 602 597

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Current Ratio The current ratio measures a companys ability to cover its shortterm liabilities with its shortterm assets Formula text Current Ratio fr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started