Answered step by step

Verified Expert Solution

Question

1 Approved Answer

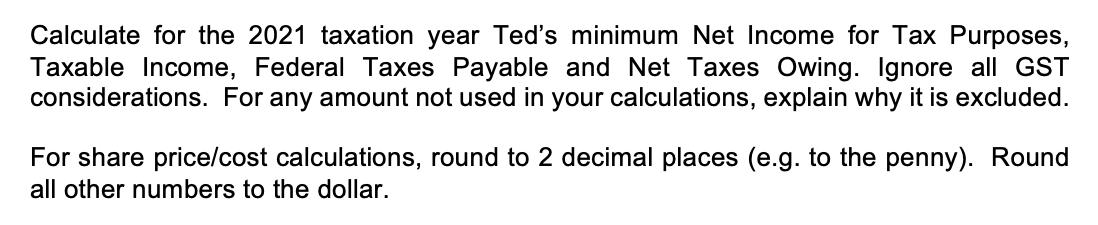

Calculate for the 2021 taxation year Ted's minimum Net Income for Tax Purposes, Taxable Income, Federal Taxes Payable and Net Taxes Owing. Ignore all

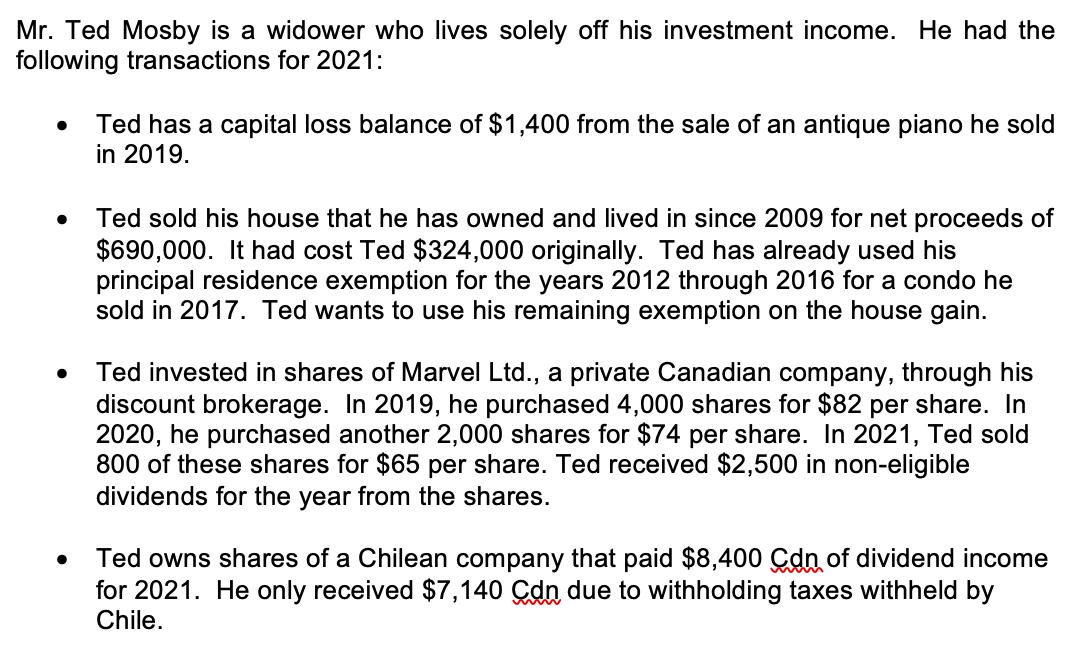

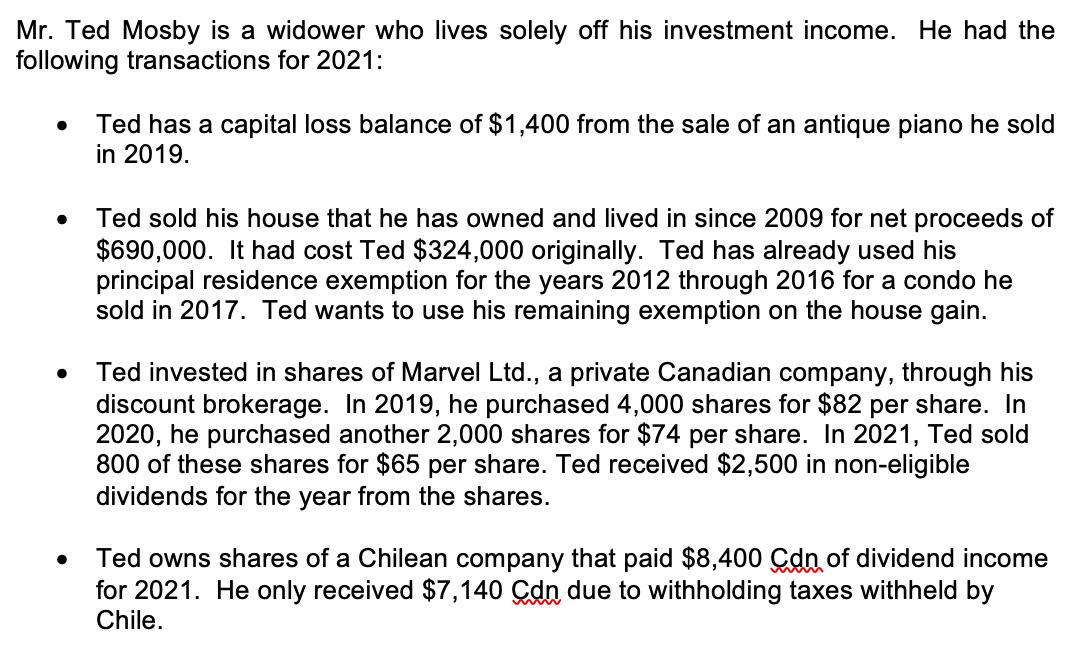

Calculate for the 2021 taxation year Ted's minimum Net Income for Tax Purposes, Taxable Income, Federal Taxes Payable and Net Taxes Owing. Ignore all GST considerations. For any amount not used in your calculations, explain why it is excluded. For share price/cost calculations, round to 2 decimal places (e.g. to the penny). Round all other numbers to the dollar. Mr. Ted Mosby is a widower who lives solely off his investment income. He had the following transactions for 2021: Ted has a capital loss balance of $1,400 from the sale of an antique piano he sold in 2019. Ted sold his house that he has owned and lived in since 2009 for net proceeds of $690,000. It had cost Ted $324,000 originally. Ted has already used his principal residence exemption for the years 2012 through 2016 for a condo he sold in 2017. Ted wants to use his remaining exemption on the house gain. Ted invested in shares of Marvel Ltd., a private Canadian company, through his discount brokerage. In 2019, he purchased 4,000 shares for $82 per share. In 2020, he purchased another 2,000 shares for $74 per share. In 2021, Ted sold 800 of these shares for $65 per share. Ted received $2,500 in non-eligible dividends for the year from the shares. Ted owns shares of a Chilean company that paid $8,400 Cdn of dividend income for 2021. He only received $7,140 Cdn due to withholding taxes withheld by Chile. Mr. Ted Mosby is a widower who lives solely off his investment income. He had the following transactions for 2021: Ted has a capital loss balance of $1,400 from the sale of an antique piano he sold in 2019. Ted sold his house that he has owned and lived in since 2009 for net proceeds of $690,000. It had cost Ted $324,000 originally. Ted has already used his principal residence exemption for the years 2012 through 2016 for a condo he sold in 2017. Ted wants to use his remaining exemption on the house gain. Ted invested in shares of Marvel Ltd., a private Canadian company, through his discount brokerage. In 2019, he purchased 4,000 shares for $82 per share. In 2020, he purchased another 2,000 shares for $74 per share. In 2021, Ted sold 800 of these shares for $65 per share. Ted received $2,500 in non-eligible dividends for the year from the shares. Ted owns shares of a Chilean company that paid $8,400 Cdn of dividend income for 2021. He only received $7,140 Cdn due to withholding taxes withheld by Chile.

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Capital Loss Ted had a capital loss balance of 1400 f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started