Answered step by step

Verified Expert Solution

Question

1 Approved Answer

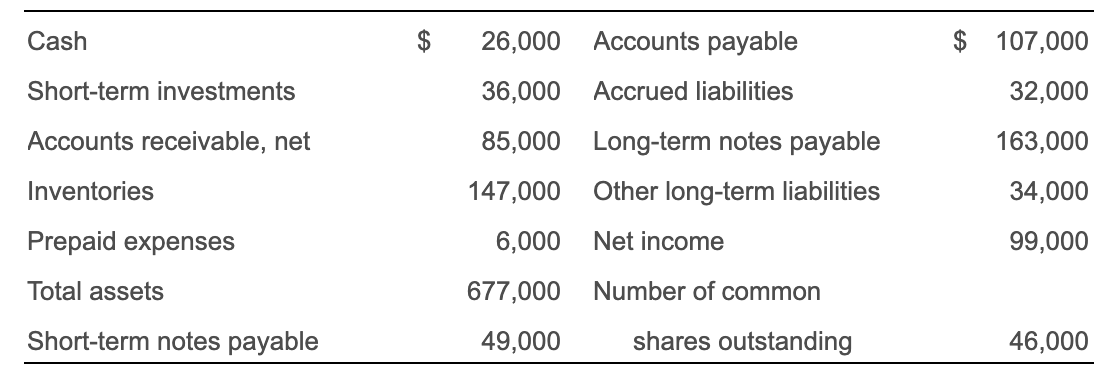

Calculate Greatland's current ratio, debt ratio, and earnings per share. Round all ratios to two decimal places. 2. Calculate the three ratios after evaluating the

Calculate Greatland's current ratio, debt ratio, and earnings per share. Round all ratios to two decimal places.

2. Calculate the three ratios after evaluating the effect of each transaction that follows. Consider each transaction separately.

a. Borrowed $105,000 on a long-term note payable

b. On January 1, Issued 40,000 shares of common stock, receiving cash of $360,000

c. Paid off short-term notes payable, $28,000

d. Purchased $43,000 of merchandise on account, debiting Inventory

e. Received cash on account, $17,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started