Answered step by step

Verified Expert Solution

Question

1 Approved Answer

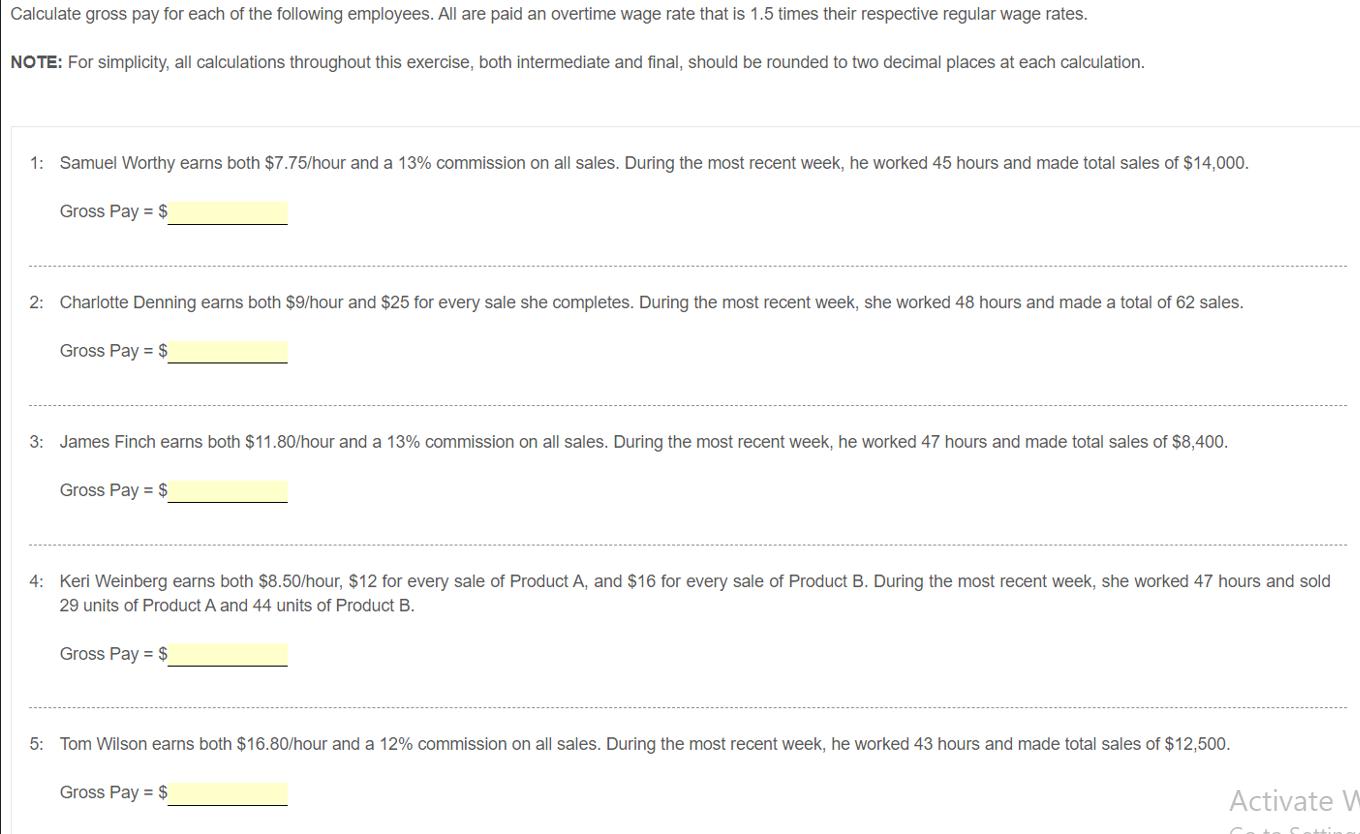

Calculate gross pay for each of the following employees. All are paid an overtime wage rate that is 1.5 times their respective regular wage

Calculate gross pay for each of the following employees. All are paid an overtime wage rate that is 1.5 times their respective regular wage rates. NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1: Samuel Worthy earns both $7.75/hour and a 13% commission on all sales. During the most recent week, he worked 45 hours and made total sales of $14,000. Gross Pay = $ 2: Charlotte Denning earns both $9/hour and $25 for every sale she completes. During the most recent week, she worked 48 hours and made a total of 62 sales. Gross Pay = $ 3: James Finch earns both $11.80/hour and a 13% commission on all sales. During the most recent week, he worked 47 hours and made total sales of $8,400. Gross Pay = $ 4: Keri Weinberg earns both $8.50/hour, $12 for every sale of Product A, and $16 for every sale of Product B. During the most recent week, she worked 47 hours and sold 29 units of Product A and 44 units of Product B. Gross Pay = $ 5: Tom Wilson earns both $16.80/hour and a 12% commission on all sales. During the most recent week, he worked 43 hours and made total sales of $12,500. Gross Pay = $ Activate W

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate Samuel Worthys gross pay we need to consider his regular wage rate and commission on sales His regular wage rate is 775hour and he worked 45 hours So his regular wages can be calculated ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e703847528_956207.pdf

180 KBs PDF File

663e703847528_956207.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started