Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate her taxes paid (ignore net investment income tax) if she elects to exclude preferential rate investment income in investment income purposes of calculating

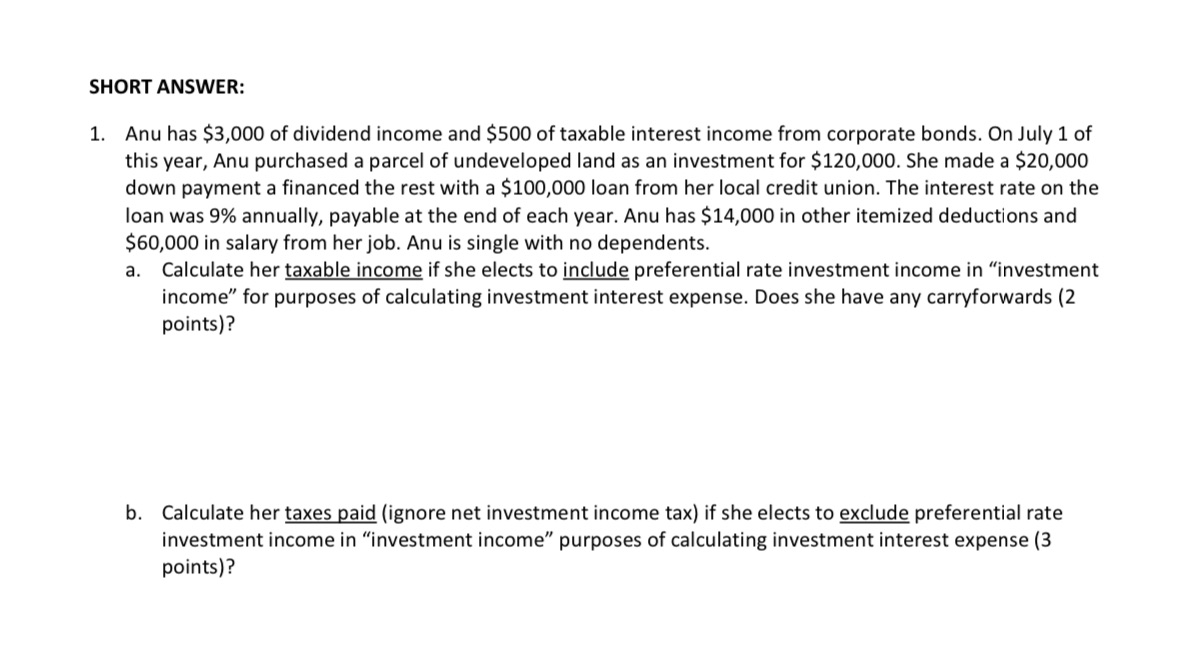

Calculate her taxes paid (ignore net investment income tax) if she elects to exclude preferential rate investment income in "investment income" purposes of calculating investment interest expense ? Calculate her taxable income if she elects to include preferential rate investment income in "investment income" for purposes of calculating investment interest expense. Does she have any carryforwards SHORT ANSWER: 1. Anu has $3,000 of dividend income and $500 of taxable interest income from corporate bonds. On July 1 of this year, Anu purchased a parcel of undeveloped land as an investment for $120,000. She made a $20,000 down payment a financed the rest with a $100,000 loan from her local credit union. The interest rate on the loan was 9% annually, payable at the end of each year. Anu has $14,000 in other itemized deductions and $60,000 in salary from her job. Anu is single with no dependents. a. Calculate her taxable income if she elects to include preferential rate investment income in "investment income" for purposes of calculating investment interest expense. Does she have any carryforwards (2 points)? b. Calculate her taxes paid (ignore net investment income tax) if she elects to exclude preferential rate investment income in "investment income" purposes of calculating investment interest expense (3 points)?

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate Anus taxable income if she elects to include preferential rate investment income in investment income for purposes of calculating inves...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started