Question

Calculate interest coverage, fixed charge coverage and Debt/EBITDA in year 4. Assume the company was purchased for a 7x multiple at the end of

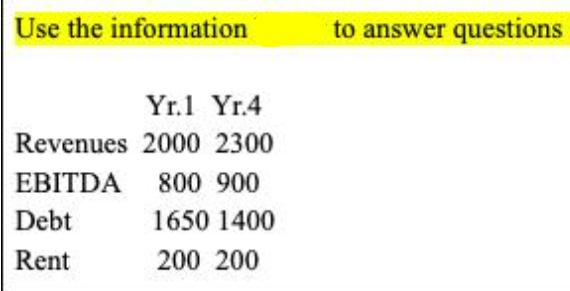

Calculate interest coverage, fixed charge coverage and Debt/EBITDA in year 4. Assume the company was purchased for a 7x multiple at the end of year 1, financed with 1650 of debt. If the company were sold at the end of year 4 for the same multiple, what would the equity return be? Use the information Yr.1 Yr.4 Revenues 2000 2300 EBITDA 800 900 Debt 1650 1400 Rent 200 200 to answer questions

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate interest coverage we first need to find the interest expense We can find this by subtra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing A Business Risk Approach

Authors: Karla Johnstone, Audrey Gramling, Larry Rittenberg

8th edition

538476230, 978-0538476232

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App