Answered step by step

Verified Expert Solution

Question

1 Approved Answer

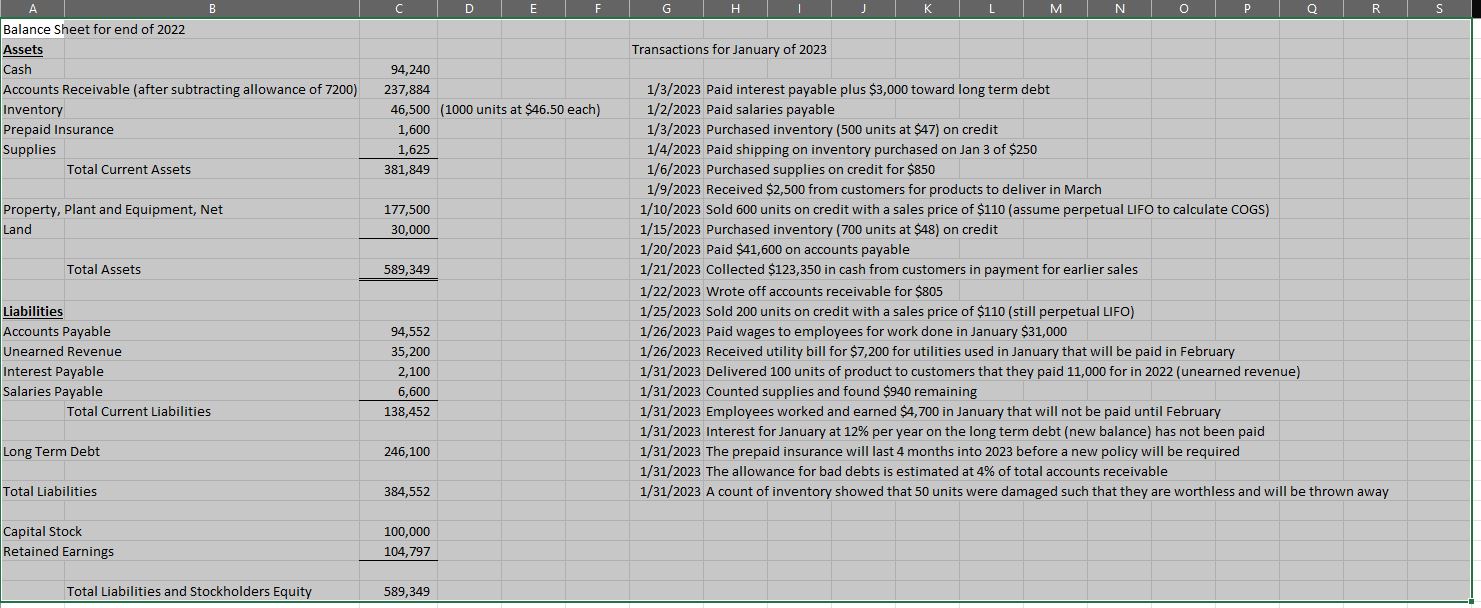

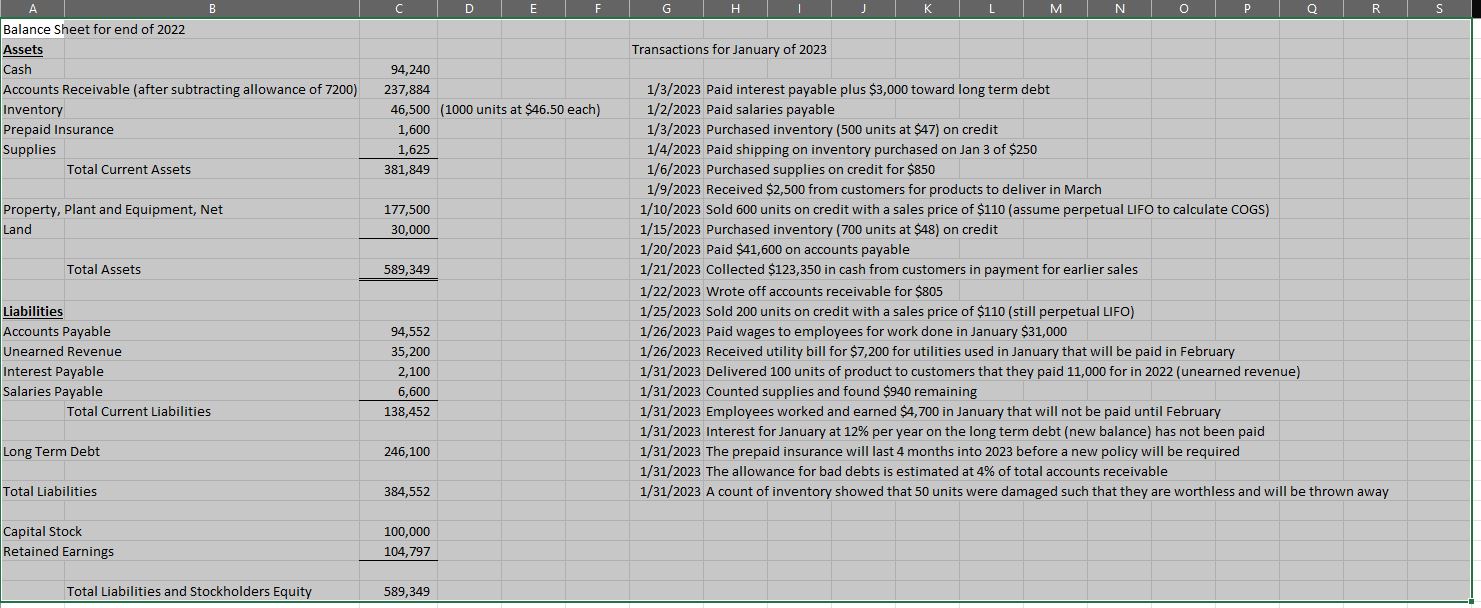

calculate journal entries, t accounts, unadjusted and adjusted trial balances, and financial statements A Balance Sheet for end of 2022 B E F H K

calculate journal entries, t accounts, unadjusted and adjusted trial balances, and financial statements

A Balance Sheet for end of 2022 B E F H K M N R S Assets Cash 94,240 Accounts Receivable (after subtracting allowance of 7200) Inventory Prepaid Insurance 237,884 46,500 (1000 units at $46.50 each) 1,600 Supplies 1,625 Total Current Assets 381,849 Property, Plant and Equipment, Net 177,500 Land 30,000 Total Assets Liabilities Accounts Payable Unearned Revenue 589,349 94,552 35,200 2,100 6,600 Interest Payable Salaries Payable Total Current Liabilities 138,452 Long Term Debt Total Liabilities Capital Stock Retained Earnings Total Liabilities and Stockholders Equity 589,349 246,100 384,552 100,000 104,797 Transactions for January of 2023 1/3/2023 Paid interest payable plus $3,000 toward long term debt 1/2/2023 Paid salaries payable 1/3/2023 Purchased inventory (500 units at $47) on credit 1/4/2023 Paid shipping on inventory purchased on Jan 3 of $250 1/6/2023 Purchased supplies on credit for $850 1/9/2023 Received $2,500 from customers for products to deliver in March 1/10/2023 Sold 600 units on credit with a sales price of $110 (assume perpetual LIFO to calculate COGS) 1/15/2023 Purchased inventory (700 units at $48) on credit 1/20/2023 Paid $41,600 on accounts payable 1/21/2023 Collected $123,350 in cash from customers in payment for earlier sales 1/22/2023 Wrote off accounts receivable for $805 1/25/2023 Sold 200 units on credit with a sales price of $110 (still perpetual LIFO) 1/26/2023 Paid wages to employees for work done in January $31,000 1/26/2023 Received utility bill for $7,200 for utilities used in January that will be paid in February 1/31/2023 Delivered 100 units of product to customers that they paid 11,000 for in 2022 (unearned revenue) 1/31/2023 Counted supplies and found $940 remaining 1/31/2023 Employees worked and earned $4,700 in January that will not be paid until February 1/31/2023 Interest for January at 12% per year on the long term debt (new balance) has not been paid 1/31/2023 The prepaid insurance will last 4 months into 2023 before a new policy will be required 1/31/2023 The allowance for bad debts is estimated at 4% of total accounts receivable 1/31/2023 A count of inventory showed that 50 units were damaged such that they are worthless and will be thrown away

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate journal entries Taccounts unadjusted and adjusted trial bala...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dbd994b320_962771.pdf

180 KBs PDF File

663dbd994b320_962771.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started