Answered step by step

Verified Expert Solution

Question

1 Approved Answer

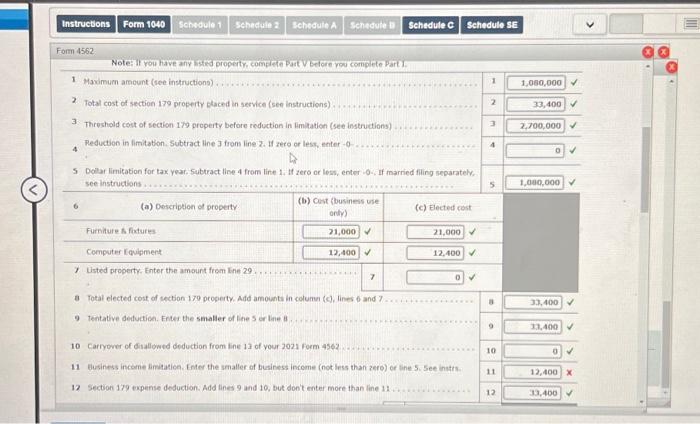

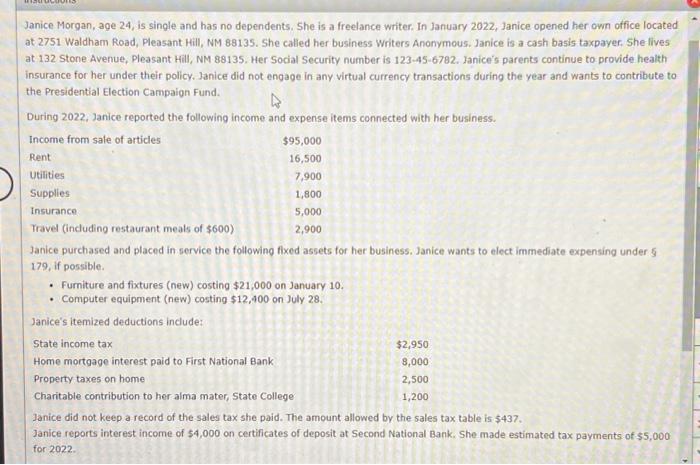

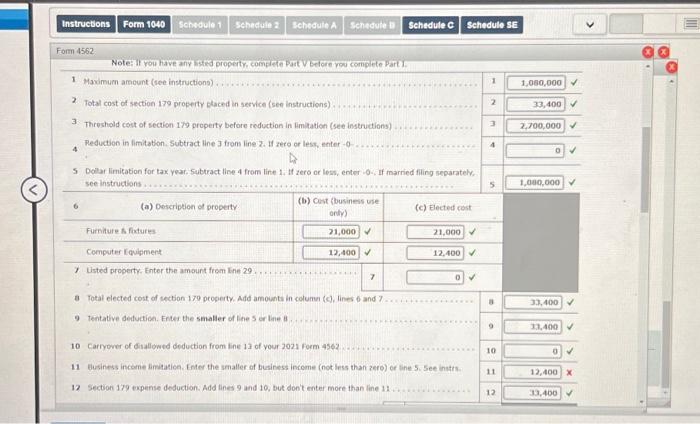

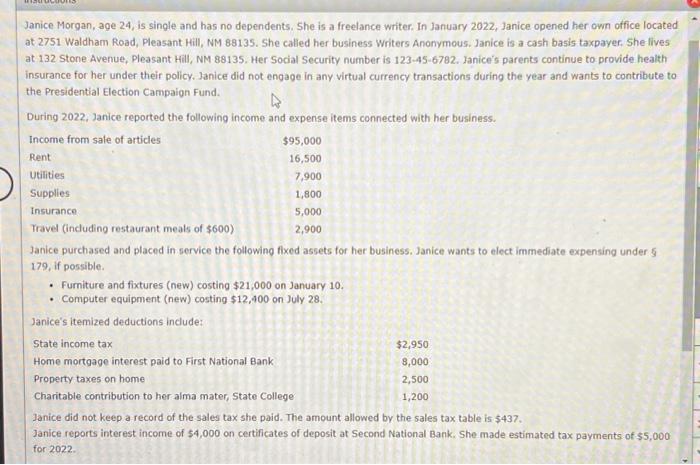

Calculate Line 11: Buisness income Limitation, using the information given. Instructions Form 1040 Form 1040 Schedule 1 Schedule 2 Schedule A Schedule B Schedule C

Calculate Line 11: Buisness income Limitation, using the information given.

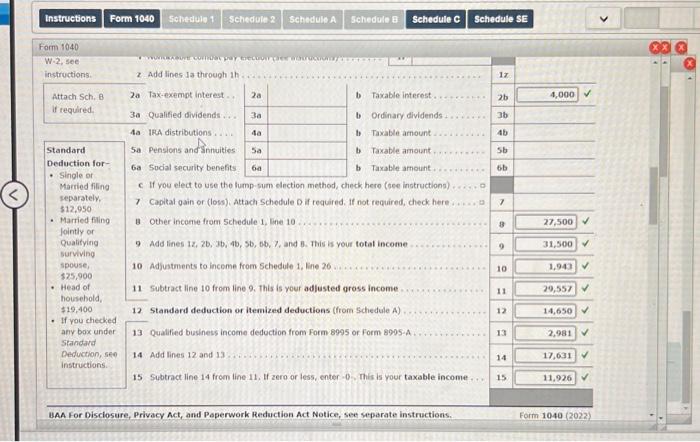

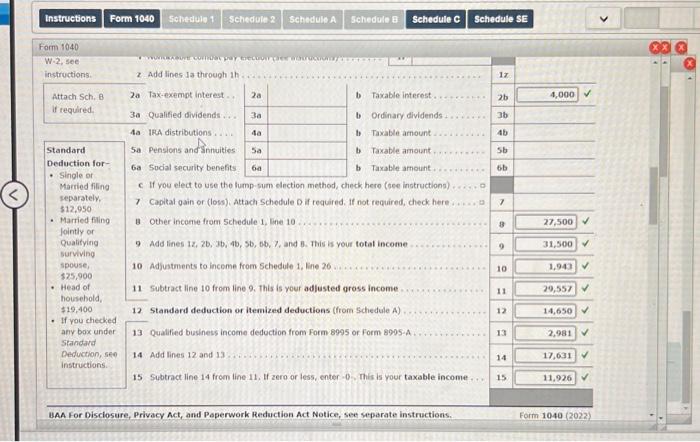

Instructions Form 1040 Form 1040 Schedule 1 Schedule 2 Schedule A Schedule B Schedule C Schedule SE W-2, see instructions. VVUVIOKABOVE compay pay trecuperper z Add lines la through th 1z Attach Sch. B 2a Tax-exempt interest.. 2a b Taxable interest.. 2b 4,000 if required. 3a Qualified dividends... 3a 4a IRA distributions.... b Ordinary dividends 36 4a b Taxable amount. 4b Standard Sa Pensions and Snnuities 5a b Taxable amount. 5b Deduction for- 6a Social security benefits. 60 b Taxable amount. 6b .Single or Married filing separately. $12,950 7 Capital gain or (loss). Attach Schedule D if required. If not required, check here. c If you elect to use the lump-sum election method, check here (see instructions) O 7 Married filing B Other income from Schedule 1, line 10 B 27,500 Jointly or Qualifying 9 Add lines 1z, 2b, 3b, 4b, 5b, 6b, 7, and B. This is your total income. 9 31,500 surviving spouse, $25,900 10 Adjustments to income from Schedule 1, line 26 a 10 1,943 v Head of household, $19,400 11 Subtract line 10 from line 9. This is your adjusted gross income. 11 29,557 12 Standard deduction or itemized deductions (from Schedule A) 12 14,650 If you checked any box under Standard Deduction, see instructions. 13 Qualified business income deduction from Form 8995 or Form 8995-A 13 2,981 V 14 Add lines 12 and 13) 14 17,631 15 Subtract line 14 from line 11. If zero or less, enter-0. This is your taxable income.. 15 11,926 BAA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Form 1040 (2022)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started