Answered step by step

Verified Expert Solution

Question

1 Approved Answer

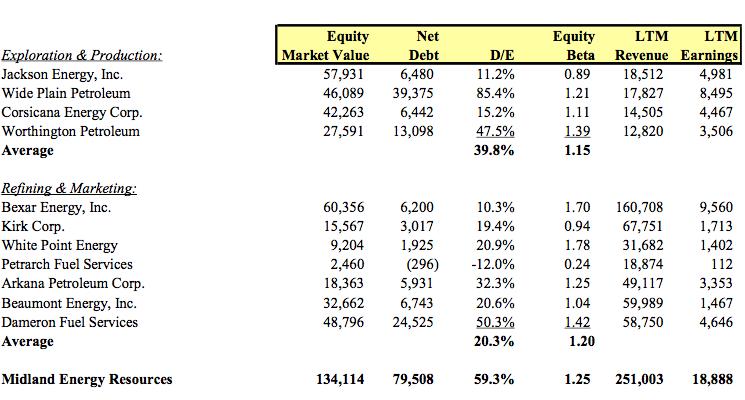

Calculate Midland's corporate WACC. Be prepared to defend your specific assumptions regarding the various components of the calculation. Is Midlands choice of CAPM Risk Premium

Calculate Midland's corporate WACC. Be prepared to defend your specific assumptions regarding the various components of the calculation. Is Midland’s choice of CAPM Risk Premium (EMRP) appropriate? If not, what recommendations would you make and why? PLEASE BE SPECIFIC, SHOW work, and how to set up in excel. The data is below.

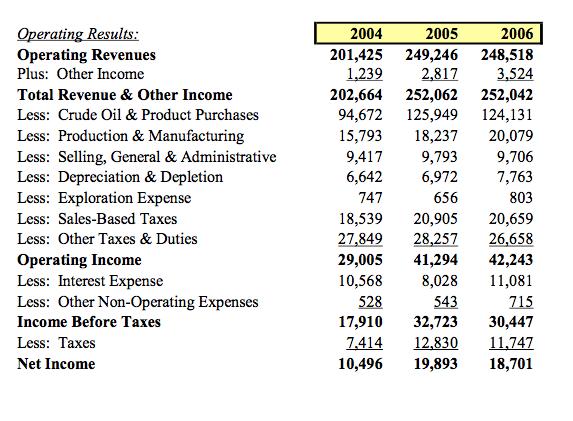

Operating Results: Operating Revenues Plus: Other Income Total Revenue & Other Income Less: Crude Oil & Product Purchases Less: Production & Manufacturing Less: Selling, General & Administrative Less: Depreciation & Depletion Less: Exploration Expense Less: Sales-Based Taxes Less: Other Taxes & Duties Operating Income Less: Interest Expense Less: Other Non-Operating Expenses Income Before Taxes Less: Taxes Net Income 2004 2005 2006 201,425 249,246 248,518 2,817 1,239 3,524 202,664 252,062 252,042 94,672 125,949 124,131 15,793 9,417 6,642 747 18,237 20,079 9,706 7,763 803 9,793 6,972 656 18,539 20,905 27,849 28,257 29,005 41,294 10,568 8,028 528 543 17,910 32,723 7.414 12,830 10,496 19,893 20,659 26,658 42,243 11,081 715 30,447 11,747 18,701

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

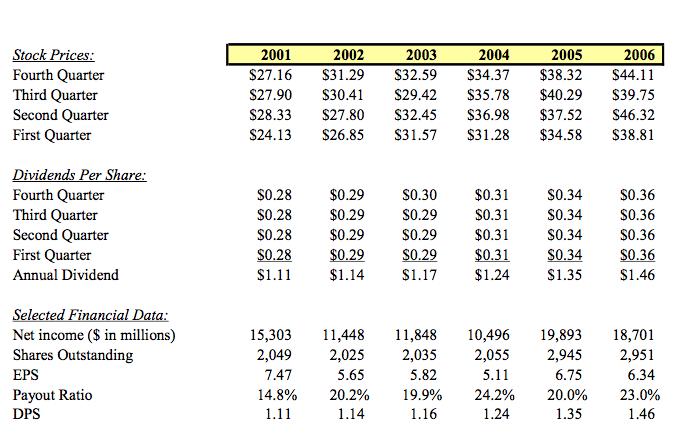

RD 30 year maturityRf Consolidated Spread 498 162 660 066 Tax Rate Assume to be 39 039 EMRP 500 Rf M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started