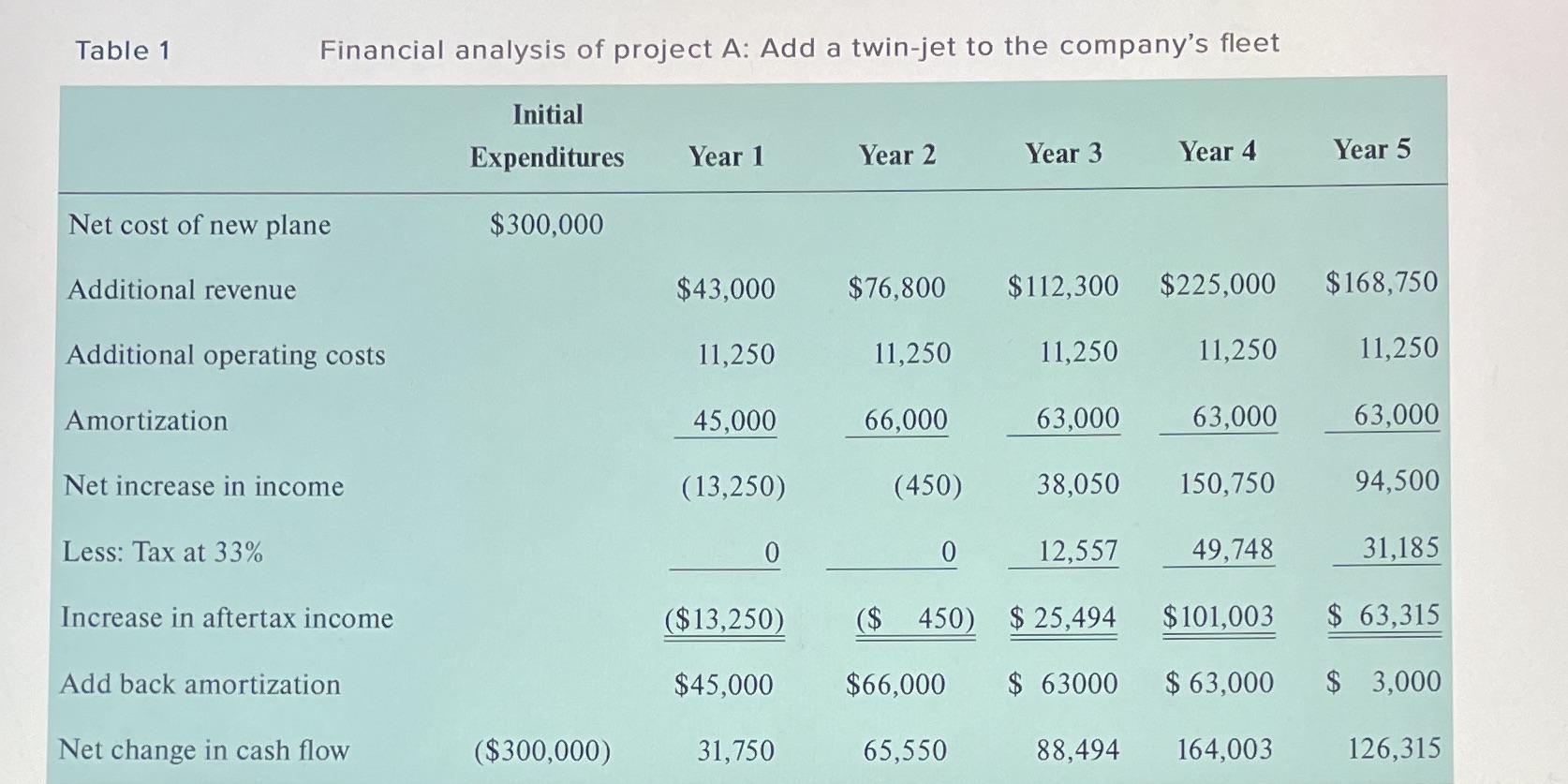

Calculate NPV, Payback and IRR Table 1 Net cost of new plane Additional revenue Financial analysis of

Fantastic news! We've Found the answer you've been seeking!

Question:

Calculate NPV, Payback and IRR

Transcribed Image Text:

Table 1 Net cost of new plane Additional revenue Financial analysis of project A: Add a twin-jet to the company's fleet Additional operating costs Amortization Net increase in income Less: Tax at 33% Increase in aftertax income Add back amortization Net change in cash flow Initial Expenditures $300,000 ($300,000) Year 1 $43,000 11,250 45,000 (13,250) 0 ($13,250) $45,000 31,750 Year 2 $76,800 11,250 66,000 (450) 0 Year 3 65,550 Year 4 $112,300 $225,000 11,250 63,000 38,050 150,750 12,557 49,748 ($ 450) $ 25,494 $66,000 $ 63000 88,494 11,250 63,000 $101,003 $ 63,000 164,003 Year 5 $168,750 11,250 63,000 94,500 31,185 $ 63,315 $ 3,000 126,315 Table 1 Net cost of new plane Additional revenue Financial analysis of project A: Add a twin-jet to the company's fleet Additional operating costs Amortization Net increase in income Less: Tax at 33% Increase in aftertax income Add back amortization Net change in cash flow Initial Expenditures $300,000 ($300,000) Year 1 $43,000 11,250 45,000 (13,250) 0 ($13,250) $45,000 31,750 Year 2 $76,800 11,250 66,000 (450) 0 Year 3 65,550 Year 4 $112,300 $225,000 11,250 63,000 38,050 150,750 12,557 49,748 ($ 450) $ 25,494 $66,000 $ 63000 88,494 11,250 63,000 $101,003 $ 63,000 164,003 Year 5 $168,750 11,250 63,000 94,500 31,185 $ 63,315 $ 3,000 126,315

Expert Answer:

Answer rating: 100% (QA)

Net Present Value NPV The NPV is the sum of the discounted cash flows over the life of the project T... View the full answer

Related Book For

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

Posted Date:

Students also viewed these accounting questions

-

Calculate the payback period NPV and IRR Keep in mind that you will need to build a simple income statement to determine aftertax net income and then derive quick cash flow to calculate the...

-

Calculate the IRR and NPV for the following two investment opportunities. Assume a 16 percent discount rate for the NPV calculations: Year Project 2 Cash Flow S10,000 1.000 Project 1 Cash Flow...

-

Calculate the NPV and IRR for the project Round your IRR answers to the nearest whole percentage value for example 156 rounds to 16 and should be entered as 16 in the answer box If the NPV is...

-

What is wrong with the following code fragment? int[] a; for (int i = 0; i < 10; i++) a[i] = i * i;

-

We saw that there are 2N possible electron states in the 3s band of Na, where N is the total number of atoms. How many possible electron states are there in the (a) 2s band (b) 2p band and (c) 3p...

-

Marilyn Marshall, a Professor of sports economics, has obtained a data set of home attendance for each of the 30 major league baseball franchises for each season from 2010 through 2016. Dr. Marshall...

-

This exercise shows why microinsurance may work. Empirical evidence suggests that an individuals degree of absolute risk aversion, A, is decreasing, where A is defined as (-u/u), with u( ) being the...

-

On the first day of the fiscal year, Shiller Company borrowed $85,000 by giving a seven year, 7% installment note to Soros Bank. The note requires annual payments of $15,772, with the first payment...

-

Flannigan Company manufactures and sells a single product that sells for $450 per unit; variable costs are $270. Annual fixed costs are $800,000. Current sales volume is $4,200,000. Compute the...

-

Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model Following are income statements and balance sheets for Cisco Systems. Cisco Systems Consolidated Statements of...

-

Which of the following is not a step in creating operatingdepartment income statements? Prepare the departmental income statements. Accumulate revenues and direct expenses by department. Allocate...

-

What is meant by a subprime mortgage-backed security?

-

The successful application of organisational behaviour principles can reduce a companys rates of turnover and absenteeism. a. True b. False

-

Describe how floating rate tranches can be created from fixed rate collateral.

-

________________ variables are always numerical. In Exercises 510, fill in each blank with the appropriate word or phrase.

-

A \(1500-\mathrm{kg}\) car constantly moving at \(90 \mathrm{kmph}\) accidentally crashes into a concrete wall. The impact produces \(750 \mathrm{~J}\) of sound energy. The car gains \(3.8...

-

Newtown Propane currently has $490,000 in total assets and sales of $1,720,000. Half of Newtown's total assets come from net fixed assets, and the rest are current assets. The firm expects sales to...

-

Troy is a qualified radiologist who operates a successful radiology practice from purpose- built rooms attached to his house. Troy works in the practice three days a week, and the other two days he...

-

Springsteen Music Company earned $820 million last year and paid out 20 percent of earnings in dividends. a. By how much did the company's retained earnings increase? b. With 100 million shares...

-

Date Wireless has the following assets: Its operating profit (EBIT) is expected to be $1.0 million. Its tax rate is 40 percent. Shares are valued $25. Capital structure is either short-term financing...

-

Five investment alternatives have the following returns and standard deviations of returns. Rank the five alternatives from lowest risk to highest risk using the coefficient of variation. Alternative...

-

Three years ago the TCBY at the local mall bought a frozenyogurt machine for $8,000. A salesperson has just suggested to the manager that she replace the machine with a new $12,500 machine. The...

-

English Bay Beach Company manufactures suntan lotion, called Surtan, in 11 -ounce plastic bottles. Surtan is sold in a competitive market. As a result, management is very cost-conscious. Surtan is...

-

Jessica Company manufactures bicycles and tricycles. For both products, mate- rials are added at the beginning of the production process, and conversion costs are in- curred uniformly. Jessica...

Study smarter with the SolutionInn App