Question

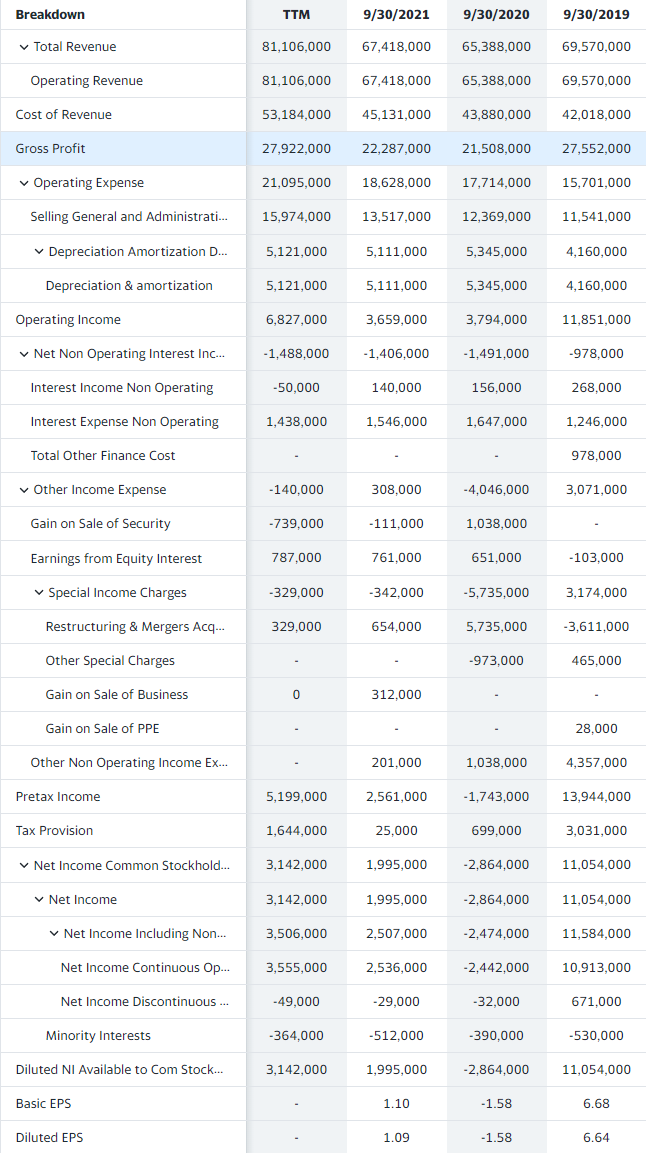

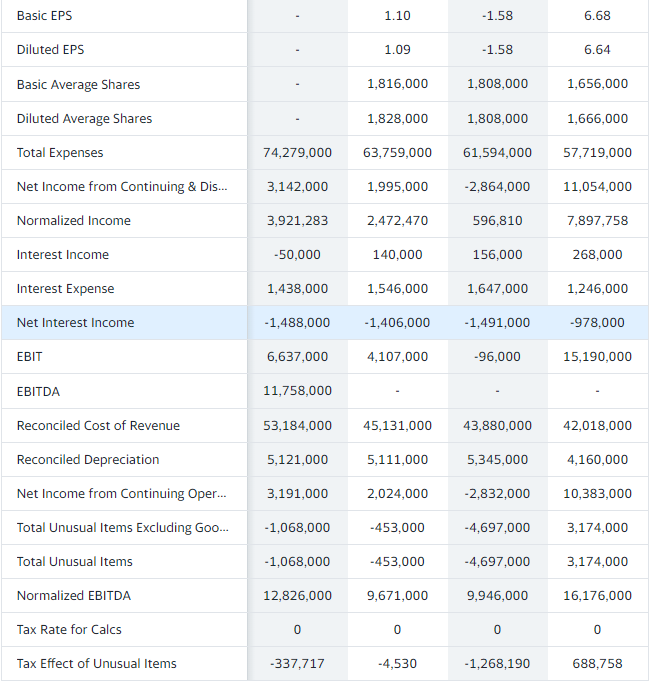

calculate Operating Cash Flow, Cash Flow from Assets You will do this for 2021, 2020 and 2019 and SHOW ALL WORK. Once you have computed

calculate Operating Cash Flow, Cash Flow from Assets You will do this for 2021, 2020 and 2019 and SHOW ALL WORK.

Once you have computed these numbers please write a few sentences summarizing the cash flow performance of Disney to illustrate your understanding of these cash flow numbers. Impress me!

Compute Disney's ratios in the 4 categories (Liquidity, Asset Management, Debt Management, and Profitability) for 2021, 2020 and 2019. Don't worry about industry averages. In a paragraph or two, discuss Disney's performance according to your ratio findings during the past 3 years.

\begin{tabular}{|lcccc} \hline Basic EPS & & 1.10 & 1.58 & 6.68 \\ \hline Diluted EPS & & 1.09 & 1.58 & 6.64 \\ \hline Basic Average Shares & & 1,816,000 & 1,808,000 & 1,656,000 \\ \hline Diluted Average Shares & & 1,828,000 & 1,808,000 & 1,666,000 \\ \hline Total Expenses & 74,279,000 & 63,759,000 & 61,594,000 & 57,719,000 \\ \hline Net Income from Continuing \& Dis... & 3,142,000 & 1,995,000 & 2,864,000 & 11,054,000 \\ \hline Normalized Income & 3,921,283 & 2,472,470 & 596,810 & 7,897,758 \\ \hline Interest Income & 50,000 & 140,000 & 156,000 & 268,000 \\ \hline Interest Expense & 1,438,000 & 1,546,000 & 1,647,000 & 1,246,000 \\ \hline Net Interest Income & 1,488,000 & 1,406,000 & 1,491,000 & 978,000 \\ \hline EBIT & 6,637,000 & 4,107,000 & 96,000 & 15,190,000 \\ \hline EBITDA & 11,758,000 & & & \\ \hline Reconciled Cost of Revenue & 53,184,000 & 45,131,000 & 43,880,000 & 42,018,000 \\ \hline Reconciled Depreciation & 5,121,000 & 5,111,000 & 5,345,000 & 4,160,000 \\ \hline Total Unusual Items & 1,068,000 & 453,000 & 4,697,000 & 3,174,000 \\ \hline Normalized EBITDA & 3,191,000 & 2,024,000 & 2,832,000 & 10,383,000 \\ \hline Tax Effect of Unusual Items from Continuing Oper... & 337,717 & 4,530 & 1,268,190 & 688,758 \\ \hline \end{tabular} \begin{tabular}{|lcccc} \hline Basic EPS & & 1.10 & 1.58 & 6.68 \\ \hline Diluted EPS & & 1.09 & 1.58 & 6.64 \\ \hline Basic Average Shares & & 1,816,000 & 1,808,000 & 1,656,000 \\ \hline Diluted Average Shares & & 1,828,000 & 1,808,000 & 1,666,000 \\ \hline Total Expenses & 74,279,000 & 63,759,000 & 61,594,000 & 57,719,000 \\ \hline Net Income from Continuing \& Dis... & 3,142,000 & 1,995,000 & 2,864,000 & 11,054,000 \\ \hline Normalized Income & 3,921,283 & 2,472,470 & 596,810 & 7,897,758 \\ \hline Interest Income & 50,000 & 140,000 & 156,000 & 268,000 \\ \hline Interest Expense & 1,438,000 & 1,546,000 & 1,647,000 & 1,246,000 \\ \hline Net Interest Income & 1,488,000 & 1,406,000 & 1,491,000 & 978,000 \\ \hline EBIT & 6,637,000 & 4,107,000 & 96,000 & 15,190,000 \\ \hline EBITDA & 11,758,000 & & & \\ \hline Reconciled Cost of Revenue & 53,184,000 & 45,131,000 & 43,880,000 & 42,018,000 \\ \hline Reconciled Depreciation & 5,121,000 & 5,111,000 & 5,345,000 & 4,160,000 \\ \hline Total Unusual Items & 1,068,000 & 453,000 & 4,697,000 & 3,174,000 \\ \hline Normalized EBITDA & 3,191,000 & 2,024,000 & 2,832,000 & 10,383,000 \\ \hline Tax Effect of Unusual Items from Continuing Oper... & 337,717 & 4,530 & 1,268,190 & 688,758 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started