Answered step by step

Verified Expert Solution

Question

1 Approved Answer

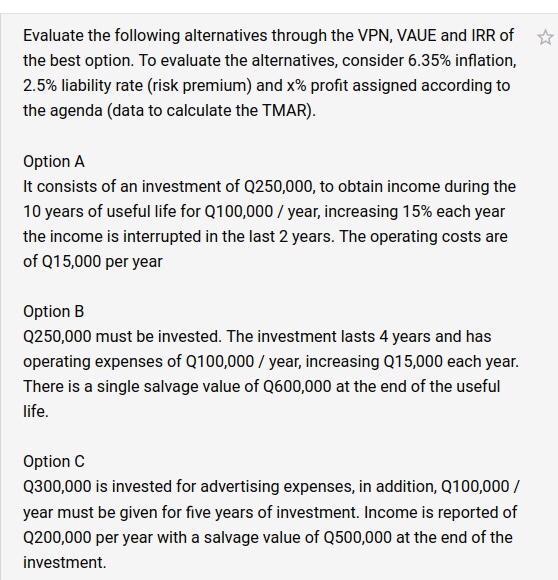

Calculate option A,B,C, please Evaluate the following alternatives through the VPN, VAUE and IRR of the best option. To evaluate the alternatives, consider 6.35% inflation,

Calculate option A,B,C, please

Evaluate the following alternatives through the VPN, VAUE and IRR of the best option. To evaluate the alternatives, consider 6.35% inflation, 2.5% liability rate (risk premium) and x% profit assigned according to the agenda (data to calculate the TMAR). Option A It consists of an investment of Q250,000, to obtain income during the 10 years of useful life for Q100,000/year, increasing 15% each year the income is interrupted in the last 2 years. The operating costs are of Q15,000 per year Option B Q250,000 must be invested. The investment lasts 4 years and has operating expenses of Q100,000/year, increasing Q15,000 each year. There is a single salvage value of Q600,000 at the end of the useful life. Option C Q300,000 is invested for advertising expenses, in addition, Q100,000 / year must be given for five years of investment. Income is reported of Q200,000 per year with a salvage value of Q500,000 at the end of the investment. Evaluate the following alternatives through the VPN, VAUE and IRR of the best option. To evaluate the alternatives, consider 6.35% inflation, 2.5% liability rate (risk premium) and x% profit assigned according to the agenda (data to calculate the TMAR). Option A It consists of an investment of Q250,000, to obtain income during the 10 years of useful life for Q100,000/year, increasing 15% each year the income is interrupted in the last 2 years. The operating costs are of Q15,000 per year Option B Q250,000 must be invested. The investment lasts 4 years and has operating expenses of Q100,000/year, increasing Q15,000 each year. There is a single salvage value of Q600,000 at the end of the useful life. Option C Q300,000 is invested for advertising expenses, in addition, Q100,000 / year must be given for five years of investment. Income is reported of Q200,000 per year with a salvage value of Q500,000 at the end of the investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started