Answered step by step

Verified Expert Solution

Question

1 Approved Answer

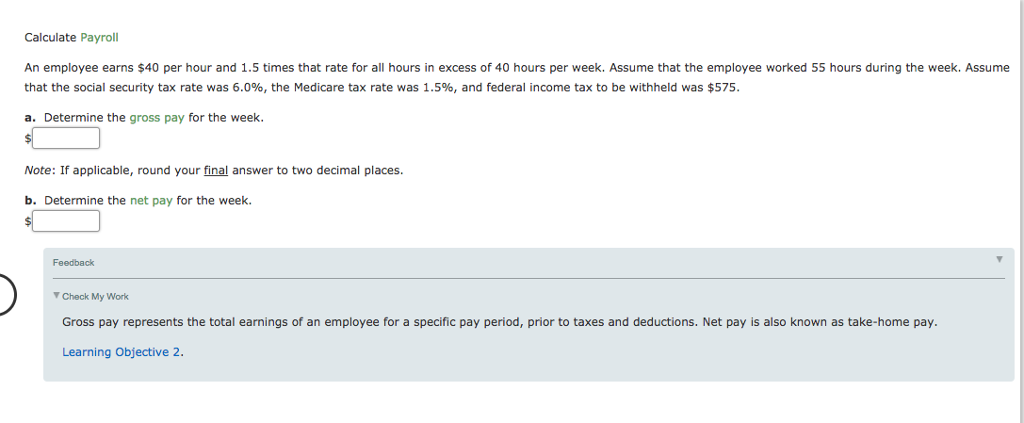

Calculate Payroll An employee earns $40 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. Assume that

Calculate Payroll An employee earns $40 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. Assume that the employee worked 55 hours during the week. Assume that the social security tax rate was 6.0%, the Medicare tax rate was 1.5%, and federal income tax to be withheld was $575.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started