CALCULATE PROCTER & GAMBLE COMPANY - 2011 :

CPM (COMPETITIVE PROFILE MATRIX)

EXTERNAL FACTOR EVALUATION (EFE) MATRIX

FINANCIAL RATIO ANALYSIS

INTERNAL FACTOR EVALUATION

QSPM

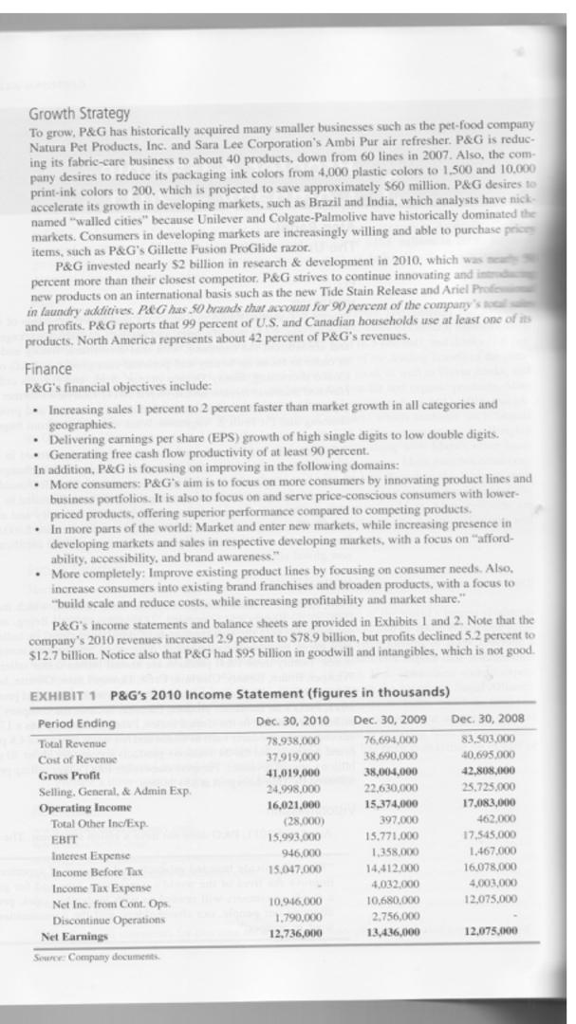

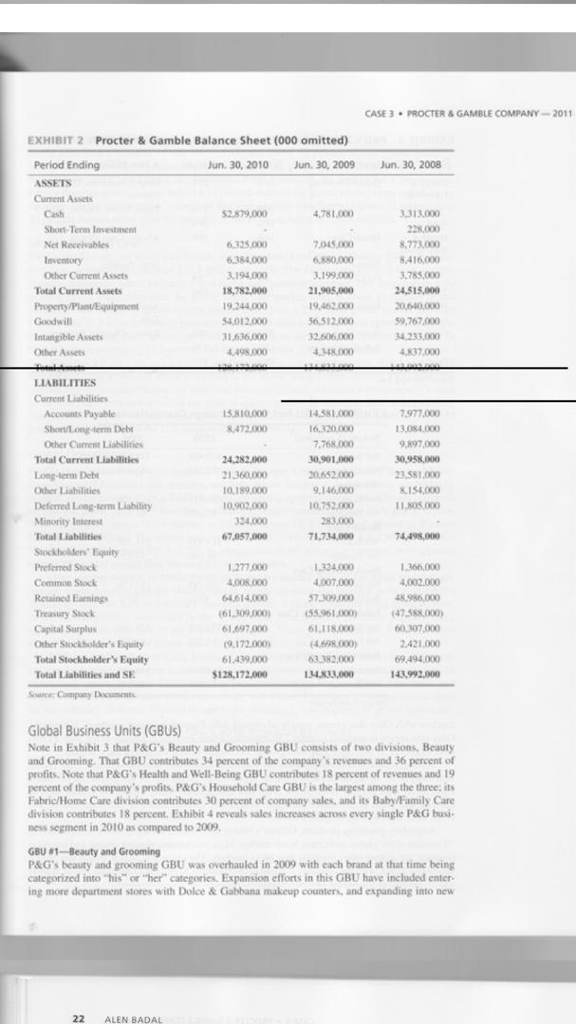

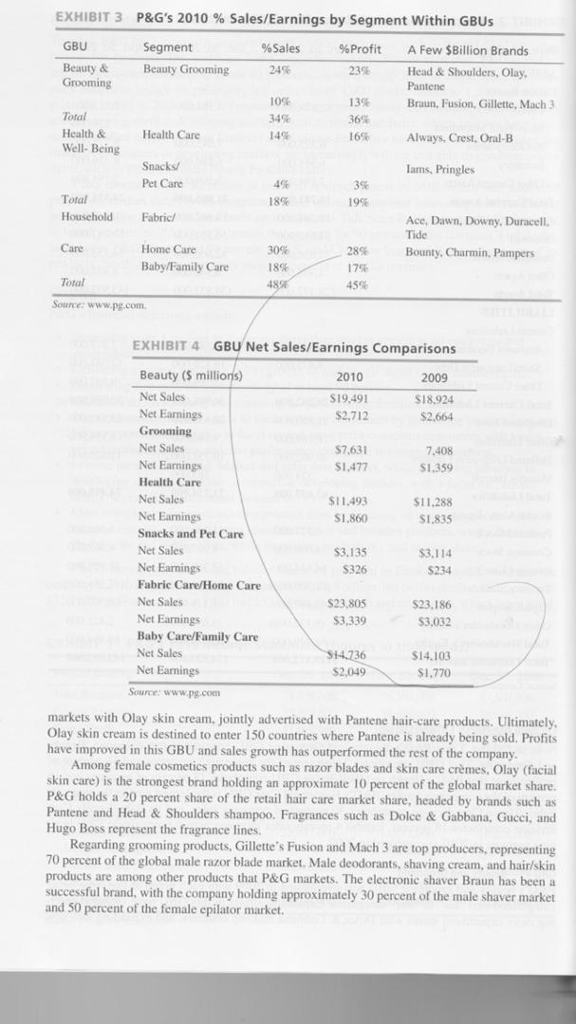

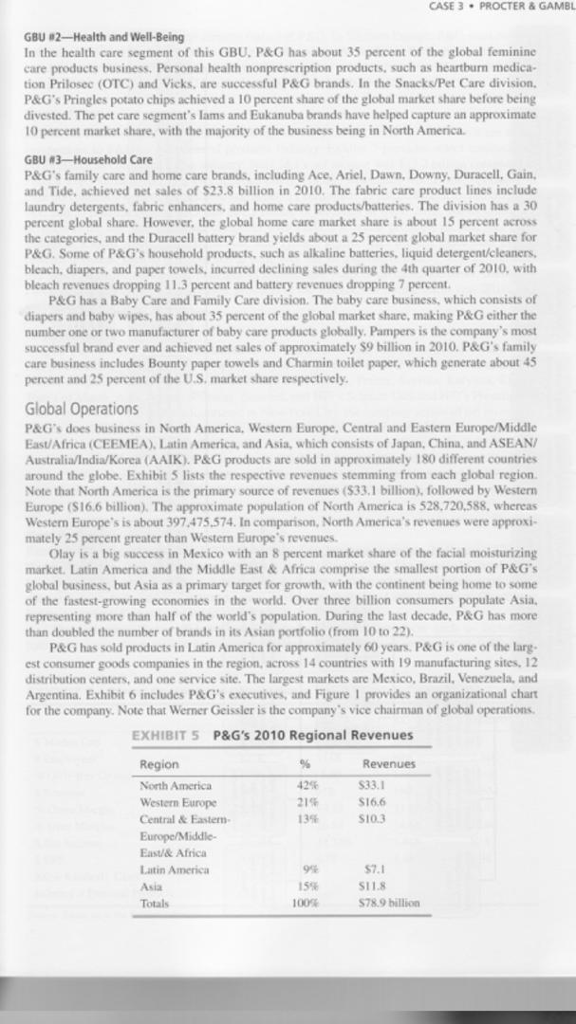

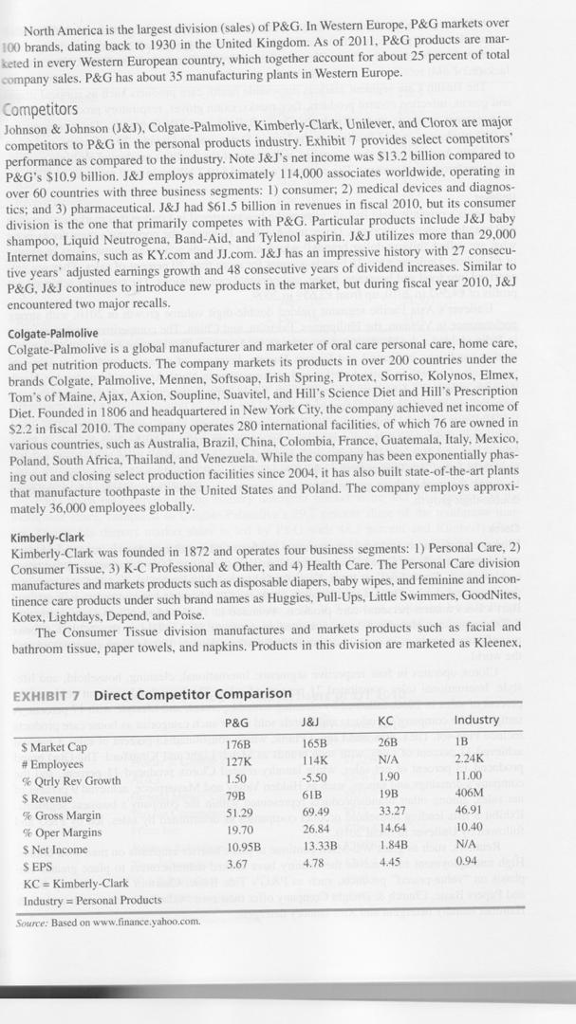

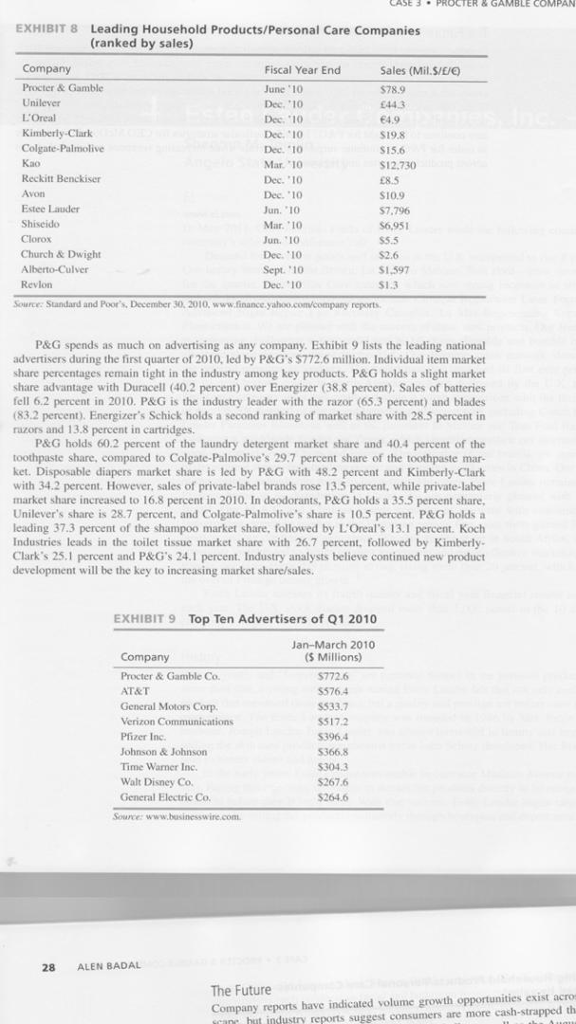

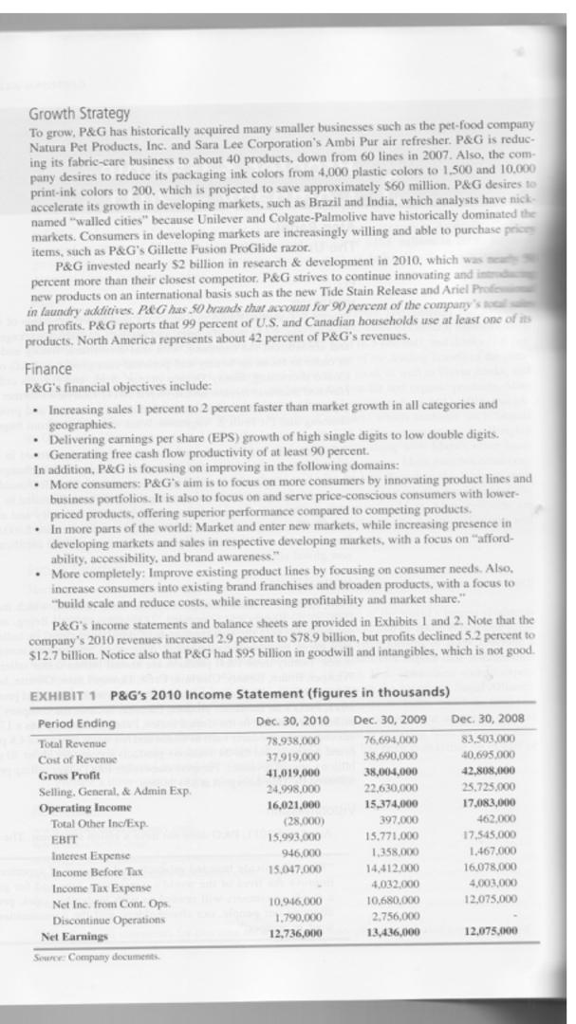

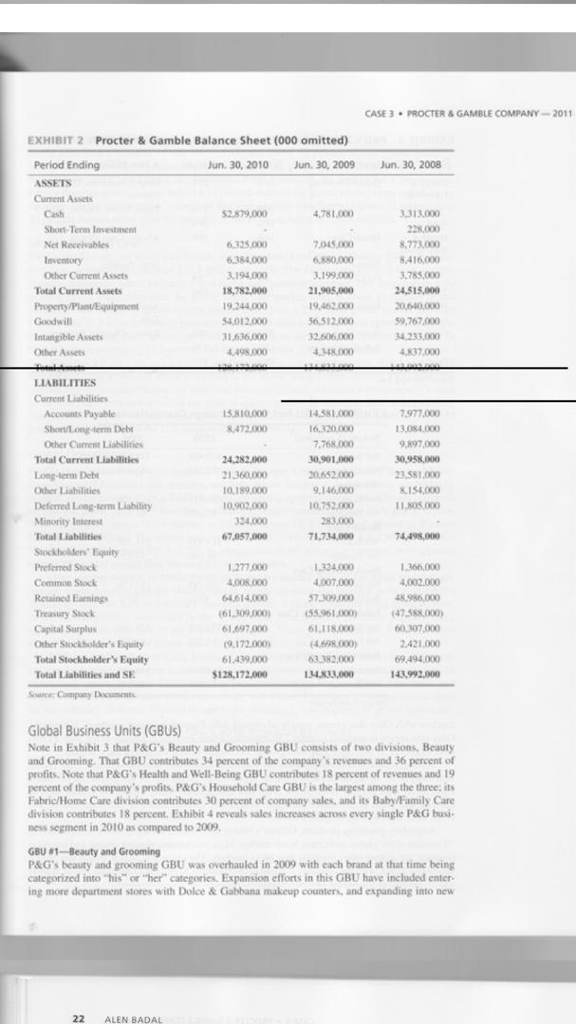

Growth Strategy To grow, P&G has historically acquired many smaller businesses such as the pet-food company atura Pet Products, Inc. and Sara Lee Corporation's Ambi Pur air refresher P&G is reduc ing its fabric-care business to about 40 products, down from 60 lines in 2007. Also, the com- to reduce its packaging ink colors from 4,000 plastic colors to 1,500 and 10.000 oximately $60 million. P&G desires to print-ink colors to 200, which is accelerate its growth in developing markets, such as Brazil and India, which analysts have nick named "walled cities" because Unilever and Colgate-Palmolive have historically dominated the markets. Consumers in developing markets are increasingly willing and able to purchase price items, such as P&G's Gillette Fusion ProGlide razor P&G invested nearly $2 billion in research & development in 2010, which was n more than their closest competitor. P&G strives to continue innovating and int new products on an international basis such as the new Tide Stain Release and Ariel Profiess n laundry adlitves. PG has 50 brands that account for 90 percent of the company's and profits. P&G reports that 99 percent of U.S. and Canadian households use at least one of i products. North America represents about 42 percent of P&G's revenues P&G's financial objectives include: Increasing sales 1 percent to 2 percent faster than market growth in all categories and geographies. .Delivering earnings per share (EPS) growth of high single digits to low double digits Generating free cash flow productivity of at least 90 percent In addition, P&G is focusing on improving in the following domains . More consumers: P&G's aim is to focus on more consumers by innovating product lines and business portfolios. It is also to focus on and serve price-conscious consumers with lower- priced products, offering superior performance compared to competing products In more parts of the world: Market and enter new markets, while increasing presence in developing markets and sales in respective developing markets, with a focus on "afford- ability, accessibility, and brand awareness. More completely: Improve existing product lines by focusing on consumer needs. Also, increase consumers into existing brand franchises and broaden products, with a focus to "build scale and reduce costs, while increasing profitability and market share." . P&G's income statements and balance sheets are provided in Exhibits 1 and 2. Note that the company's 2010 revenues increased 2.9 percent to $78.9 billion, but profits declined 5.2 percent to $12.7 billion. Notice also that P&G had $95 billion in goodwill and intangibles, which is not good EXHIBIT 1 P&G's 2010 Income Statement (figures in thousands) Dec. 30, 2010 Dec. 30, 2009 Dec 30, 2008 83,503,000 8.938,000 37,919,000 41,019,000 24,998,000 16,021,000 Total Revenue Cost of Revenue 38,690,000 38,004,000 22.630,000 15.374,000 25,725000 Selling. General,& Admin Exp Operating Income Total Other Inc/Exp 17,545.000 1467.000 15.771,000 1,358,000 4,412.000 ,032.000 15,993,000 15,047,000 Income Before Tax Income Tax Expense Net Inc. from Cont. Ops 12,075,000 2.756,000 1,790,000 12,736,000 12.975,000 Net Earnings Growth Strategy To grow, P&G has historically acquired many smaller businesses such as the pet-food company atura Pet Products, Inc. and Sara Lee Corporation's Ambi Pur air refresher P&G is reduc ing its fabric-care business to about 40 products, down from 60 lines in 2007. Also, the com- to reduce its packaging ink colors from 4,000 plastic colors to 1,500 and 10.000 oximately $60 million. P&G desires to print-ink colors to 200, which is accelerate its growth in developing markets, such as Brazil and India, which analysts have nick named "walled cities" because Unilever and Colgate-Palmolive have historically dominated the markets. Consumers in developing markets are increasingly willing and able to purchase price items, such as P&G's Gillette Fusion ProGlide razor P&G invested nearly $2 billion in research & development in 2010, which was n more than their closest competitor. P&G strives to continue innovating and int new products on an international basis such as the new Tide Stain Release and Ariel Profiess n laundry adlitves. PG has 50 brands that account for 90 percent of the company's and profits. P&G reports that 99 percent of U.S. and Canadian households use at least one of i products. North America represents about 42 percent of P&G's revenues P&G's financial objectives include: Increasing sales 1 percent to 2 percent faster than market growth in all categories and geographies. .Delivering earnings per share (EPS) growth of high single digits to low double digits Generating free cash flow productivity of at least 90 percent In addition, P&G is focusing on improving in the following domains . More consumers: P&G's aim is to focus on more consumers by innovating product lines and business portfolios. It is also to focus on and serve price-conscious consumers with lower- priced products, offering superior performance compared to competing products In more parts of the world: Market and enter new markets, while increasing presence in developing markets and sales in respective developing markets, with a focus on "afford- ability, accessibility, and brand awareness. More completely: Improve existing product lines by focusing on consumer needs. Also, increase consumers into existing brand franchises and broaden products, with a focus to "build scale and reduce costs, while increasing profitability and market share." . P&G's income statements and balance sheets are provided in Exhibits 1 and 2. Note that the company's 2010 revenues increased 2.9 percent to $78.9 billion, but profits declined 5.2 percent to $12.7 billion. Notice also that P&G had $95 billion in goodwill and intangibles, which is not good EXHIBIT 1 P&G's 2010 Income Statement (figures in thousands) Dec. 30, 2010 Dec. 30, 2009 Dec 30, 2008 83,503,000 8.938,000 37,919,000 41,019,000 24,998,000 16,021,000 Total Revenue Cost of Revenue 38,690,000 38,004,000 22.630,000 15.374,000 25,725000 Selling. General,& Admin Exp Operating Income Total Other Inc/Exp 17,545.000 1467.000 15.771,000 1,358,000 4,412.000 ,032.000 15,993,000 15,047,000 Income Before Tax Income Tax Expense Net Inc. from Cont. Ops 12,075,000 2.756,000 1,790,000 12,736,000 12.975,000 Net Earnings