Answered step by step

Verified Expert Solution

Question

1 Approved Answer

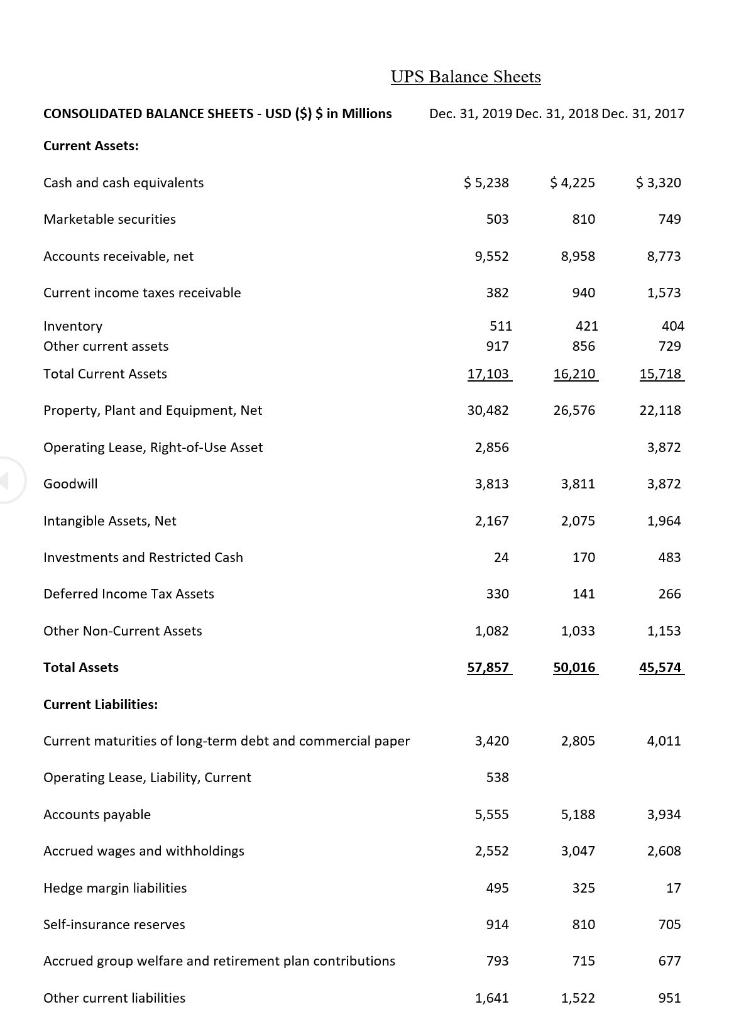

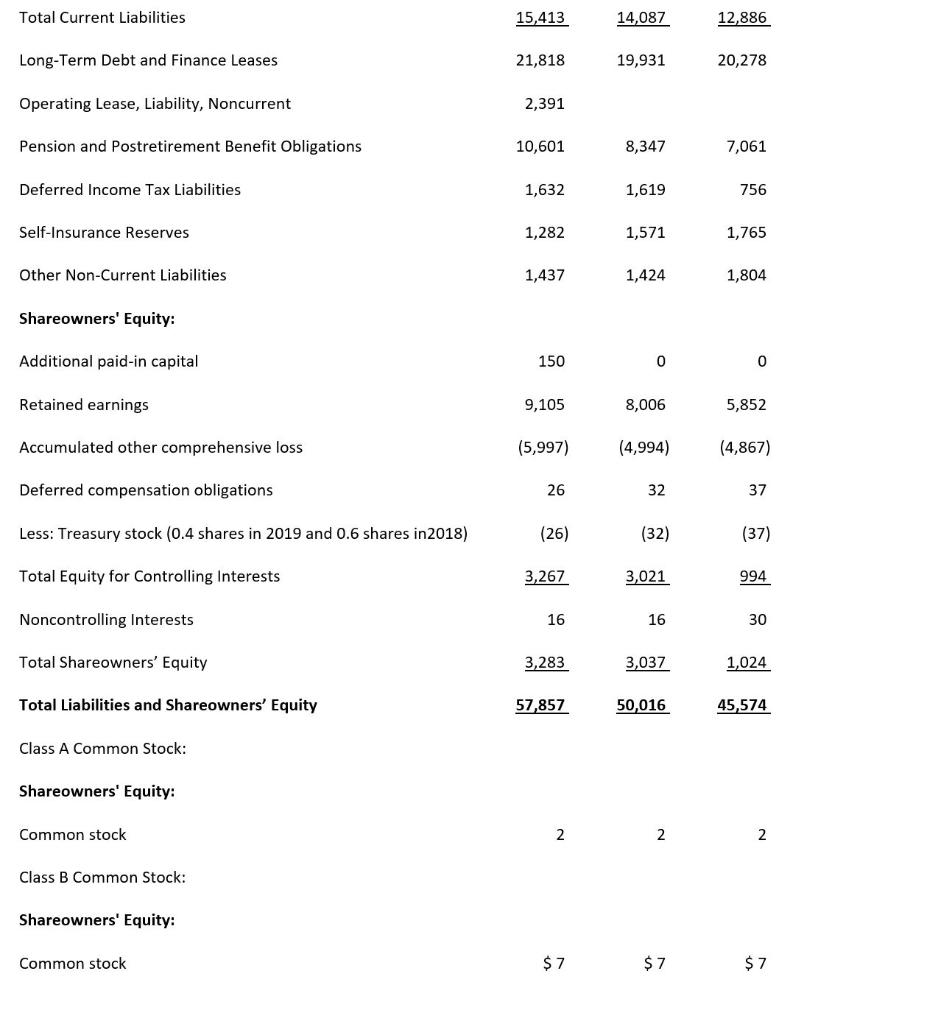

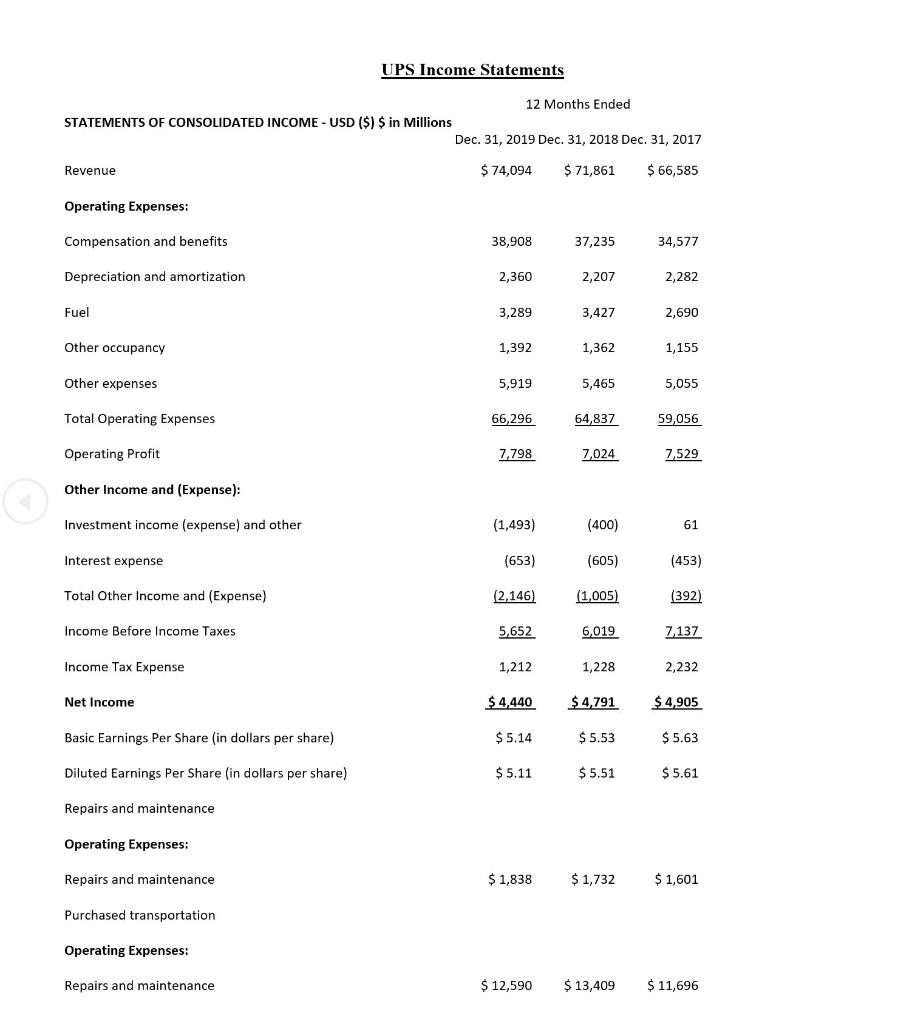

Calculate profit margin and return on equity of year 2019, 2018 and 2017 use given UPS Balance sheet and Income statement of company UPS Balance

Calculate profit margin and return on equity of year 2019, 2018 and 2017 use given UPS Balance sheet and Income statement of company

UPS Balance Sheets CONSOLIDATED BALANCE SHEETS - USD ($) $ in Millions Dec 31, 2019 Dec. 31, 2018 Dec 31, 2017 Current Assets: Cash and cash equivalents $ 5,238 $ 4,225 $ 3,320 Marketable securities 503 810 749 Accounts receivable, net 9,552 8,958 8,773 Current income taxes receivable 382 940 1,573 Inventory Other current assets 511 917 421 856 404 729 Total Current Assets 17 103 16,210 15, 718 Property, Plant and Equipment, Net 30,482 26,576 22,118 Operating Lease, Right-of-Use Asset 2,856 3,872 Goodwill 3,813 3,811 3,872 Intangible Assets, Net 2,167 2,075 1,964 Investments and Restricted Cash 24 170 483 Deferred Income Tax Assets 330 141 266 Other Non-Current Assets 1,082 1,033 1,153 Total Assets 57,857 50,016 45,574 Current Liabilities: Current maturities of long-term debt and commercial paper 3,420 2,805 4,011 Operating Lease, Liability, Current 538 Accounts payable 5,555 5,188 3,934 Accrued wages and withholdings 2,552 3,047 2,608 Hedge margin liabilities 495 325 17 Self-insurance reserves 914 810 705 Accrued group welfare and retirement plan contributions 793 715 677 Other current liabilities 1,641 1,522 951 Total Current Liabilities 15,413 14,087 14,087 12,886 Long-Term Debt and Finance Leases 21,818 19,931 20,278 Operating Lease, Liability, Noncurrent 2,391 Pension and Postretirement Benefit Obligations 10,601 8,347 7,061 Deferred Income Tax Liabilities 1,632 1,619 756 Self-Insurance Reserves 1,282 1,571 1,765 Other Non-Current Liabilities 1,437 1,424 1,804 Shareowners' Equity: Additional paid-in capital 150 o 0 Retained earnings 9,105 8,006 5,852 Accumulated other comprehensive loss (5,997) (4,994) (4,867) Deferred compensation obligations 26 32 37 Less: Treasury stock (0.4 shares in 2019 and 0.6 shares in 2018) (26) (32) (37) Total Equity for Controlling Interests 3,267 3,021 994 Noncontrolling Interests 16 16 30 Total Shareowners' Equity 3,283 3,037 1,024 Total Liabilities and Shareowners' Equity 57,857 50,016 45,574 Class A Common Stock: Shareowners' Equity: Common stock 2 2 2 Class B Common Stock: Shareowners' Equity: Common stock $ 7 $ 7 $ 7 UPS Income Statements 12 Months Ended STATEMENTS OF CONSOLIDATED INCOME - USD ($) $ in Millions Dec. 31, 2019 Dec. 31, 2018 Dec. 31, 2017 Revenue $ 74,094 $ 71,861 $ 66,585 Operating Expenses: Compensation and benefits 38,908 37,235 34,577 Depreciation and amortization 2,360 2,207 2,282 Fuel 3,289 3,427 2,690 Other occupancy 1,392 1,362 1,155 Other expenses 5,919 5,465 5,055 Total Operating Expenses 66,296 64,837 59,056 Operating Profit 7,798 7,024 7,529 Other Income and (Expense): Investment income (expense) and other (1,493) (400) 61 Interest expense (653) (605) (453) Total Other Income and (Expense) (2,146) (1,005) (392) Income Before Income Taxes 5,652 6,019 7,137 Income Tax Expense 1,212 1,228 2,232 Net Income $ 4,440 $4,791 $ 4,905 Basic Earnings Per Share (in dollars per share) $5.14 $ 5.53 $ 5.63 Diluted Earnings Per Share (in dollars per share) $5.11 $5.51 $5.61 Repairs and maintenance Operating Expenses: Repairs and maintenance $ 1,838 $ 1,732 $ 1,601 Purchased transportation Operating Expenses: Repairs and maintenance $ 12,590 $ 13,409 $ 11,696Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started