Calculate relevant ratios on Dec 31, 1992 and evaluate the financial position of the firm.

Calculate relevant ratios on Dec 31, 1992 and evaluate the financial position of the firm.

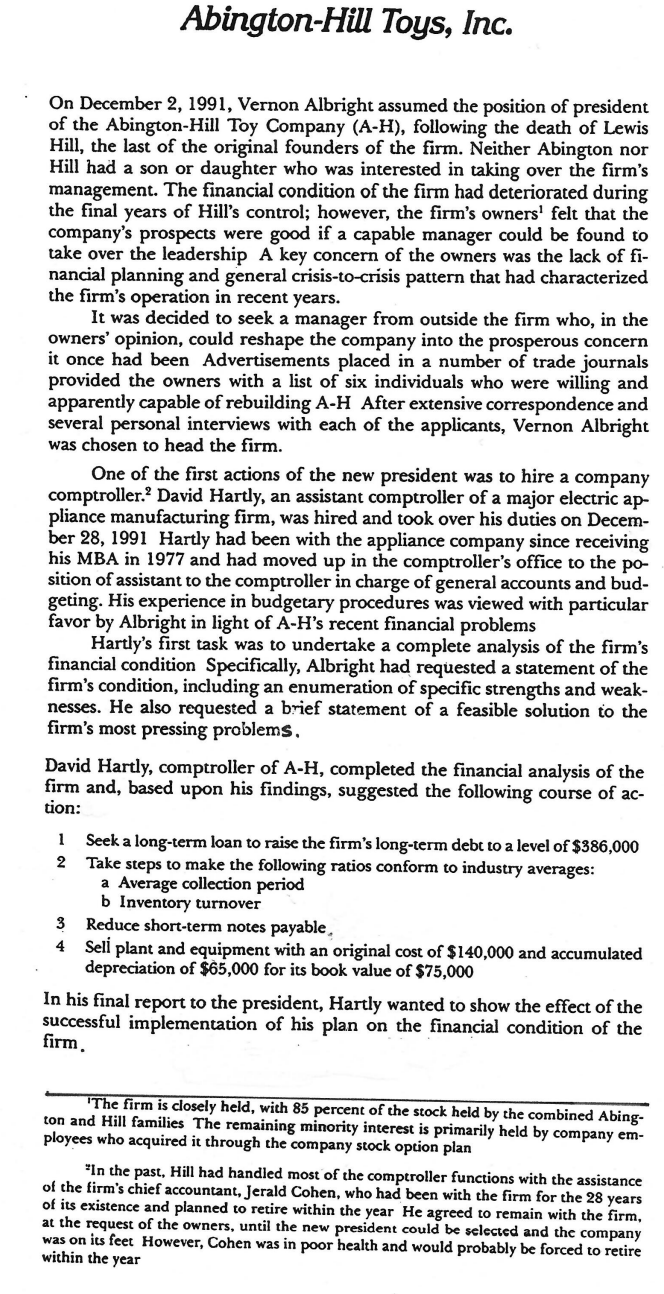

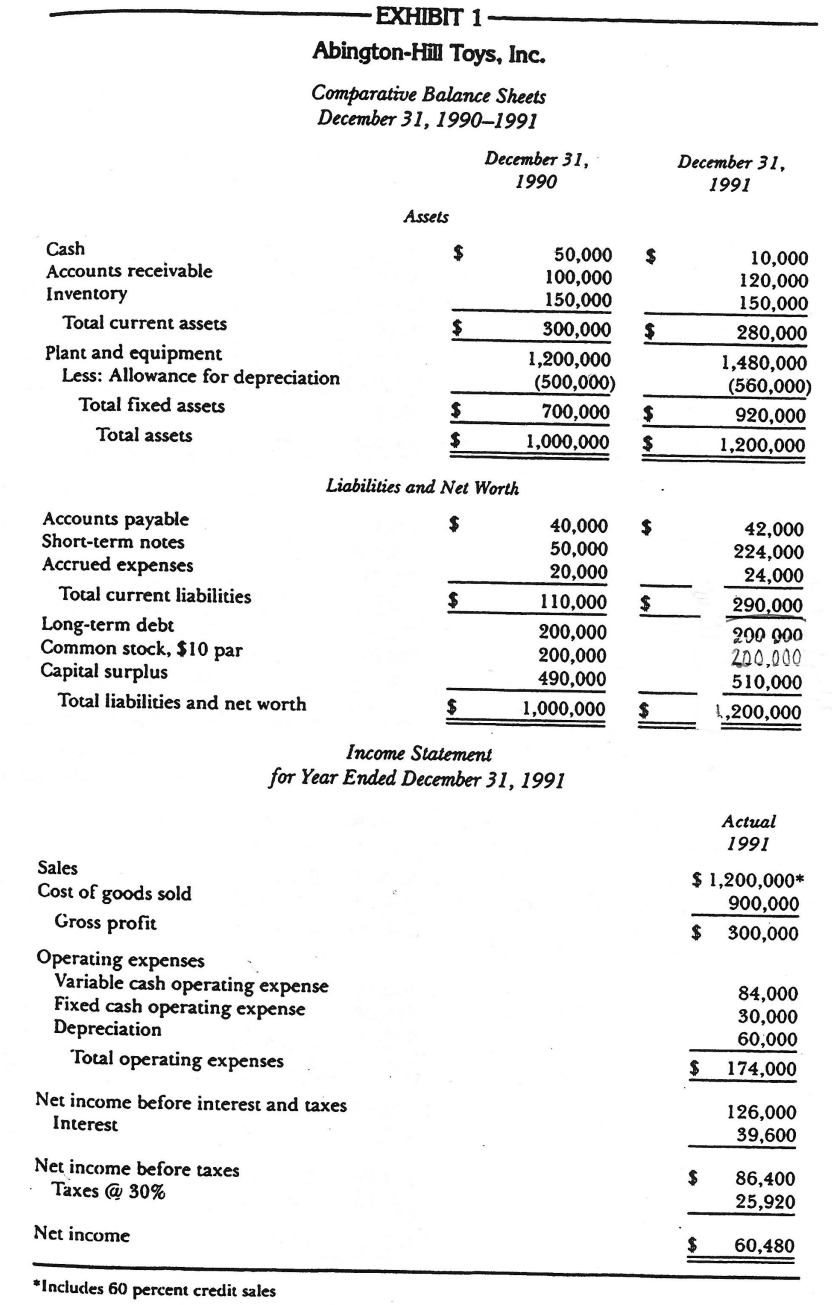

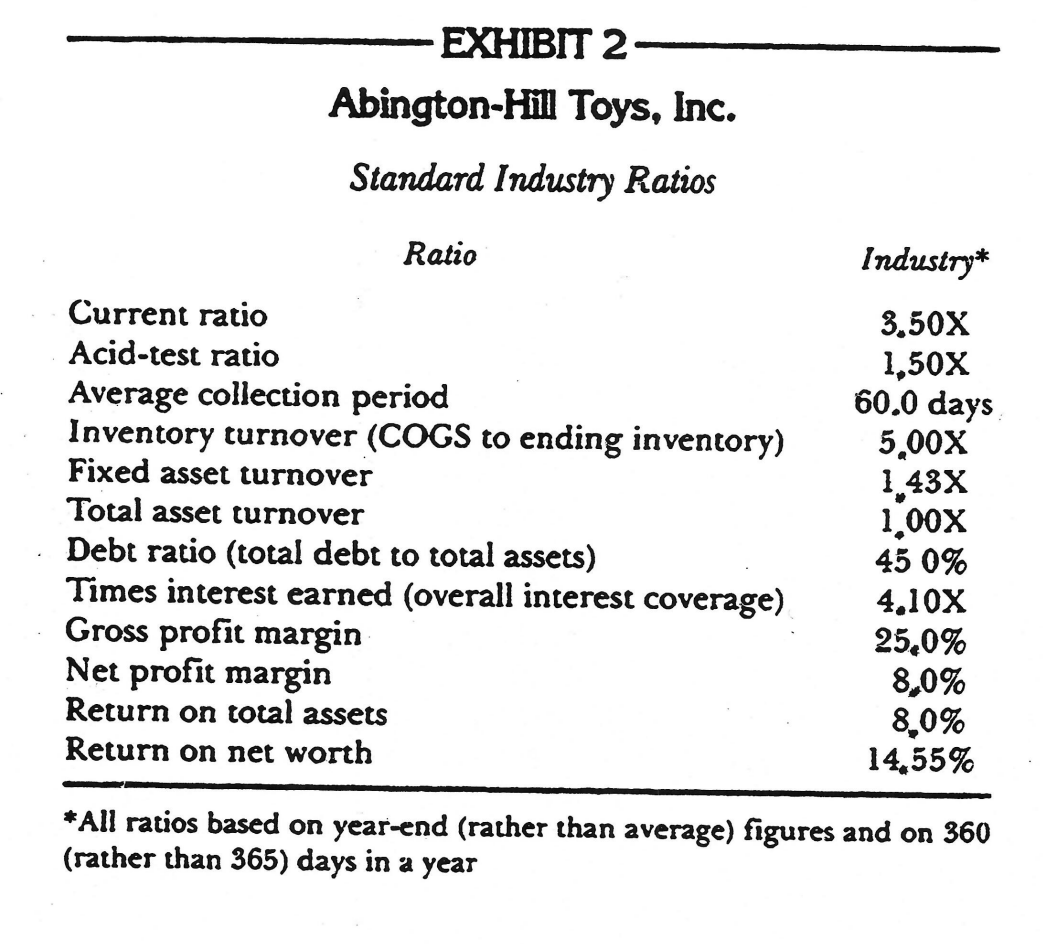

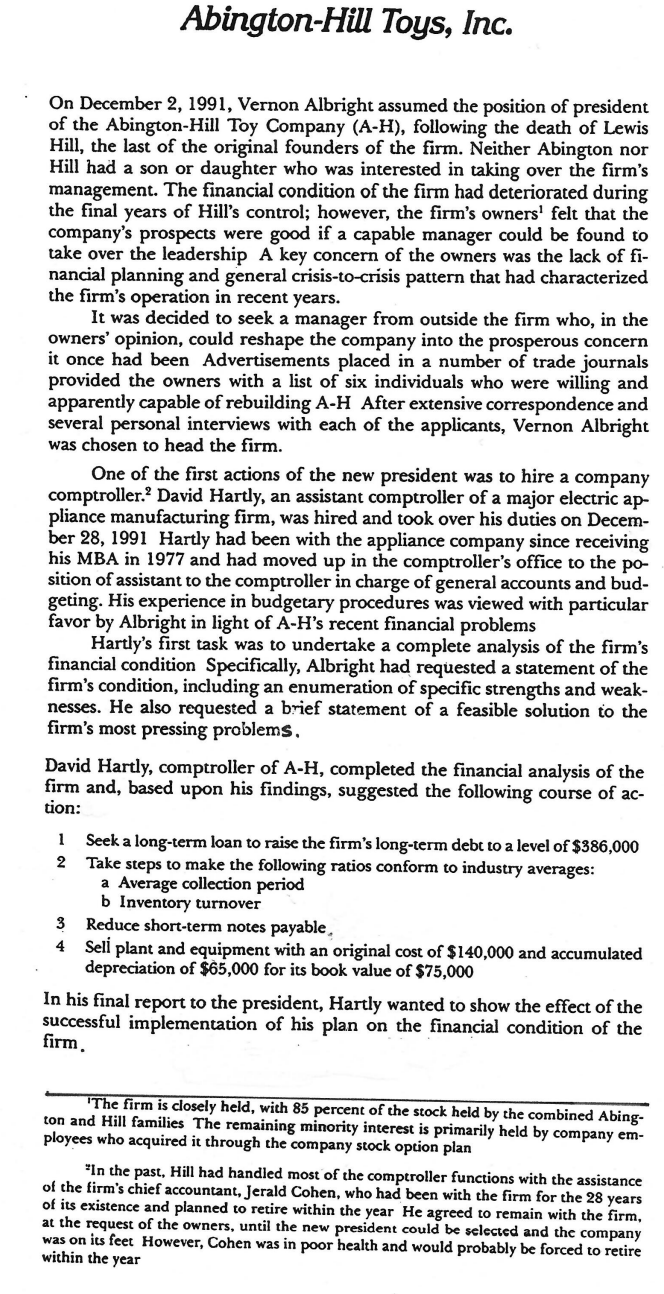

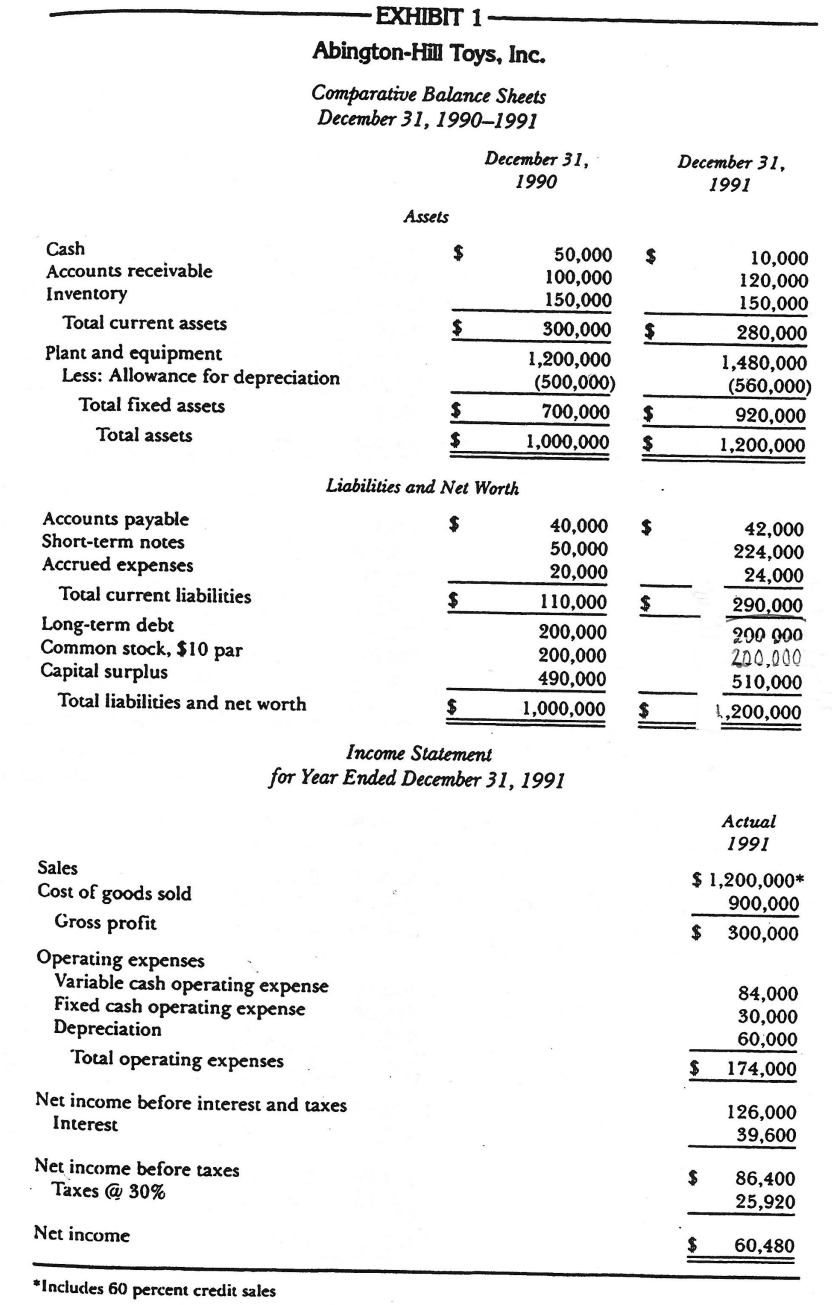

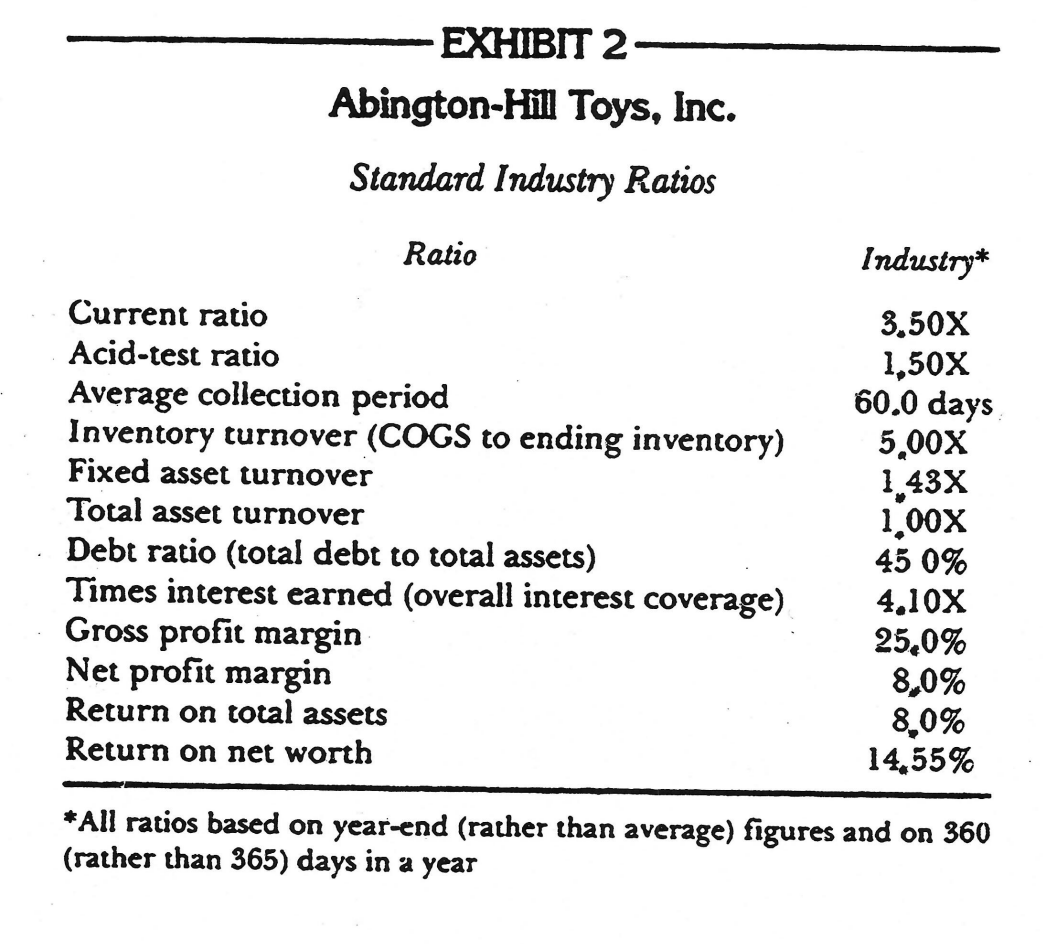

Abington-Hill Toys, Inc. On December 2, 1991, Vernon Albright assumed the position of president of the Abington-Hill Toy Company (AH), following the death of Lewis Hill, the last of the original founders of the firm. Neither Abington nor Hill had a son or daughter who was interested in taking over the firm's management. The financial condition of the firm had deteriorated during the final years of Hill's control; however, the firm's owners 1 felt that the company's prospects were good if a capable manager could be found to take over the leadership A key concern of the owners was the lack of financial planning and general crisis-to-crisis pattern that had characterized the firm's operation in recent years. It was decided to seek a manager from outside the firm who, in the owners' opinion, could reshape the company into the prosperous concern it once had been Advertisements placed in a number of trade journals provided the owners with a list of six individuals who were willing and apparently capable of rebuilding A-H After extensive correspondence and several personal interviews with each of the applicants, Vernon Albright was chosen to head the firm. One of the first actions of the new president was to hire a company comptroller. 2 David Hartly, an assistant comptroller of a major electric appliance manufacturing firm, was hired and took over his duties on December 28, 1991 Hartly had been with the appliance company since receiving his MBA in 1977 and had moved up in the comptroller's office to the position of assistant to the comptroller in charge of general accounts and budgeting. His experience in budgetary procedures was viewed with particular favor by Albright in light of A-H's recent financial problems Hartly's first task was to undertake a complete analysis of the firm's financial condition Specifically, Albright had requested a statement of the firm's condition, including an enumeration of specific strengths and weaknesses. He also requested a brief statement of a feasible solution to the firm's most pressing problems. David Hartly, comptroller of A-H, completed the financial analysis of the firm and, based upon his findings, suggested the following course of action: 1 Seek a long-term loan to raise the firm's long-term debt to a level of $386,000 2 Take steps to make the following ratios conform to industry averages: a Average collection period b Inventory turnover 3 Reduce short-term notes payable, 4 Seli plant and equipment with an original cost of $140,000 and accumulated depreciation of $65,000 for its book value of $75,000 In his final report to the president, Hartly wanted to show the effect of the successful implementation of his plan on the financial condition of the firm. 'The firm is closely held, with 85 percent of the stock held by the combined Abington and Hill families The remaining minority interest is primarily held by company employees who acquired it through the company stock option plan "In the past, Hill had handled most of the comptroller functions with the assistance of the firm's chief accountant, Jerald Cohen, who had been with the firm for the 28 years of its existence and planned to retire within the year He agreed to remain with the firm, at the request of the owners, until the new president could be selected and the company was on its feet However, Cohen was in poor health and would probably be forced to retire within the year Abington-Hill Toys, Inc. Comparative Balance Sheets (rather than 365) days in a year

Calculate relevant ratios on Dec 31, 1992 and evaluate the financial position of the firm.

Calculate relevant ratios on Dec 31, 1992 and evaluate the financial position of the firm.