Answered step by step

Verified Expert Solution

Question

1 Approved Answer

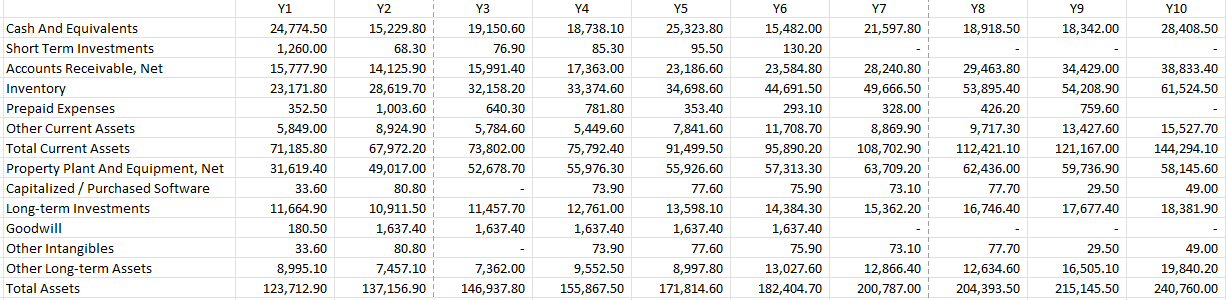

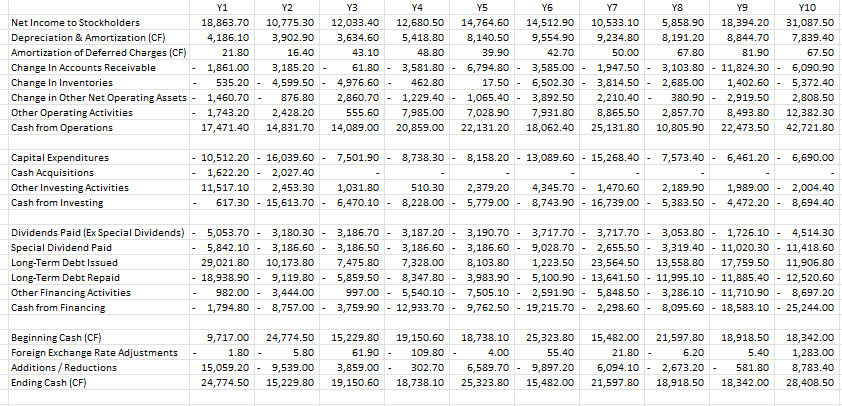

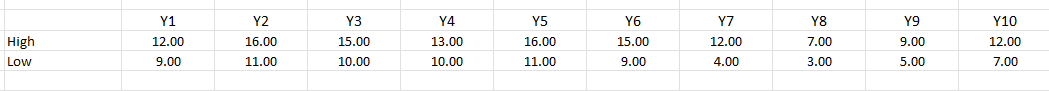

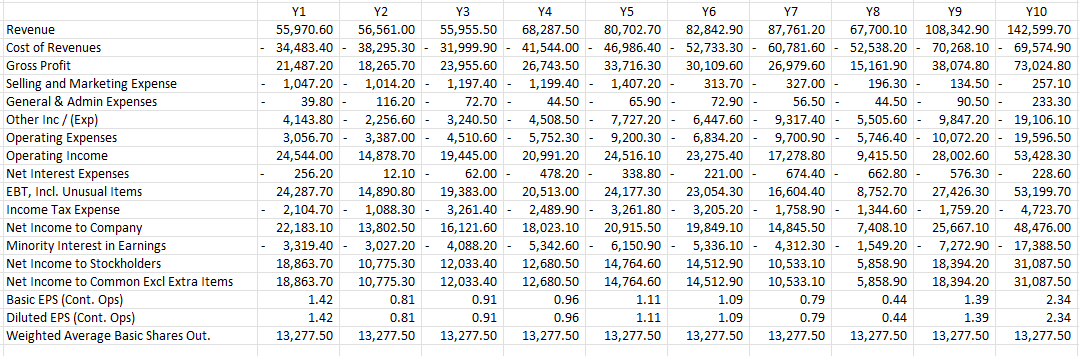

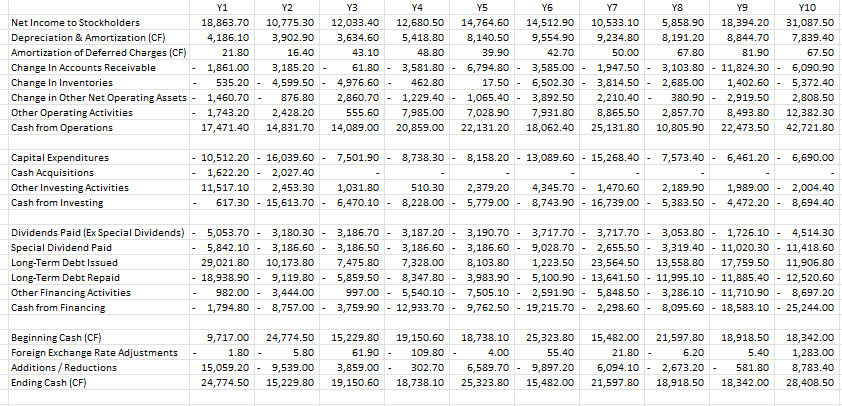

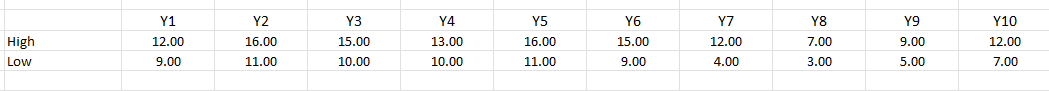

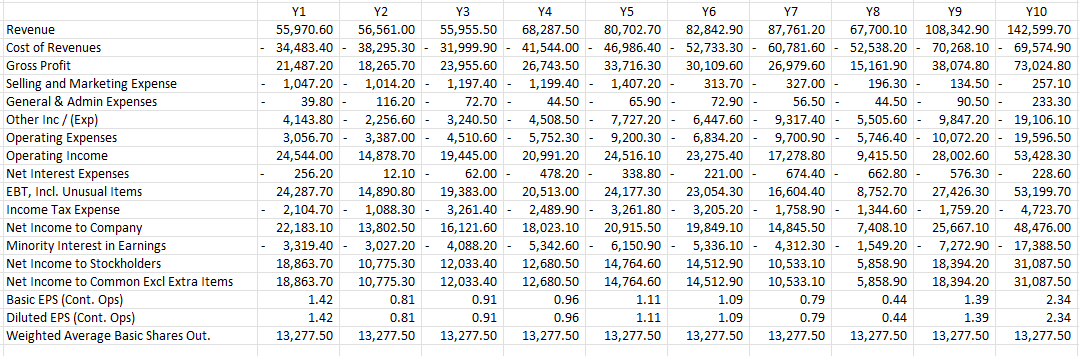

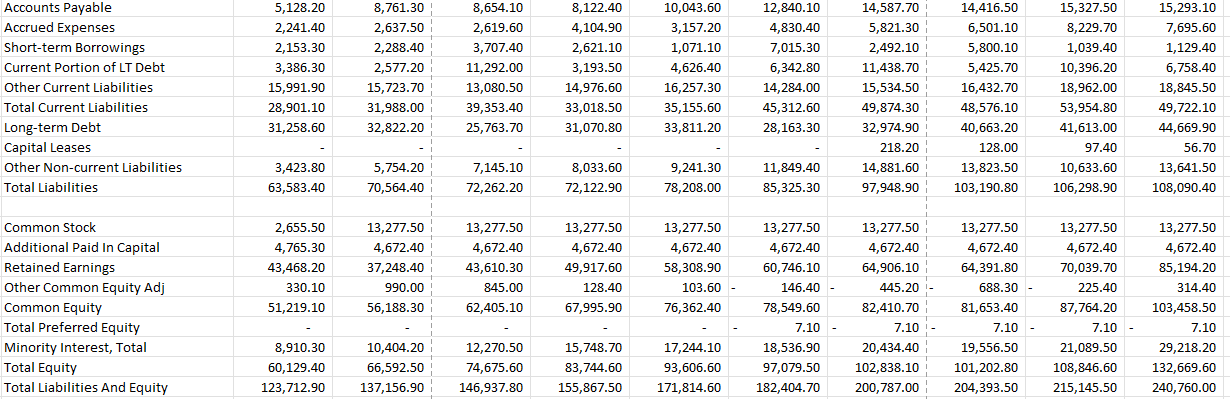

Calculate residual income model of dmci for 10 years? Y1 Y2 Y3 Y4 Y5 Y6 Y7 Y8 Y9 Y10 Cash And Equivalents 24,774.50 15,229.80 19,150.60

Calculate residual income model of dmci for 10 years?

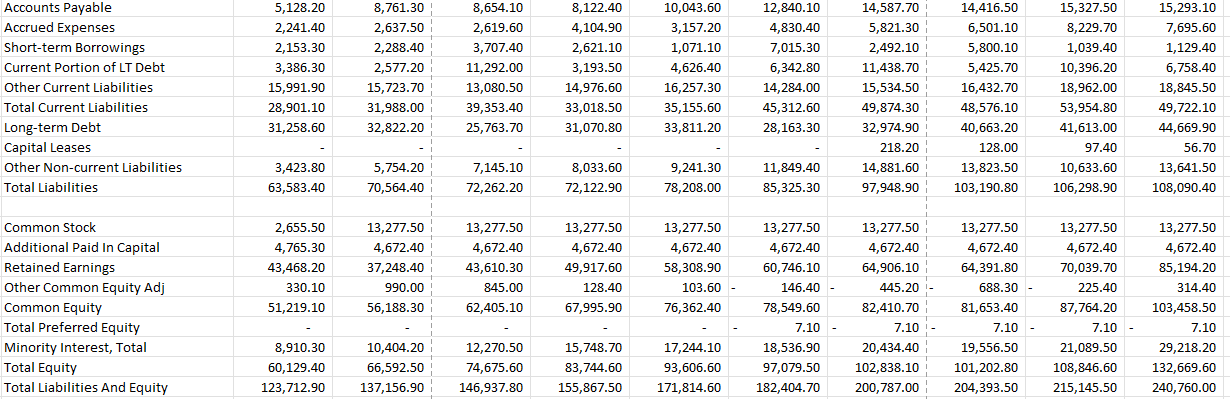

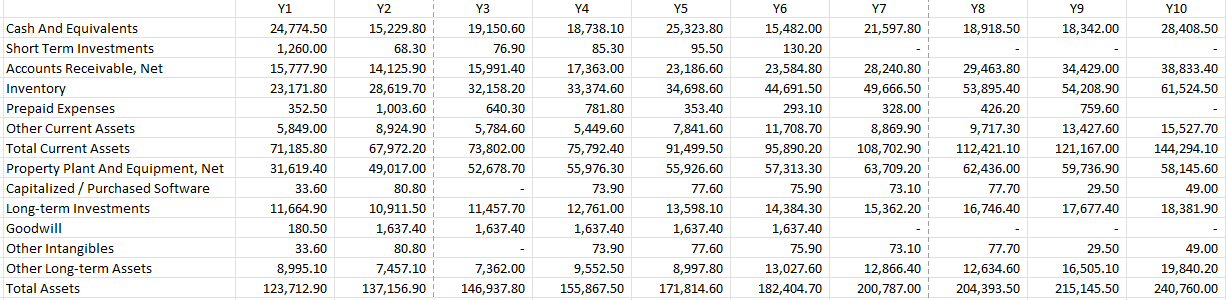

Y1 Y2 Y3 Y4 Y5 Y6 Y7 Y8 Y9 Y10 Cash And Equivalents 24,774.50 15,229.80 19,150.60 18,738.10 25,323.80 15,482.00 21,597.80 18,918.50 18,342.00 28,408.50 Short Term Investments 1,260.00 Accounts Receivable, Net 15,777.90 68.30 14,125.90 76.90 15,991.40 85.30 17,363.00 95.50 23,186.60 130.20 23,584.80 Inventory 23,171.80 28,619.70 32,158.20 33,374.60 Prepaid Expenses 352.50 1,003.60 640.30 Other Current Assets 5,849.00 8,924.90 5,784.60 781.80 5,449.60 34,698.60 353.40 7,841.60 44,691.50 293.10 11,708.70 28,240.80 49,666.50 29,463.80 34,429.00 38,833.40 Total Current Assets 71,185.80 67,972.20 73,802.00 75,792.40 91,499.50 95,890.20 Property Plant And Equipment, Net 31,619.40 49,017.00 52,678.70 55,976.30 55,926.60 57,313.30 Capitalized/Purchased Software 33.60 Long-term Investments 11,664.90 Goodwill Other Intangibles 180.50 33.60 80.80 10,911.50 1,637.40 11,457.70 1,637.40 73.90 12,761.00 1,637.40 Other Long-term Assets 8,995.10 Total Assets 123,712.90 80.80 7,457.10 137,156.90 7,362.00 146,937.80 73.90 9,552.50 155,867.50 77.60 13,598.10 1,637.40 77.60 8,997.80 171,814.60 75.90 14,384.30 1,637.40 75.90 328.00 8,869.90 108,702.90 63,709.20 73.10 15,362.20 53,895.40 426.20 9,717.30 112,421.10 62,436.00 77.70 16,746.40 54,208.90 61,524.50 759.60 13,427.60 121,167.00 15,527.70 144,294.10 59,736.90 29.50 17,677.40 58,145.60 49.00 18,381.90 - 13,027.60 182,404.70 73.10 12,866.40 200,787.00 77.70 12,634.60 29.50 16,505.10 49.00 19,840.20 204,393.50 215,145.50 240,760.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started