Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate ROI for geographic segments; analyze results-McDonald's Corp. McDonald's conducts operations worldwide and is managed in three primary geographic segments: U.S., International Lead Markets

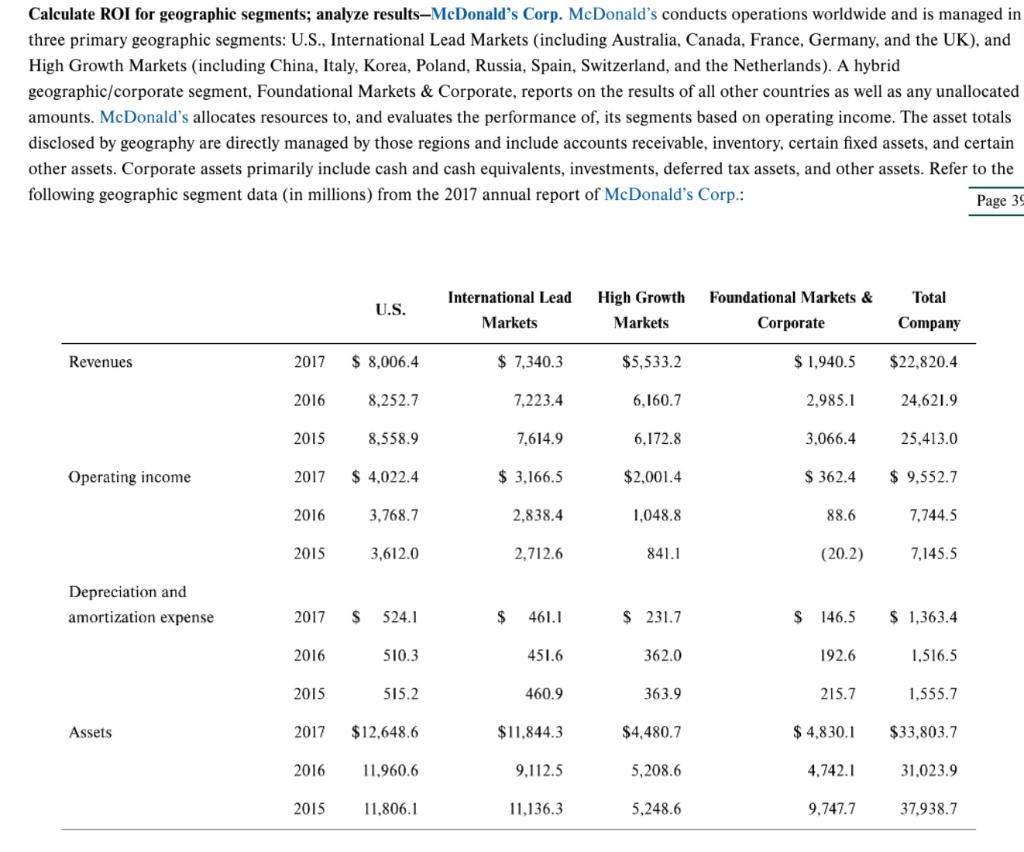

Calculate ROI for geographic segments; analyze results-McDonald's Corp. McDonald's conducts operations worldwide and is managed in three primary geographic segments: U.S., International Lead Markets (including Australia, Canada, France, Germany, and the UK), and High Growth Markets (including China, Italy, Korea, Poland, Russia, Spain, Switzerland, and the Netherlands). A hybrid geographic/corporate segment, Foundational Markets & Corporate, reports on the results of all other countries as well as any unallocated amounts. McDonald's allocates resources to, and evaluates the performance of, its segments based on operating income. The asset totals disclosed by geography are directly managed by those regions and include accounts receivable, inventory, certain fixed assets, and certain other assets. Corporate assets primarily include cash and cash equivalents, investments, deferred tax assets, and other assets. Refer to the following geographic segment data (in millions) from the 2017 annual report of McDonald's Corp.: Page 39 U.S. International Lead Markets High Growth Markets Foundational Markets & Corporate Total Company Revenues. 2017 $ 8,006.4 $ 7,340.3 $5,533.2 $ 1,940.5 $22,820.4 2016 8,252.7 7,223.4 6,160.7 2,985.1 24,621.9 2015 8,558.9 7,614.9 6,172.8 3,066.4 25,413.0 Operating income 2017 $4,022.4 $ 3,166.5 $2,001.4 $362.4 $ 9,552.7 2016 3,768.7 2,838.4 1,048,8 88.6 7,744.5 2015 3,612.0 2,712.6 841.1 (20.2) 7,145.5 Depreciation and amortization expense 2017 $ 524.1 $ 461.1 $ 231.7 $ 1,363.4 2016 510.3 451.6 362.0 1,516.5 2015 515.2 460.9 363.9 1,555.7 Assets 2017 $12,648.6 $11,844.3 $4,480.7 $33,803.7 2016 11,960.6 9,112.5 5,208.6 31,023.9 2015 11,806.1 11,136.3 5,248.6 37,938.7 $ 146.5 192.6 215.7 $4,830.1 4,742.1 9,747.7 d. Comment about the difficulties you may encounter when attempting to interpret the Foundational Markets and Corporate segment results. Calculate ROI for geographic segments; analyze results-McDonald's Corp. McDonald's conducts operations worldwide and is managed in three primary geographic segments: U.S., International Lead Markets (including Australia, Canada, France, Germany, and the UK), and High Growth Markets (including China, Italy, Korea, Poland, Russia, Spain, Switzerland, and the Netherlands). A hybrid geographic/corporate segment, Foundational Markets & Corporate, reports on the results of all other countries as well as any unallocated amounts. McDonald's allocates resources to, and evaluates the performance of, its segments based on operating income. The asset totals disclosed by geography are directly managed by those regions and include accounts receivable, inventory, certain fixed assets, and certain other assets. Corporate assets primarily include cash and cash equivalents, investments, deferred tax assets, and other assets. Refer to the following geographic segment data (in millions) from the 2017 annual report of McDonald's Corp.: Page 39 U.S. International Lead Markets High Growth Markets Foundational Markets & Corporate Total Company Revenues. 2017 $ 8,006.4 $ 7,340.3 $5,533.2 $ 1,940.5 $22,820.4 2016 8,252.7 7,223.4 6,160.7 2,985.1 24,621.9 2015 8,558.9 7,614.9 6,172.8 3,066.4 25,413.0 Operating income 2017 $4,022.4 $ 3,166.5 $2,001.4 $362.4 $ 9,552.7 2016 3,768.7 2,838.4 1,048,8 88.6 7,744.5 2015 3,612.0 2,712.6 841.1 (20.2) 7,145.5 Depreciation and amortization expense 2017 $ 524.1 $ 461.1 $ 231.7 $ 1,363.4 2016 510.3 451.6 362.0 1,516.5 2015 515.2 460.9 363.9 1,555.7 Assets 2017 $12,648.6 $11,844.3 $4,480.7 $33,803.7 2016 11,960.6 9,112.5 5,208.6 31,023.9 2015 11,806.1 11,136.3 5,248.6 37,938.7 $ 146.5 192.6 215.7 $4,830.1 4,742.1 9,747.7 d. Comment about the difficulties you may encounter when attempting to interpret the Foundational Markets and Corporate segment results.

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

2017 ROI by Primary Geographic segment US RevenueA 800640 Operating income B ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started