Answered step by step

Verified Expert Solution

Question

1 Approved Answer

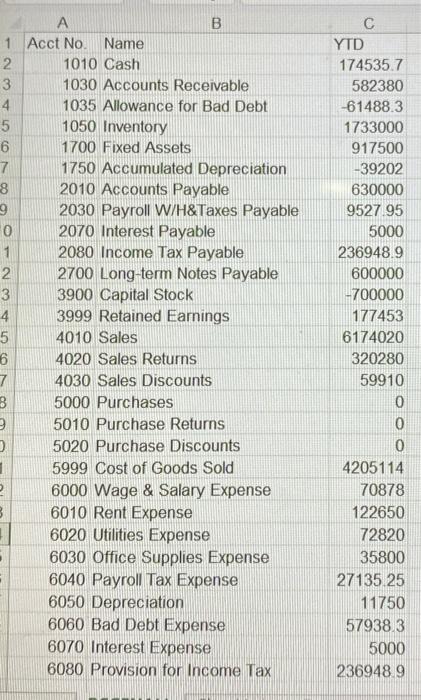

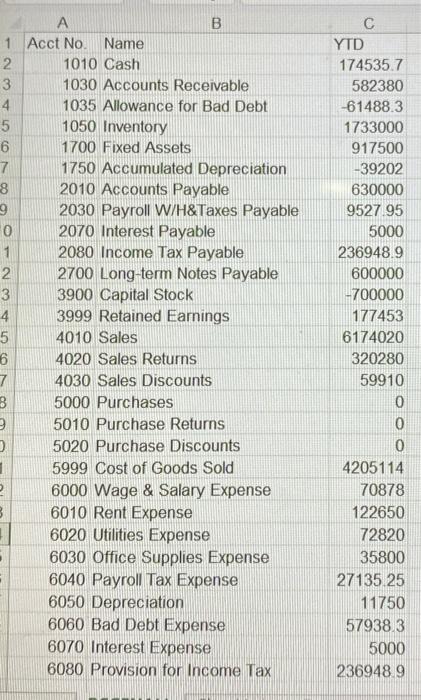

calculate ROI, GM%, CR, DE, EPS. ROI is supposed to equal 77.29% please explain how that is the correct answer begin{tabular}{l|l|r|} hline & multicolumn{1}{c}{ B

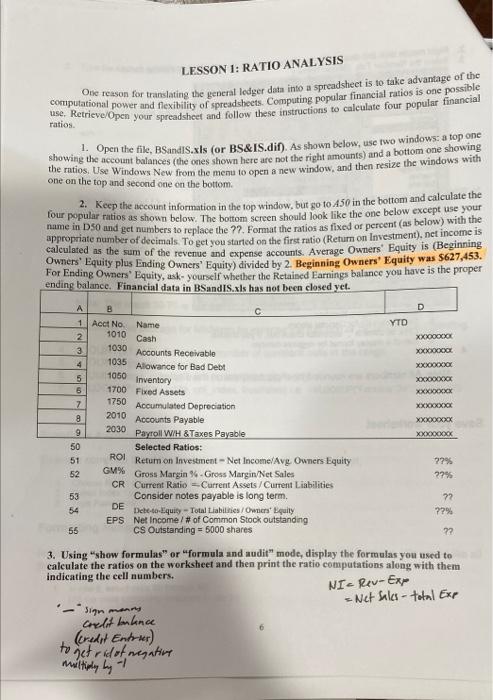

calculate ROI, GM%, CR, DE, EPS. ROI is supposed to equal 77.29% please explain how that is the correct answer

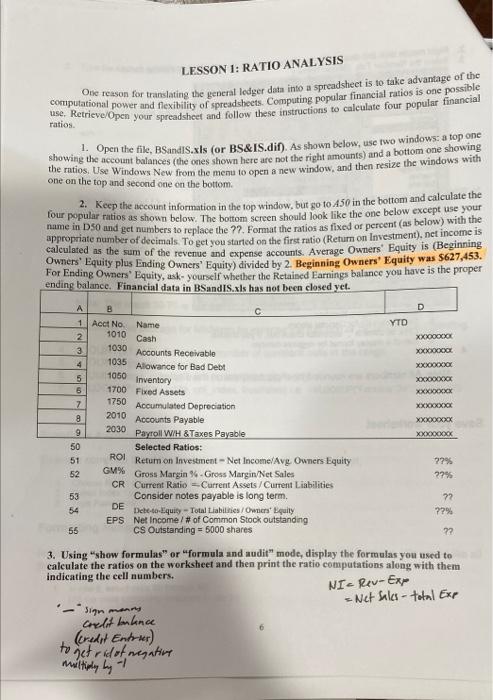

\begin{tabular}{l|l|r|} \hline & \multicolumn{1}{c}{ B } & \multicolumn{1}{c}{ C } \\ \hline 1 & Acct No. & Name \\ \hline 2 & 1010 Cash & 174535.7 \\ 3 & 1030 Accounts Receivable & 582380 \\ 4 & 1035 Allowance for Bad Debt & -61488.3 \\ \hline 5 & 1050 Inventory & 1733000 \\ \hline 6 & 1700 Fixed Assets & 917500 \\ 7 & 1750 Accumulated Depreciation & -39202 \\ \hline 8 & 2010 Accounts Payable & 630000 \\ \hline 9 & 2030 Payroll W/H\&Taxes Payable & 9527.95 \\ \hline 0 & 2070 Interest Payable & 5000 \\ \hline 1 & 2080 Income Tax Payable & 236948.9 \\ \hline 2 & 2700 Long-term Notes Payable & 600000 \\ \hline 3 & 3900 Capital Stock & -700000 \\ \hline 4 & 3999 Retained Earnings & 177453 \\ \hline 5 & 4010 Sales & 6174020 \\ \hline 6 & 4020 Sales Returns & 320280 \\ \hline 7 & 4030 Sales Discounts & 59910 \\ \hline 3 & 5000 Purchases & 0 \\ \hline 9 & 5010 Purchase Returns & 0 \\ \hline 5020 Purchase Discounts & 0 \\ \hline 5 & 5999 Cost of Goods Sold & 7205114 \\ \hline 6000 Wage \& Salary Expense & 70878 \\ \hline 6010 Rent Expense & 122650 \\ \hline 6020 Utilities Expense & 72820 \\ \hline 6030 Office Supplies Expense & 35800 \\ \hline 6040 Payroll Tax Expense & 27135.25 \\ \hline 6050 Depreciation & 11750 \\ \hline 6060 Bad Debt Expense & 57938.3 \\ \hline 6070 Interest Expense & 5000 \\ \hline 6080 Provision for Income Tax & 236948.9 \\ \hline \end{tabular} LESSON 1: RATIO ANALYSIS Ote reason for translating the general lodger data into a spreadshect is to take advantage of the coruputational power and flexibility of spreadsbets. Computing popolar financial ratios is one possible use. Retrieve/Open your spreadsheet and follow these instructions to calculate four popular financial ratios. 1. Open the file, BSandIS.xls (or BS\&IS.dif). As shown below, use two windows: a top one showing the account balances (the ones shown here are not the right amounts) and a bottom one showing the ratios, Use Windows New from the menu to open a new window, and then resize the windows with one on the top and second one on the bottom. 2. Keep the account information in the top window, but go to A50 in the bottom and calculate the four popular ratios as shown below. The bottom screen should look like the one below except use your name in DSO and get numbers to replace the ??. Format the ratios as fixed or percent (as below) with the appropriate number of decimals. To get you started on the first ratio (Return on Investment), net income is calculated as the sum of the revenue and expense accounts. Average Owners' Bquity is (Beginning Owners' Equity plus Ending Owners' Equity) divided by 2. Beginning Owners' Equity was \$627,453. For Ending Owners' Equity, axk- yourself whether the Retaised Earnings balance you have is the proper 3. Using "show formulas" or "formula and audit" mode, display the formulas you used to calculate the ratios on the worksheet and then print the ratio computations along with them indicating the cell numbers. NII=Rev-Exp=NetSilas-totalExr multiven Ly1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started