Answered step by step

Verified Expert Solution

Question

1 Approved Answer

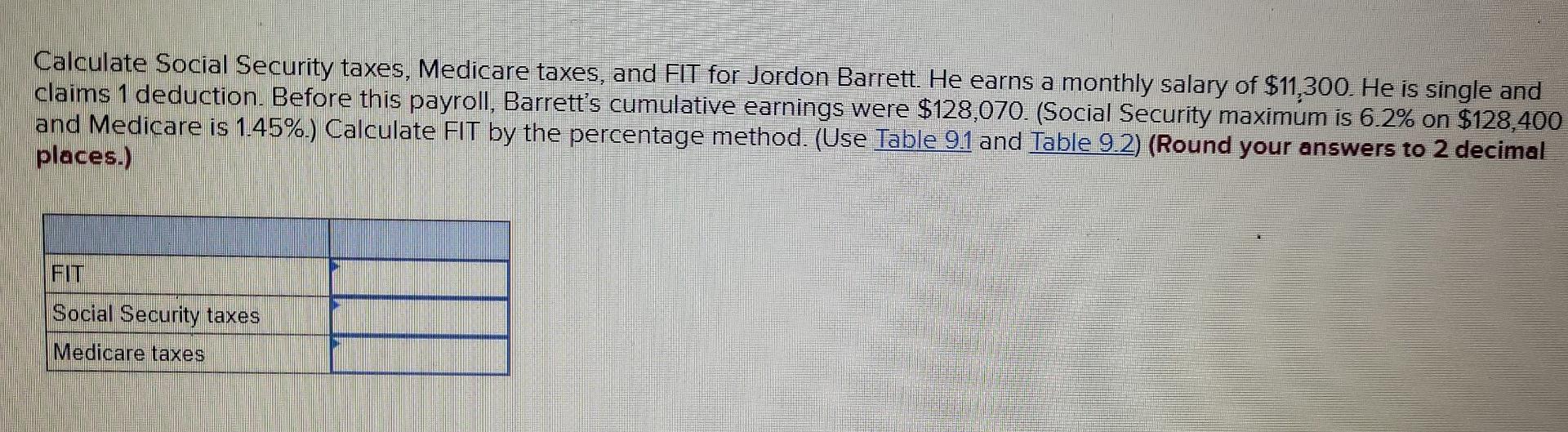

Calculate Social Security taxes, Medicare taxes, and FIT for Jordon Barrett. He earns a monthly salary of $11,300. He is single and claims 1 deduction.

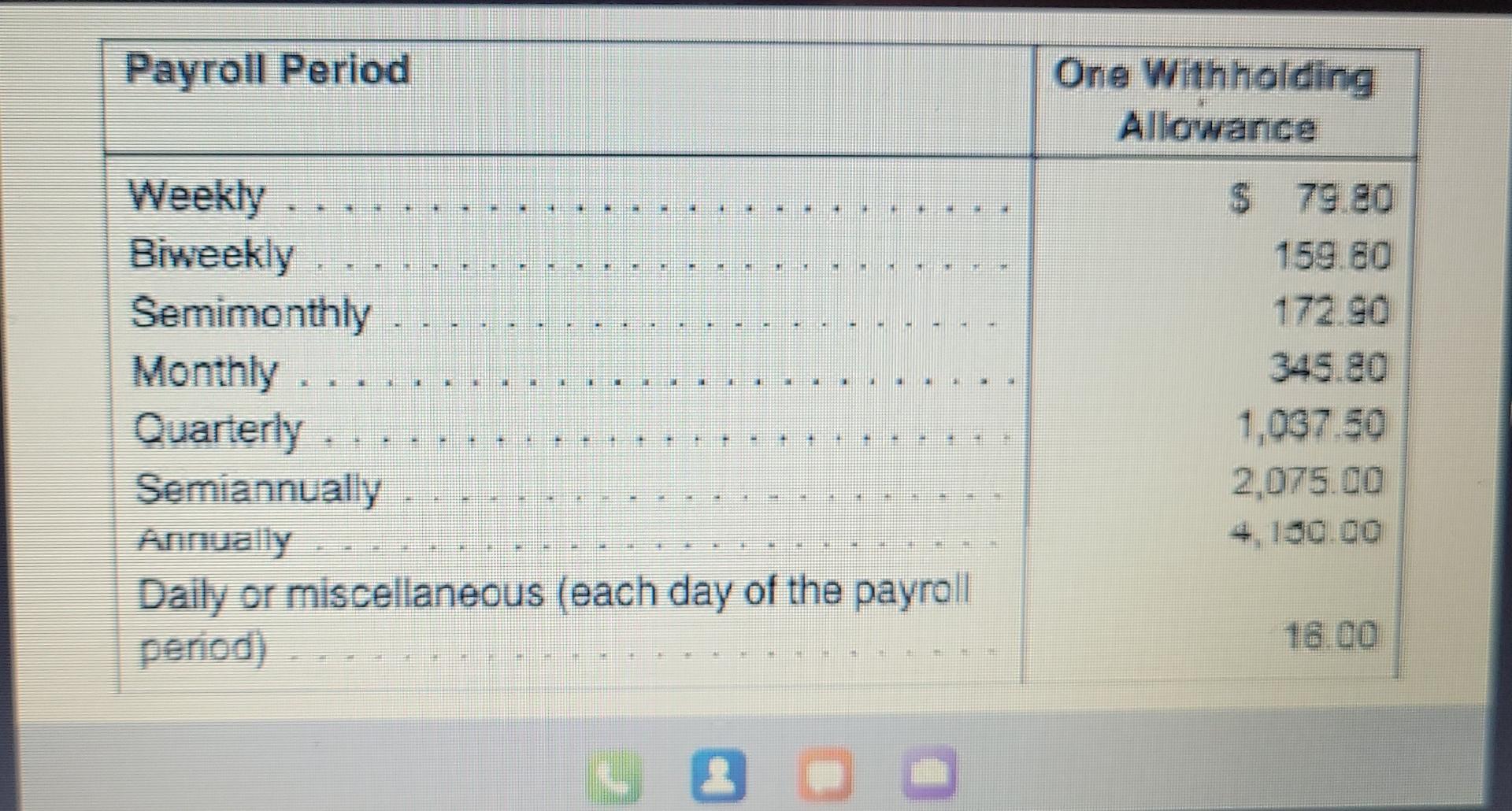

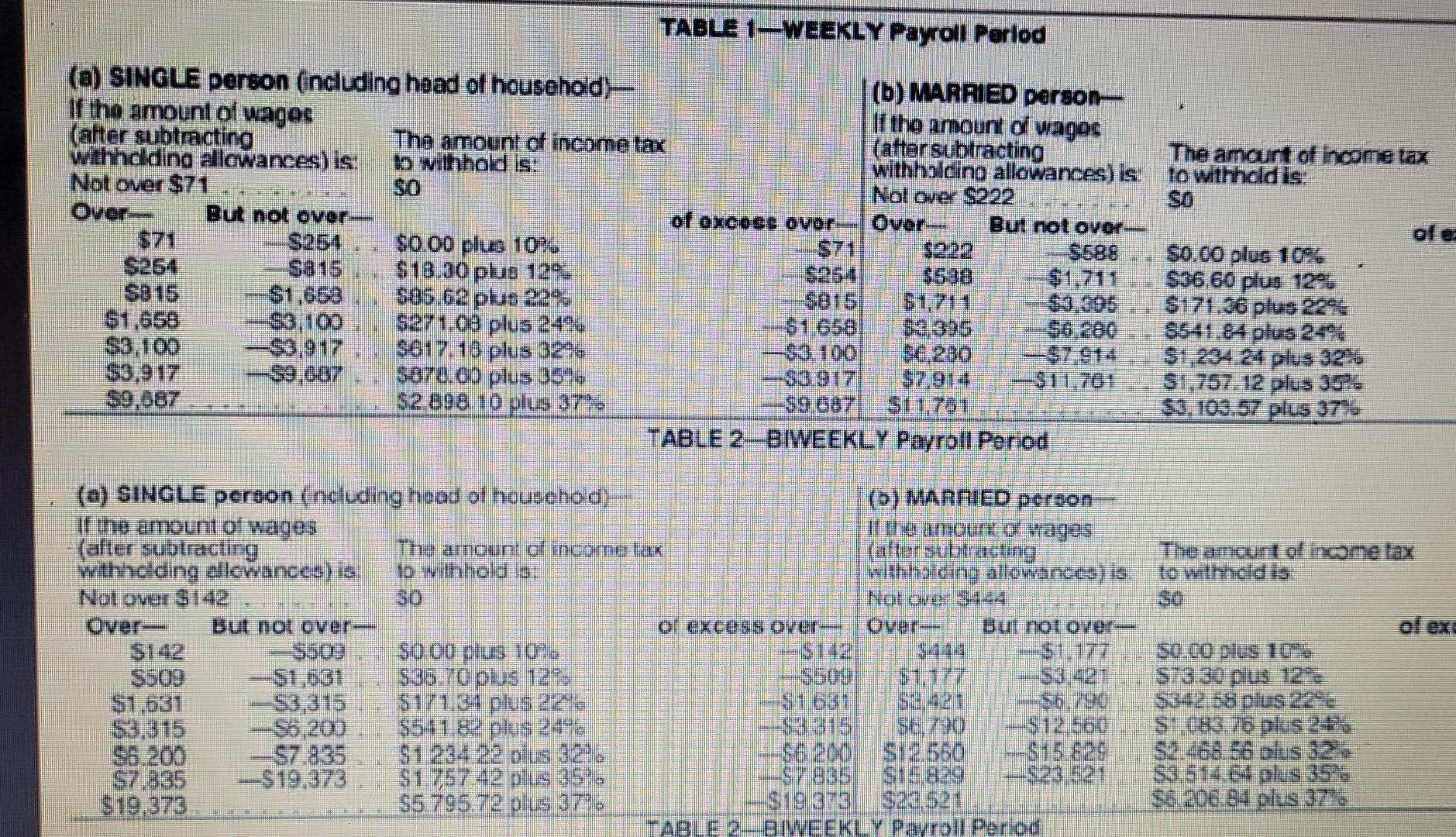

Calculate Social Security taxes, Medicare taxes, and FIT for Jordon Barrett. He earns a monthly salary of $11,300. He is single and claims 1 deduction. Before this payroll , Barrett's cumulative earnings were $128,070. (Social Security maximum is 6.2% on $128,400 and Medicare is 1.45%.) Calculate FIT by the percentage method. (Use Table 9.1 and Table 9.2) (Round your answers to 2 decimal places.) Social Security taxes Medicare taxes Payroll Period One Withholding Allowance $ 79 80 159.80 172 90 M M Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll perod) 1,037.50 2,075.00 4 150.00 16.00 s TABLE 1-WEEKLY Payroll Period (a) SINGLE person (ncluding head of household (b) MARRIED person If the amount ol wagoc If the amount of wagec (after subtracting The amount of income tax (aftersubtracting The amart of income tax withholding allowances) Is. b withhold is: withholdino allowances) is to withheld is Not over $71 Not over $222 SO Over- But not over- - of excese ovor Over Bu not over ole $71 $0.00 plus 104 $588 $0.00 plus 10% S254 $18.30 plus 129 $530 $1,711 $36 60 plus 129 $66.62 plus 22% $815 $1,711 $171.06 plus 22% $1,658 $3,100 $271.08 plus 2494 $1 658 52,395 $6 280 $541.84 plus 244 $3,100 -$3,917 S617. 16 plus 32% $3 100 -$7.914 $1,234 24 plus 32% $3,917 -S9,087 S070.00 plus 356 $3.917 $11.761 S: 757. 12 plus 35- 50,567 52 898 10 plus 37). S9 687 St 1.781 $3. 103.57 plus 3716 TABLE 2-BIWEEKLY Payroll Period The amount of income tax to withhold is ol ex (a) SINGLE person (ncluding head of houschod) (b) MARRIED person If the amount of wages If the amount of wages (after subtracting The annount of income tax (after subtracting with adding allowances) 16 lo vihold 5: withholding allowances) is Not over $142 Not ave34:23 Over- But no over- or exce55 over- Over-- but not over $500 S000 plus 10! S509 $1,631 $35.70 plus 12 $1.531 S3,315 S1/1.34 plus 2246 - $6.790 53,315 -56,200 S541.82 plus 2446 $3:315 SE, 790 $12.560 $6.200 $1 234 22 plus 3276 $6.200 $12.550 S7.335 -$19,373 S1 757 42 plus 35'. S16,829 $19.373 55 795 72 plus 37%. $19373 $23.521 TABLE 2 BINEEKLY Payroll Period SO 60 plus 10% S73.30 $342.58 plus 22 S1.083.76 plus 24% $2.468. 56 olus 32. S3.514.64 plus 35. $6 206.84 plus 37% LESS La

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started