Answered step by step

Verified Expert Solution

Question

1 Approved Answer

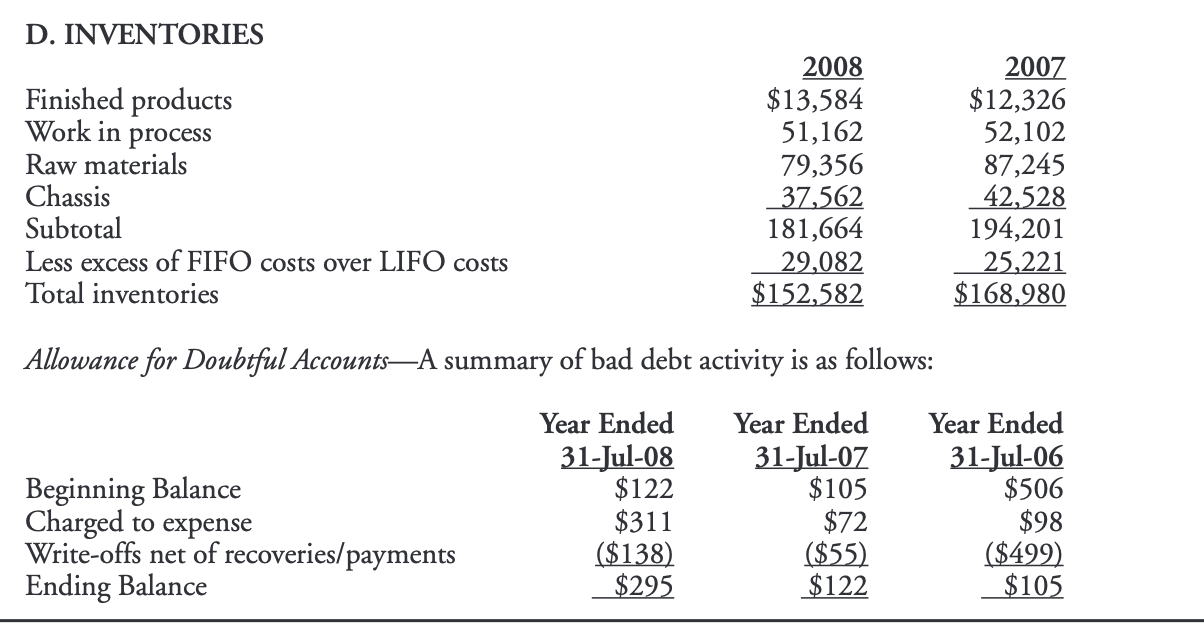

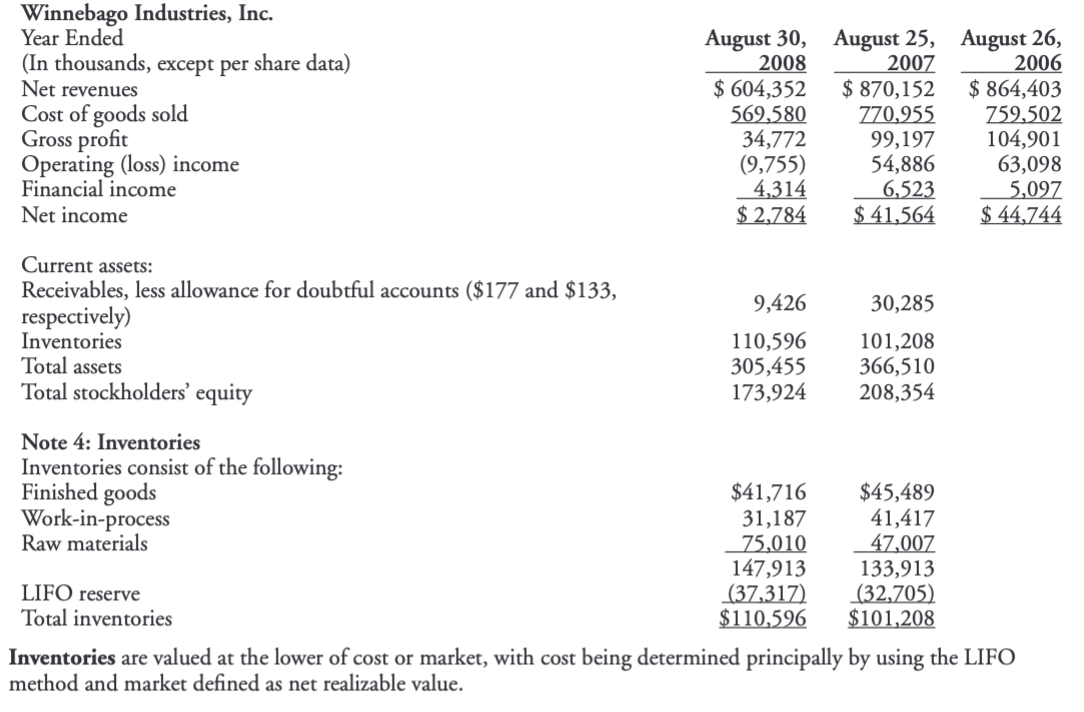

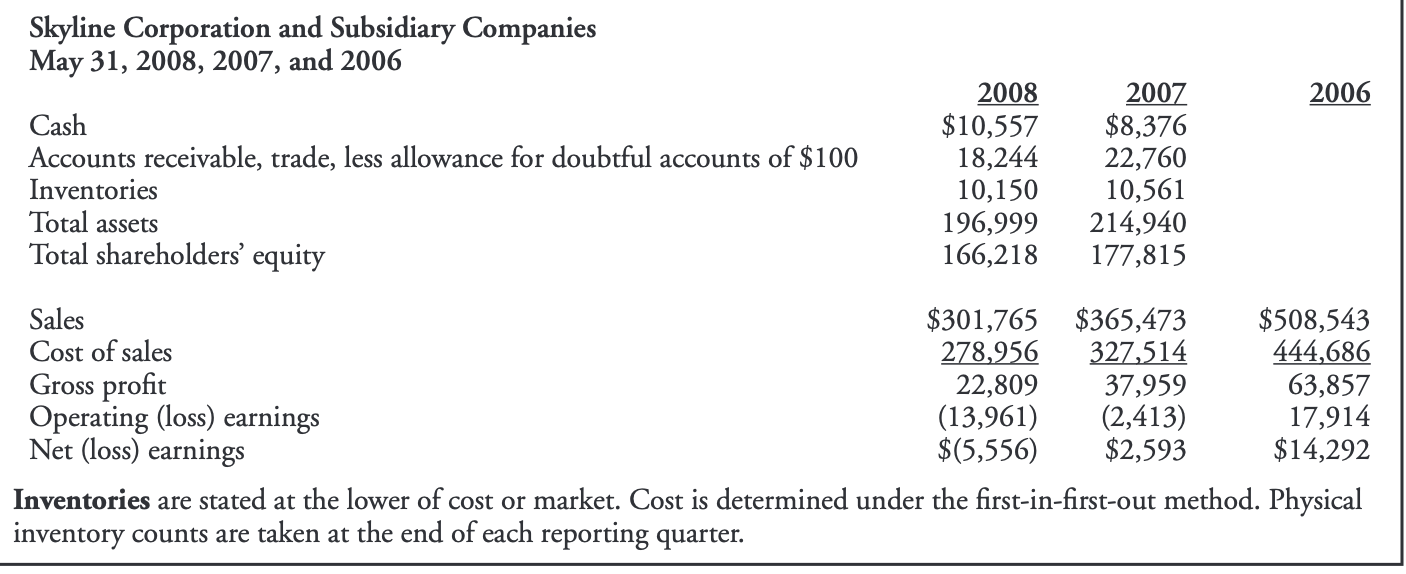

Calculate & switch the Inventory to FIFO using the table above. Explain the benefit of the change from LIFO to FIFO. Compare & Contrast the

Calculate & switch the Inventory to FIFO using the table above. Explain the benefit of the change from LIFO to FIFO.

Compare & Contrast the Inventories of the three tables above and explain.

*if more info is needed please let me know.

D. INVENTORIES Finished products Work in process Raw materials Chassis Subtotal Less excess of FIFO costs over LIFO costs Total inventories 2008 $13,584 51,162 79,356 _37,562 181,664 29,082 $152,582 2007 $12,326 52,102 87,245 42,528 194,201 25,221 $168,980 Allowance for Doubtful AccountsA summary of bad debt activity is as follows: Beginning Balance Charged to expense Write-offs net of recoveries/payments Ending Balance Year Ended 31-Jul-08 $122 $311 ($138) $295 Year Ended 31-Jul-07 $105 $72 ($55) $122 Year Ended 31-Jul-06 $506 $98 ($499) $105 Winnebago Industries, Inc. Year Ended (In thousands, except per share data) Net revenues Cost of goods sold Gross profit Operating (loss) income Financial income Net income August 30, August 25, August 26, 2008 2007 2006 $ 604,352 $ 870,152 $ 864,403 569,580 770,955 759,502 34,772 99,197 104,901 (9,755) 54,886 63,098 4,314 6,523 5,097 $ 2,784 $ 41,564 $ 44,744 Current assets: Receivables, less allowance for doubtful accounts ($177 and $133, 9,426 30,285 respectively) Inventories 110,596 101,208 Total assets 305,455 366,510 Total stockholders' equity 173,924 208,354 Note 4: Inventories Inventories consist of the following: Finished goods $41,716 $45,489 Work-in-process 31,187 41,417 Raw materials 75,010 47,007 147,913 133,913 LIFO reserve (37,317) (32,705) Total inventories $110,596 $101,208 Inventories are valued at the lower of cost or market, with cost being determined principally by using the LIFO method and market defined as net realizable value. Skyline Corporation and Subsidiary Companies May 31, 2008, 2007, and 2006 2006 Cash Accounts receivable, trade, less allowance for doubtful accounts of $100 Inventories Total assets Total shareholders' equity 2008 $10,557 18,244 10,150 196,999 166,218 2007 $8,376 22,760 10,561 214,940 177,815 Sales $301,765 $365,473 $508,543 Cost of sales 278,956 327,514 444,686 Gross profit 22,809 37,959 63,857 Operating (loss) earnings (13,961) (2,413) 17,914 Net (loss) earnings $(5,556) $2,593 $14,292 Inventories are stated at the lower of cost or market. Cost is determined under the first-in-first-out method. Physical inventory counts are taken at the end of each reporting quarter. D. INVENTORIES Finished products Work in process Raw materials Chassis Subtotal Less excess of FIFO costs over LIFO costs Total inventories 2008 $13,584 51,162 79,356 _37,562 181,664 29,082 $152,582 2007 $12,326 52,102 87,245 42,528 194,201 25,221 $168,980 Allowance for Doubtful AccountsA summary of bad debt activity is as follows: Beginning Balance Charged to expense Write-offs net of recoveries/payments Ending Balance Year Ended 31-Jul-08 $122 $311 ($138) $295 Year Ended 31-Jul-07 $105 $72 ($55) $122 Year Ended 31-Jul-06 $506 $98 ($499) $105 Winnebago Industries, Inc. Year Ended (In thousands, except per share data) Net revenues Cost of goods sold Gross profit Operating (loss) income Financial income Net income August 30, August 25, August 26, 2008 2007 2006 $ 604,352 $ 870,152 $ 864,403 569,580 770,955 759,502 34,772 99,197 104,901 (9,755) 54,886 63,098 4,314 6,523 5,097 $ 2,784 $ 41,564 $ 44,744 Current assets: Receivables, less allowance for doubtful accounts ($177 and $133, 9,426 30,285 respectively) Inventories 110,596 101,208 Total assets 305,455 366,510 Total stockholders' equity 173,924 208,354 Note 4: Inventories Inventories consist of the following: Finished goods $41,716 $45,489 Work-in-process 31,187 41,417 Raw materials 75,010 47,007 147,913 133,913 LIFO reserve (37,317) (32,705) Total inventories $110,596 $101,208 Inventories are valued at the lower of cost or market, with cost being determined principally by using the LIFO method and market defined as net realizable value. Skyline Corporation and Subsidiary Companies May 31, 2008, 2007, and 2006 2006 Cash Accounts receivable, trade, less allowance for doubtful accounts of $100 Inventories Total assets Total shareholders' equity 2008 $10,557 18,244 10,150 196,999 166,218 2007 $8,376 22,760 10,561 214,940 177,815 Sales $301,765 $365,473 $508,543 Cost of sales 278,956 327,514 444,686 Gross profit 22,809 37,959 63,857 Operating (loss) earnings (13,961) (2,413) 17,914 Net (loss) earnings $(5,556) $2,593 $14,292 Inventories are stated at the lower of cost or market. Cost is determined under the first-in-first-out method. Physical inventory counts are taken at the end of each reporting quarterStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started