Calculate taxable income and journal entries based on this info. Thanks.

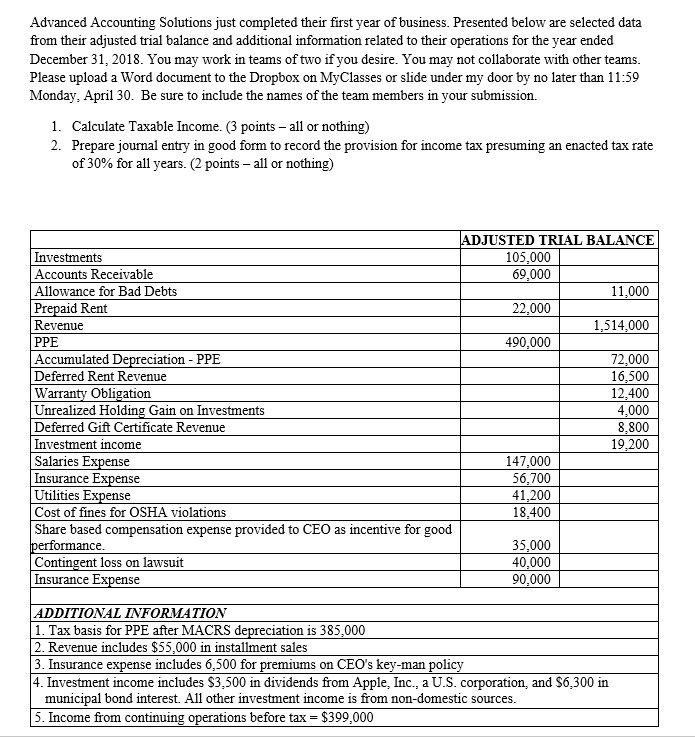

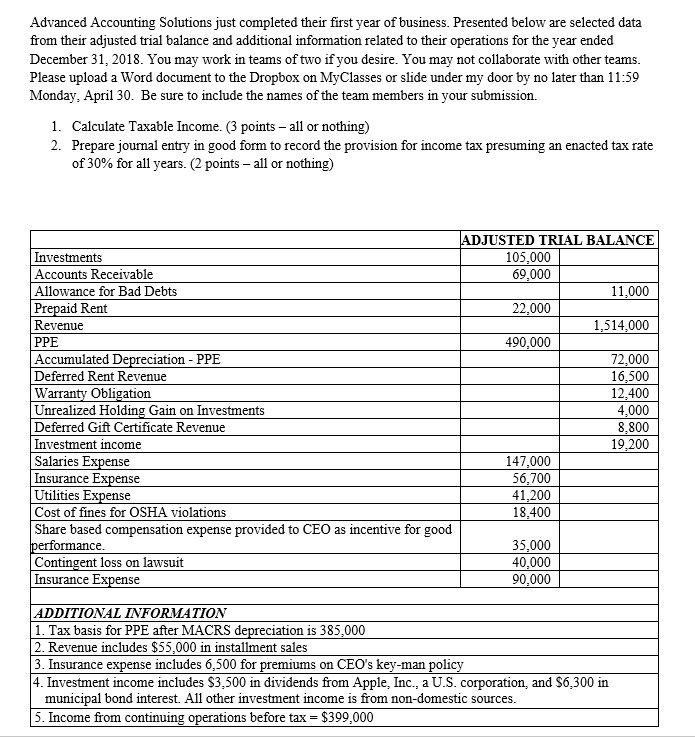

Advanced Accounting Solutions just completed their first year of business. Presented below are selected data from their adjusted trial balance and additional information related to their operations for the year ended December 31, 2018. You may work in teams of two if you desire. You may not collaborate with other teams Please upload a Word document to the Dropbox on MyClasses or slide under my door by no later than 11:59 Monday, April 30. Be sure to include the names of the team members in your submission. 1. 2. Calculate Taxable Income. (3 points - all or nothing) Prepare journal entry in good form to record the provision for income tax presuming an enacted tax rate of 30% for all years. (2 points-all or nothing ADJUSTED TRIAL BALANCE Investments Accounts Receivable Allowance for Bad Debts Prepaid Rent Revenue PPE Accumulated Deferred Rent Revenue 105,000 69,000 22,000 490,000 11,000 .514.000 iation - PPE 72,000 16,500 12,400 4,000 8,800 19.200 Obligation Unrealized Holding Gain on Investments Deferred Gift Certificate Revenue Investment income Salaries Expense nsurance E Utilities Cost of fines for OSHA violations Share based compensation expense provided to CEO as incentive for good 147,000 56,700 41,200 18,400 se se 5,000 40,000 90,000 ance Contingent loss on lawsuit Insurance Ex se ADDITIONAL INFORMATION 1. Tax basis for PPE after MACRS depreciation is 385.000 2. Revenue includes $55,000 in installment sales 3. Insurance ex 4. Investment income includes $3,500 in dividends from Apple, Inc., a U.S. corporation, and S6,300 in e includes 6.500 for iums on CEO's key-man municipal bond interest. All other investment income is from non-domestic sources 5. Income from continuing operations before tax $399,000 Advanced Accounting Solutions just completed their first year of business. Presented below are selected data from their adjusted trial balance and additional information related to their operations for the year ended December 31, 2018. You may work in teams of two if you desire. You may not collaborate with other teams Please upload a Word document to the Dropbox on MyClasses or slide under my door by no later than 11:59 Monday, April 30. Be sure to include the names of the team members in your submission. 1. 2. Calculate Taxable Income. (3 points - all or nothing) Prepare journal entry in good form to record the provision for income tax presuming an enacted tax rate of 30% for all years. (2 points-all or nothing ADJUSTED TRIAL BALANCE Investments Accounts Receivable Allowance for Bad Debts Prepaid Rent Revenue PPE Accumulated Deferred Rent Revenue 105,000 69,000 22,000 490,000 11,000 .514.000 iation - PPE 72,000 16,500 12,400 4,000 8,800 19.200 Obligation Unrealized Holding Gain on Investments Deferred Gift Certificate Revenue Investment income Salaries Expense nsurance E Utilities Cost of fines for OSHA violations Share based compensation expense provided to CEO as incentive for good 147,000 56,700 41,200 18,400 se se 5,000 40,000 90,000 ance Contingent loss on lawsuit Insurance Ex se ADDITIONAL INFORMATION 1. Tax basis for PPE after MACRS depreciation is 385.000 2. Revenue includes $55,000 in installment sales 3. Insurance ex 4. Investment income includes $3,500 in dividends from Apple, Inc., a U.S. corporation, and S6,300 in e includes 6.500 for iums on CEO's key-man municipal bond interest. All other investment income is from non-domestic sources 5. Income from continuing operations before tax $399,000