Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the Activity Based Costing Allocations for each product line and calculate your gross margins based on the ABC allocations. In addition to the calculations,

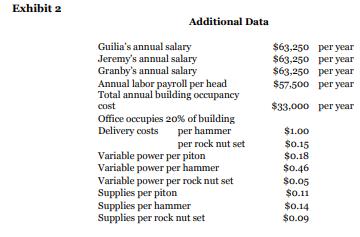

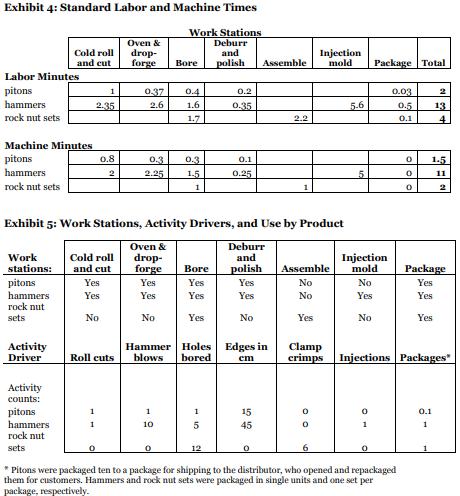

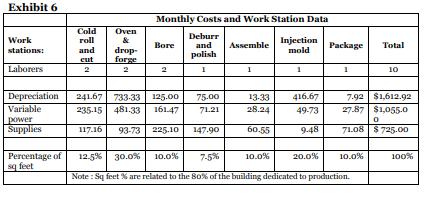

Calculate the Activity Based Costing Allocations for each product line and calculate your gross margins based on the ABC allocations. In addition to the calculations, your paper should include a discussion of what other possible drivers may be useful if you were able to get the appropriate information.

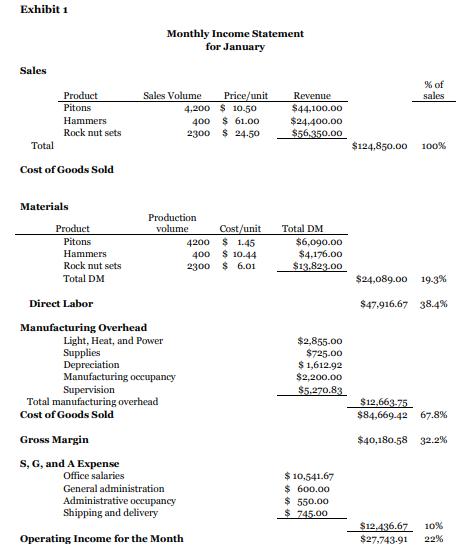

Exhibit 1 Monthly Income Statement for January Sales Product Sales Volume Price/unit Revenue % of sales Pitons 4,200 $ 10.50 $44,100.00 Hammers 400 $ 61.00 $24,400.00 Total Rock nut sets Cost of Goods Sold 2300 $ 24.50 $56,350.00 $124,850.00 100% Materials Product Pitons Hammers Rock nut sets Total DM Production volume Cost/unit Total DM 4200 $ 1.45 $6,090.00 400 $ 10.44 2300 $ 6.01 $4.176.00 $13,823.00 $24,089.00 19.3% $47,916.67 38.4% Direct Labor Manufacturing Overhead Light, Heat, and Power $2,855.00 Supplies $725.00 Depreciation $1,612.92 Manufacturing occupancy $2,200.00 $5.270.83 Supervision Total manufacturing overhead Cost of Goods Sold Gross Margin S, G, and A Expense Office salaries General administration Administrative occupancy Shipping and delivery Operating Income for the Month $ 10,541.67 $ 600.00 $ 550.00 $ 745.00 $12,663.75 $84,669.42 67.8% $40,180.58 32.2% $12,436.67 10% $27.743-91 22%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets walk through a detailed example of Activity Based Costing ABC allocations for different product lines and then discuss additional possible driver...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started