Answered step by step

Verified Expert Solution

Question

1 Approved Answer

30) Calculate the annual cost for commercial paper (CP) on a $10,000,000 CP issue with a 60-day maturity at a discount rate of 7%.

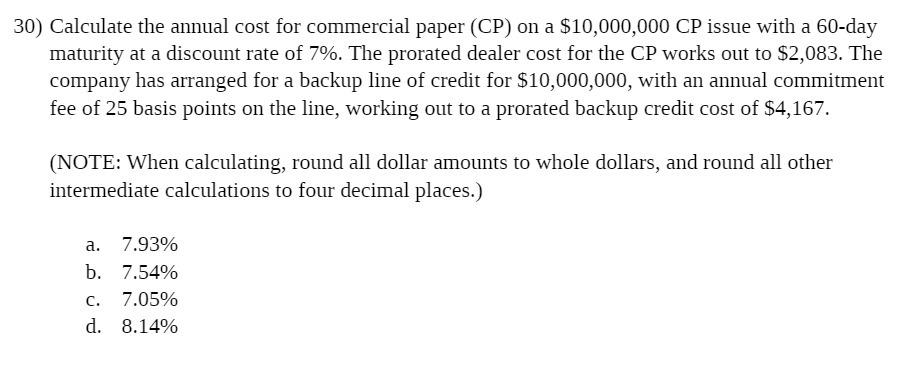

30) Calculate the annual cost for commercial paper (CP) on a $10,000,000 CP issue with a 60-day maturity at a discount rate of 7%. The prorated dealer cost for the CP works out to $2,083. The company has arranged for a backup line of credit for $10,000,000, with an annual commitment fee of 25 basis points on the line, working out to a prorated backup credit cost of $4,167. (NOTE: When calculating, round all dollar amounts to whole dollars, and round all other intermediate calculations to four decimal places.) a. 7.93% b. 7.54% C. 7.05% d. 8.14%

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 In this it is given question it is that issue of the Commercial Paper 1000000 Rate of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started