Answered step by step

Verified Expert Solution

Question

1 Approved Answer

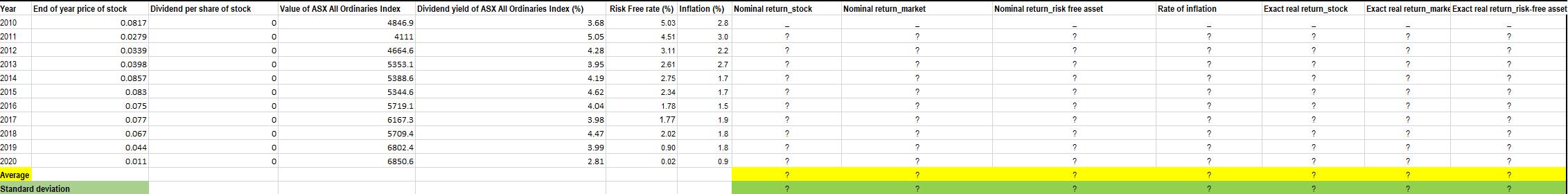

Calculate the annual nominal return (2010-2020) for the stock (in decimals). 2. Calculate the annual nominal return (2010-2020) for the market (in decimals). 3. Present

Calculate the annual nominal return (2010-2020) for the stock (in decimals).

2. Calculate the annual nominal return (2010-2020) for the market (in decimals).

3. Present the annual nominal return (2010-2020) for the risk-free asset (in decimals).

4. Present the annual rate of inflation (2010-2020) in (in decimals).

5. Calculate the exact annual real return (2010-2020) for the stock (in decimals).

6. Calculate the exact annual real return (2010-2020) for the market (in decimals).

7. Calculate the exact annual real return (2010-2020) for the risk-free asset (in decimals).

2. Calculate the annual nominal return (2010-2020) for the market (in decimals).

3. Present the annual nominal return (2010-2020) for the risk-free asset (in decimals).

4. Present the annual rate of inflation (2010-2020) in (in decimals).

5. Calculate the exact annual real return (2010-2020) for the stock (in decimals).

6. Calculate the exact annual real return (2010-2020) for the market (in decimals).

7. Calculate the exact annual real return (2010-2020) for the risk-free asset (in decimals).

Year 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 End of year price of stock Average Standard deviation 0.0817 0.0279 0.0339 0.0398 0.0857 0.083 0.075 0.077 0.067 0.044 0.011 Dividend per share of stock 0 0 0 0 0 0 0 0 0 0 0 Value of ASX All Ordinaries Index 4846.9 4111 4664.6 5353.1 5388.6 5344.6 5719.1 6167.3 5709.4 6802.4 6850.6 Dividend yield of ASX All Ordinaries Index (%) 3.68 5.05 4.28 3.95 4.19 4.62 4.04 3.98 4.47 3.99 2.81 Risk Free rate (%) Inflation (%) Nominal return_stock 5.03 2.8 3.0 4.51 3.11 2.2 2.61 2.7 2.75 1.7 2.34 1.7 1.5 1.9 1.8 1.8 0.9 1.78 1.77 2.02 0.90 0.02 ? ? ? ? 2 ? ? ? 2 ? ? ? Nominal return_market ? ? ? ? ? ? ? ? ? ? ? ? Nominal return_risk free asset ? ? ? ? ? ? ? ? ? ? ? ? Rate of inflation ? ? 2 ? ? ? ? ? 2 ? ? ? Exact real return_stock ? ? ? ? ? ? ? ? ? ? ? ? Exact real return_marke Exact real return_risk-free asset ? ? ? ? ? ? ? ? ? ? ? 2 ? ? ? ? ? ? ? ? ? ? ? 2

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Data Stock Prices 20102020 89 76 70 Assuming we have data for all years Market Index 20102020 111 26...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started