Answered step by step

Verified Expert Solution

Question

1 Approved Answer

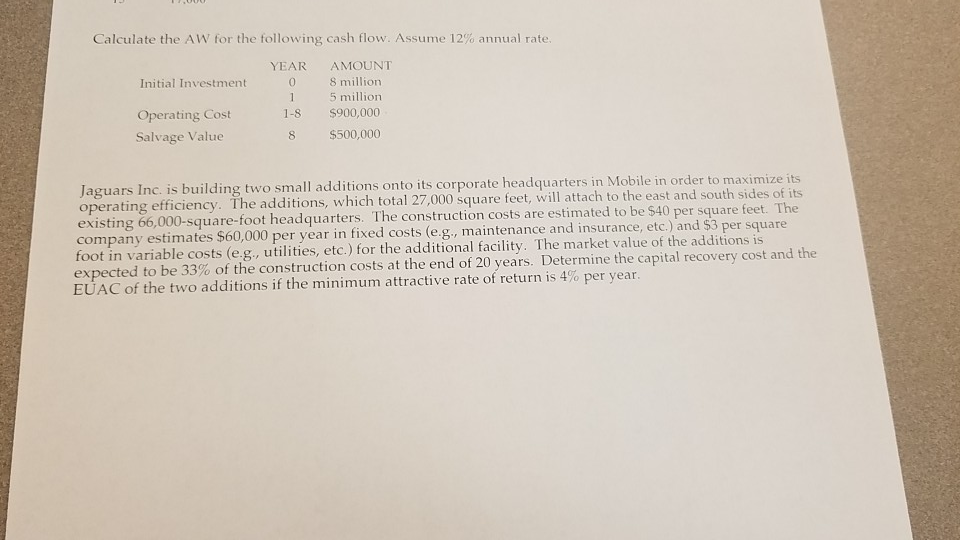

Calculate the AW for the following cash flow. Assume 12% annual rate. YEAR AMOUNT Initial Investment 0 8 million 1 5 million Operating Cost 1-8

Calculate the AW for the following cash flow. Assume 12% annual rate. YEAR AMOUNT Initial Investment 0 8 million 1 5 million Operating Cost 1-8 $900,000 Salvage Value 8 $500,000 Jaguars Inc. is building two small additions onto its corporate headquarters in Mobile in order to maximize its operating efficiency. The additions, which total 27,000 square feet, will attach to the east and south sides of its existing 66,000-square-foot headquarters. The construction costs are estimated to be $40 per square feet. The company estimates $60,000 per year in fixed costs (e.g., maintenance and insurance, etc.) and $3 per square foot in variable costs (e.g., utilities, etc.) for the additional facility. The market value of the additions is expected to be 33% of the construction costs at the end of 20 years. Determine the capital recovery cost and the EUAC of the two additions if the minimum attractive rate of return is 4% per year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started