Question

Calculate the before-tax cost of bank loans, mortgage loans, and corporate bonds b) Calculate the (market) value of bank loans, mortgage loans, and corporate bonds

Calculate the before-tax cost of bank loans, mortgage loans, and corporate bonds

b) Calculate the (market) value of bank loans, mortgage loans, and corporate bonds

c) Calculate the cost of ordinary shares and preference shares

d) Calculate the market prices of ordinary shares and preference shares

e) Calculate the total market values of ordinary shares and preference shares

f) Calculate the company's WACC

The equipment will cost $720, is expected to have a working life of 4 years, and will be depreciated on a diminishing-value basis to a book value of zero.

• The equipment is expected to have a salvage value of $120 at the end of 4 years.

• The new equipment will improve efficiency and result in increased revenue of $850 in its first year of operation, but because of reduced efficiency from normal wear and tear, revenue will decrease by 4% (from the previous year's revenue) for each of the remaining 3 years of the equipment's life.

• Excluding maintenance, all other costs from operating the equipment will be $280 per year. Maintenance costs will amount to $120 in the equipment's first year of operation and will then increase by $30 per year for the remaining 3 years of the equipment's life.

• The equipment will require additional net working capital of $200. The net working capital will be recovered in full after the equipment is sold at the end of its working life.

• The equipment will be installed in a building that is owned by the company but currently is not being used. If the project does not proceed, this building could be rented out for $200 per year.

• A feasibility study has been undertaken on the purchase of the new equipment. The cost of preparing the feasibility study was $400.

• The company has sufficient capital to undertake all positive-NPV projects. If the Payback Period method is used to evaluate projects, management's policy is that the maximum acceptable payback period is 3 years, and all cash flows in Year 0 would need to be recovered within 3 years for the project to be acceptable under this method.

Notes

1. The interest rate on the bank loan is 8.2% p.a.

2. The interest rate on the mortgage loan is 5.9% p.a.

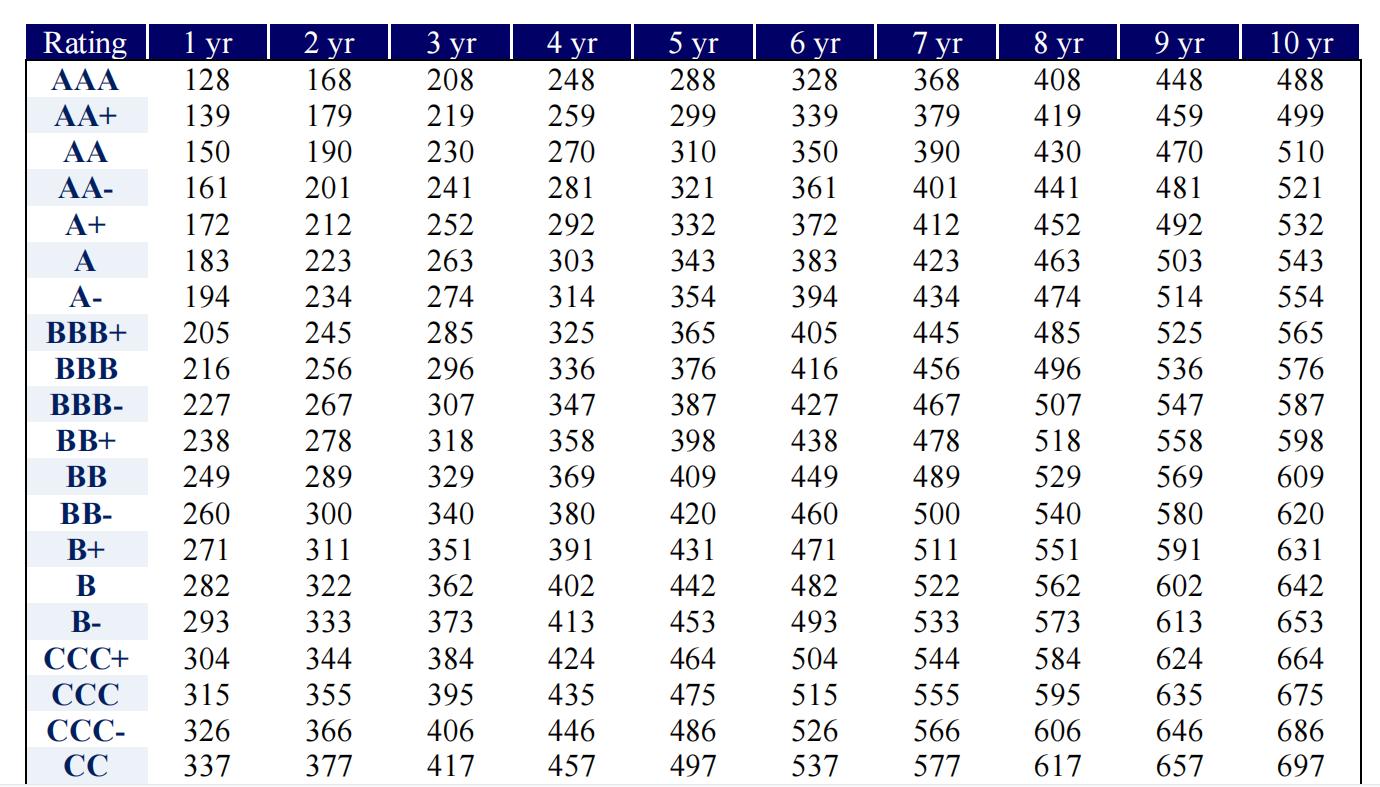

3. The corporate bonds have a credit rating of AA and have 2 years to maturity. They make quarterly coupon payments at a coupon rate of 7% p.a.

4. The ordinary shares are shown on the balance sheet at their book value of $1 per share.

They have a beta of 1.2. They have just paid a dividend of $0.07. The dividend is expected to grow at a rate of 7% p.a. for the next 3 years, and after that, it will grow at a constant rate of 3% p.a. in perpetuity.

5. The preference shares have a par value of $1 each and are shown on the Balance Sheet at their par value. They pay a constant dividend of $0.10, and they are currently trading for $1.2.

6. The risk premium for ordinary shares is 8%.

7. The corporate tax rate is 30%. The 2-year risk-free rate is 0.03%. The 10-year risk-free rate is 1.14%

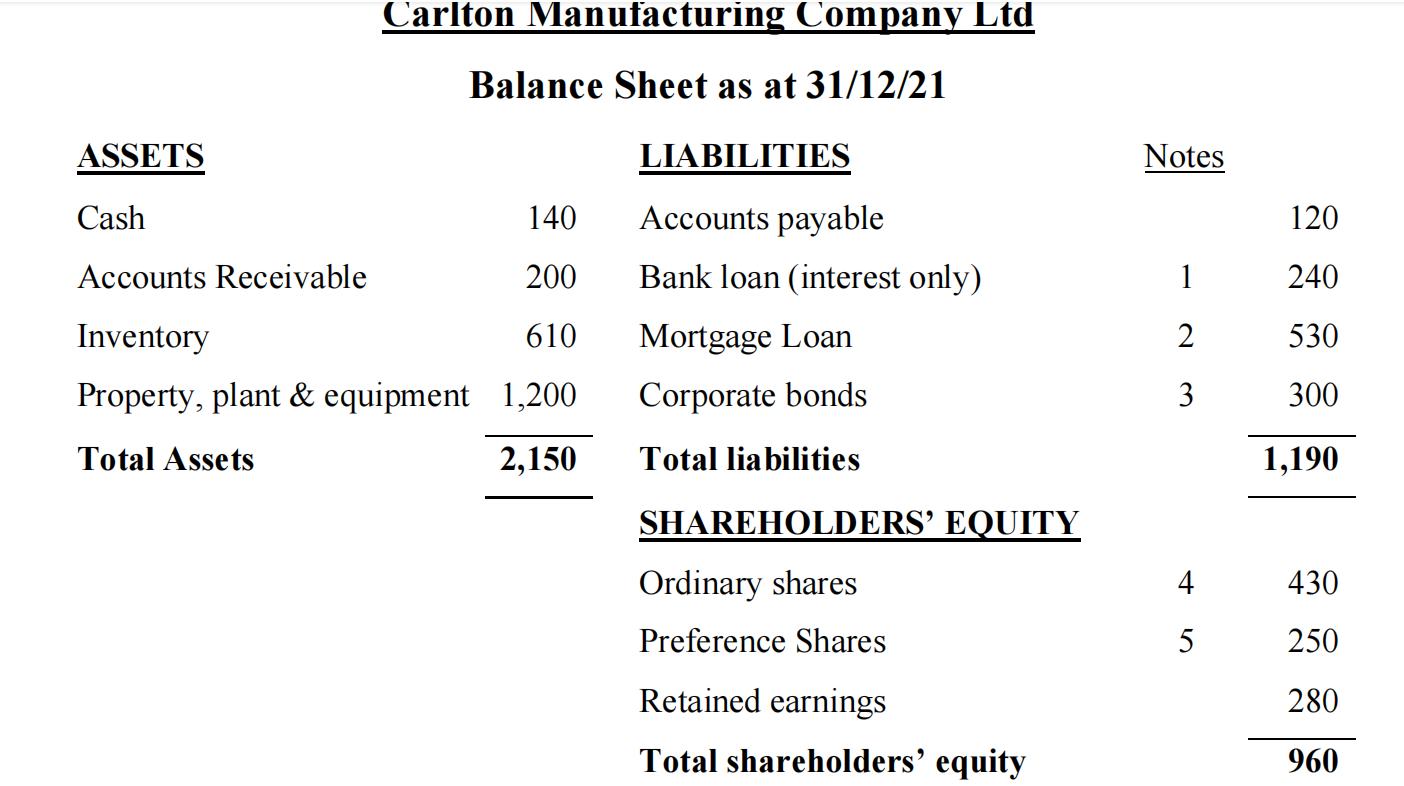

ASSETS Carlton Manufacturing Company Ltd Balance Sheet as at 31/12/21 Cash 140 Accounts Receivable 200 Inventory 610 Property, plant & equipment 1,200 Total Assets 2,150 LIABILITIES Accounts payable Bank loan (interest only) Mortgage Loan Corporate bonds Total liabilities SHAREHOLDERS' EQUITY Ordinary shares Preference Shares Retained earnings Total shareholders' equity Notes 1 2 3 4 5 120 240 530 300 1,190 430 250 280 960

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the WACC of the company we first need to calculate the cost of each component of capital a Cost of capital Bank loans 82 Mortgage loans 59 Corporate bonds The yield to maturity of the cor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started