Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the break even point based on 4 alternative and calculate new selling price per unit, variable cost per unit and fixed cost based on

Calculate the break even point based on 4 alternative and calculate new selling price per unit, variable cost per unit and fixed cost based on 4 alternative above

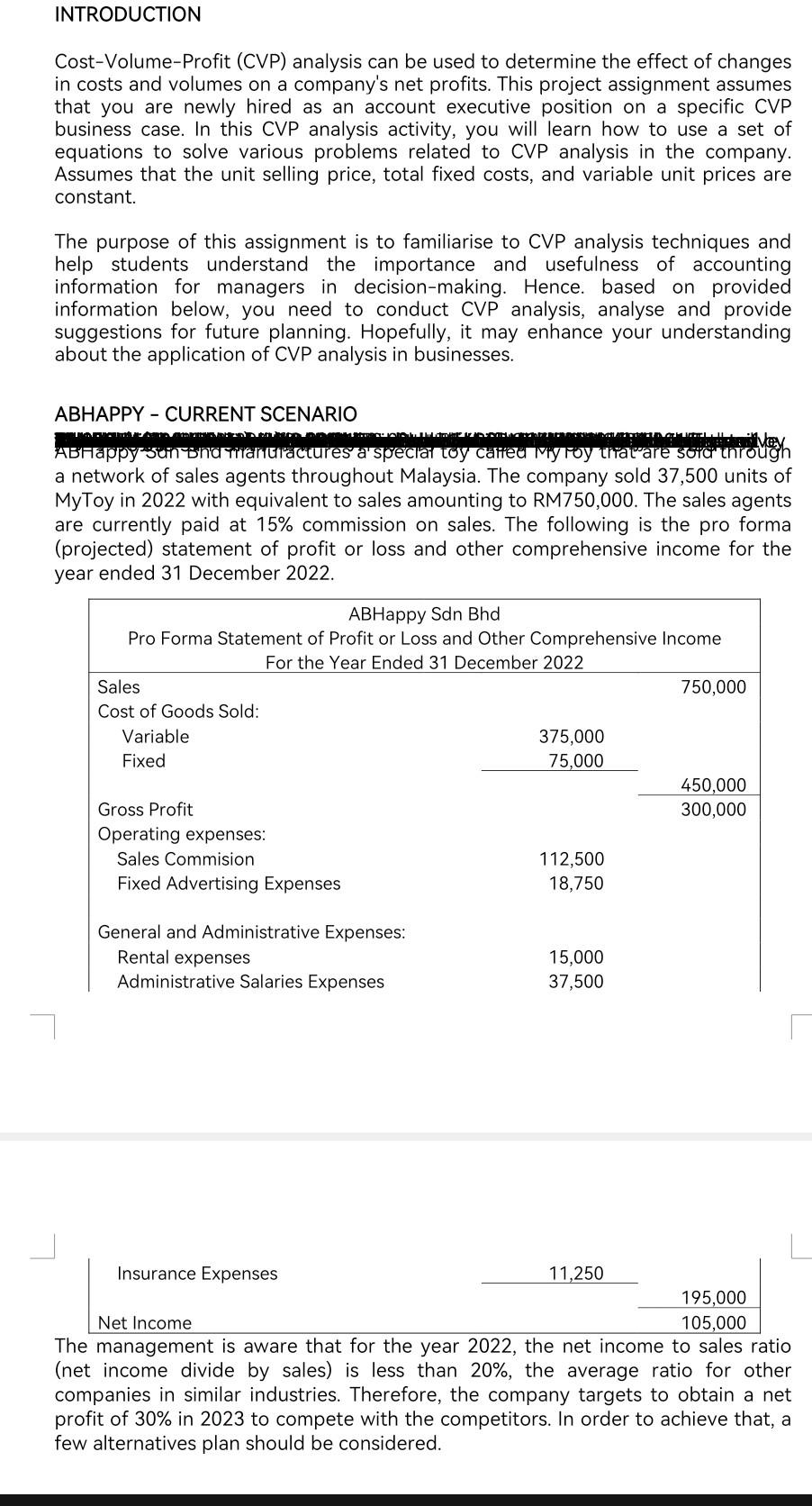

INTRODUCTION Cost-Volume-Profit (CVP) analysis can be used to determine the effect of changes in costs and volumes on a company's net profits. This project assignment assumes that you are newly hired as an account executive position on a specific CVP business case. In this CVP analysis activity, you will learn how to use a set of equations to solve various problems related to CVP analysis in the company. Assumes that the unit selling price, total fixed costs, and variable unit prices are constant. The purpose of this assignment is to familiarise to CVP analysis techniques and help students understand the importance and usefulness of accounting information for managers in decision-making. Hence. based on provided information below, you need to conduct CVP analysis, analyse and provide suggestions for future planning. Hopefully, it may enhance your understanding about the application of CVP analysis in businesses. ABHAPPY - CURRENT SCENARIO a network of sales agents throughout Malaysia. The company sold 37,500 units of MyToy in 2022 with equivalent to sales amounting to RM750,000. The sales agents are currently paid at 15% commission on sales. The following is the pro forma (projected) statement of profit or loss and other comprehensive income for the year ended 31 December 2022. \begin{tabular}{|l} Insurance Expenses \\ \\ Net Income \end{tabular} The management is aware that for the year 2022, the net income to sales ratio (net income divide by sales) is less than 20%, the average ratio for other companies in similar industries. Therefore, the company targets to obtain a net profit of 30% in 2023 to compete with the competitors. In order to achieve that, a few alternatives plan should be considered. The management is aware that for the year 2022, the net income to sales ratio (net income divide by sales) is less than 20%, the average ratio for other companies in similar industries. Therefore, the company targets to obtain a net profit of 30% in 2023 to compete with the competitors. In order to achieve that, a few alternatives plan should be considered. INSTRUCTION As the newly hired Account Executive, you are required to prepare a report to propose/suggest a few alternatives to the management of the company for future expansion. The following discussion should be included in the report (each question is independent of the others): 1. Calculate the Break-Even Point (BEP) in units and amount and identify the number of units of product MyToy that need to be sold by the company in order to obtain a net income of 30% of sales. Briefly describe possible actions that should be taken by the company to achieve the target. 2. If the company is not able to increase the number of unit sales. Advise the company on the selling price that needs to be charged for the firm to earn operating income of 30% of sales. Briefly describe the possibility that the company can increase the amount of sales by simply increasing the selling price. 3. If the company plans to improve the quality of MyToy over the next year, suppose the improvement will increase the COGS-variable cost to 55% per unit sales instead of at 50% at the current level. Fixed advertising expenses is expected to increase by RM2,500 due to an advertising campaign planned to boost sales. It is expected that the product improvements combined with higher advertising expenses will increase sales by 200%. Discuss whether the company has the possibilities to proceed with the plan. Justify your answer. 4. The company is faced with its sales agents requesting an increase in the sales commission rate to 20 percent for the upcoming year. As a result, the company's CEO decided to investigate the possibility of hiring its own sales staff to replace the network of sales agents. The company is expected to bear additional cost associated with this change. The company will have to hire six (6) sales people to cover the current market area, and the fixed salaries cost of each employee will average RM625 per month. In addition to their fixed salary, the six (6) sales people will each earn commissions at the rate of 5% on all sales. Advise the company whether or not to approve the agent's request. Justify your answer. 5. Recommend to the company management what alternatives would be best implemented in 2023 to improve the company's performance and make it more competitive in the marketStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started