Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the capital gains and losses for the following scenarios: a.) In 2020, Mario sold 400 shares of XYZ Public Corporation of Canada for

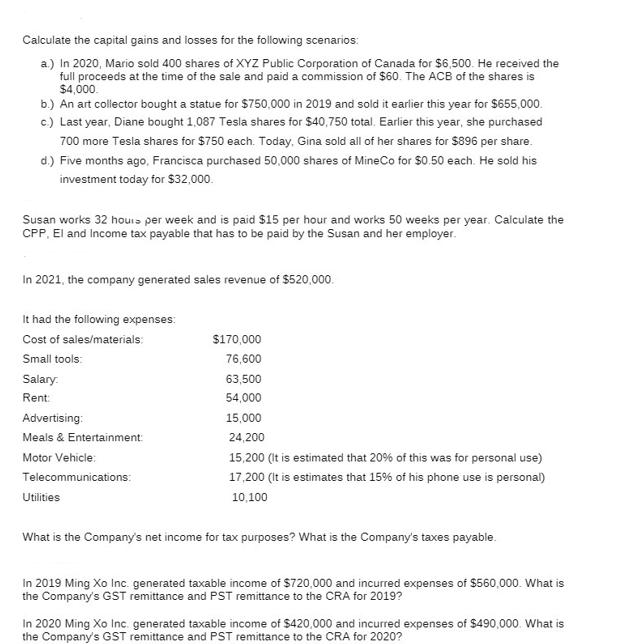

Calculate the capital gains and losses for the following scenarios: a.) In 2020, Mario sold 400 shares of XYZ Public Corporation of Canada for $6,500. He received the full proceeds at the time of the sale and paid a commission of $60. The ACB of the shares is $4,000. b.) An art collector bought a statue for $750,000 in 2019 and sold it earlier this year for $655,000. c.) Last year, Diane bought 1,087 Tesla shares for $40,750 total. Earlier this year, she purchased 700 more Tesla shares for $750 each. Today, Gina sold all of her shares for $896 per share. d.) Five months ago, Francisca purchased 50,000 shares of MineCo for $0.50 each. He sold his investment today for $32,000. Susan works 32 hours per week and is paid $15 per hour and works 50 weeks per year. Calculate the CPP, El and Income tax payable that has to be paid by the Susan and her employer. In 2021, the company generated sales revenue of $520,000. It had the following expenses: Cost of sales/materials: Small tools: Salary: Rent: Advertising: Meals & Entertainment: Motor Vehicle: Telecommunications: Utilities $170,000 76,600 63,500 54,000 15,000 24,200 15,200 (It is estimated that 20% of this was for personal use) 17,200 (It is estimates that 15% of his phone use is personal) 10,100 What is the Company's net income for tax purposes? What is the Company's taxes payable. In 2019 Ming Xo Inc. generated taxable income of $720,000 and incurred expenses of $560,000. What is the Company's GST remittance and PST remittance to the CRA for 2019? In 2020 Ming Xo Inc. generated taxable income of $420,000 and incurred expenses of $490,000. What is the Company's GST remittance and PST remittance to the CRA for 2020?

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started