Answered step by step

Verified Expert Solution

Question

1 Approved Answer

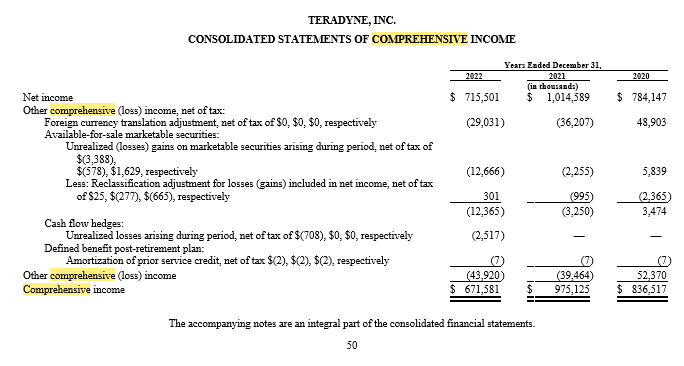

Calculate the change in the unrealized gain (loss) in the company's investments in debt. The table below may be helpful or if you prefer, you

- Calculate the changein the unrealized gain (loss) in the company's investments in debt. The table below may be helpful or if you prefer, you could also use a t-account.

End-of-year net unrealized gain (loss)

Beginning-of-year net unrealized gain (loss)

Change

b. Use the company's statement of comprehensive income to identify the pretax effect of available-for-sale investments in debt on comprehensive income. Note that your answer will be almost identical to your answer to part a. (+ or - a $1 or 2). Show your supporting calculations.

- What is the journal entry that would be recorded for part b of this question? Include the journal entry in a table below with debit and credit entries fully labeled.

- What is the cumulative amount in AOCI relating to unrealized gains (losses) on marketable securities before tax? How does this amount relate to your answer to part a of this question?

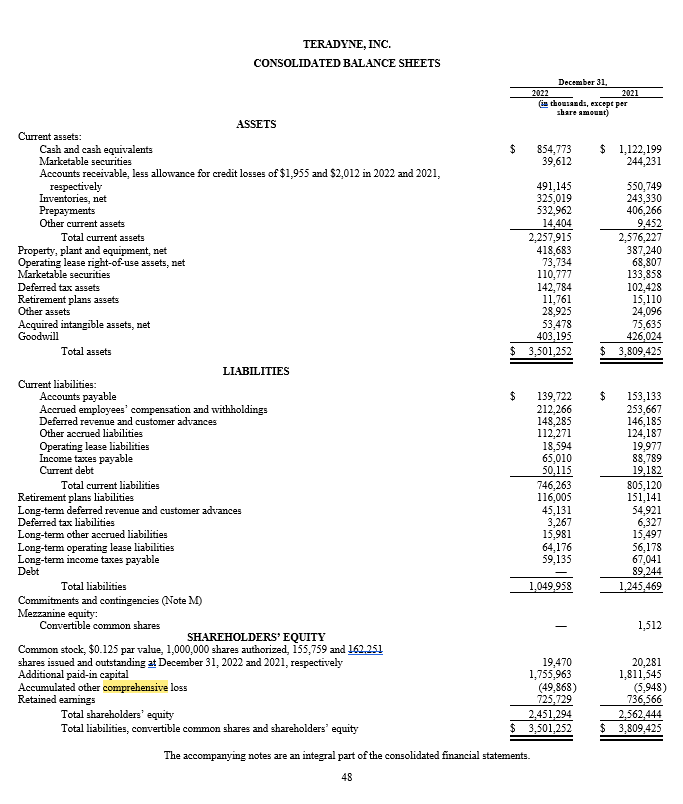

TERADYNE, INC. CONSOLIDATED BALANCE SHEETS ASSETS December 31, 2022 2021 (in thousands, except per share amount) Current assets: Cash and cash equivalents Marketable securities Accounts receivable, less allowance for credit losses of $1,955 and $2,012 in 2022 and 2021, $ 854,773 39,612 $ 1,122,199 244,231 respectively Inventories, net Prepayments 491,145 550,749 325,019 243,330 532,962 406,266 Other current assets Total current assets Property, plant and equipment, net Operating lease right-of-use assets, net Marketable securities Deferred tax assets Retirement plans assets Other assets Acquired intangible assets, net Goodwill 14,404 9,452 2,257,915 2,576,227 418,683 387,240 73,734 68,807 110,777 133,858 142,784 102,428 11,761 15,110 28,925 24,096 53,478 75,635 403,195 426,024 Total assets Current liabilities: $ 3,501,252 $ 3,809,425 LIABILITIES Accounts payable Accrued employees' compensation and withholdings Deferred revenue and customer advances Other accrued liabilities Operating lease liabilities Income taxes payable Current debt Total current liabilities Retirement plans liabilities Long-term deferred revenue and customer advances Deferred tax liabilities Long-term other accrued liabilities Long-term operating lease liabilities Long-term income taxes payable Debt $ 139,722 $ 153,133 212,266 253,667 148,285 146,185 112,271 124,187 18,594 19,977 65,010 88,789 50,115 19,182 746,263 805,120 116,005 151,141 45,131 54,921 3,267 6,327 15,981 15,497 64,176 56,178 59,135 67,041 89,244 1,049,958 1,245,469 Total liabilities Commitments and contingencies (Note M) Mezzanine equity: Convertible common shares SHAREHOLDERS' EQUITY Common stock, $0.125 par value, 1,000,000 shares authorized, 155,759 and 162,251 shares issued and outstanding at December 31, 2022 and 2021, respectively Additional paid-in capital Accumulated other comprehensive loss Retained earnings Total shareholders' equity Total liabilities, convertible common shares and shareholders' equity - 1,512 19,470 1,755,963 20,281 1,811,545 (49,868) 725,729 (5,948) 2,451,294 $ 3,501,252 736,566 2,562,444 $ 3,809,425 The accompanying notes are an integral part of the consolidated financial statements. 48

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started