Answered step by step

Verified Expert Solution

Question

1 Approved Answer

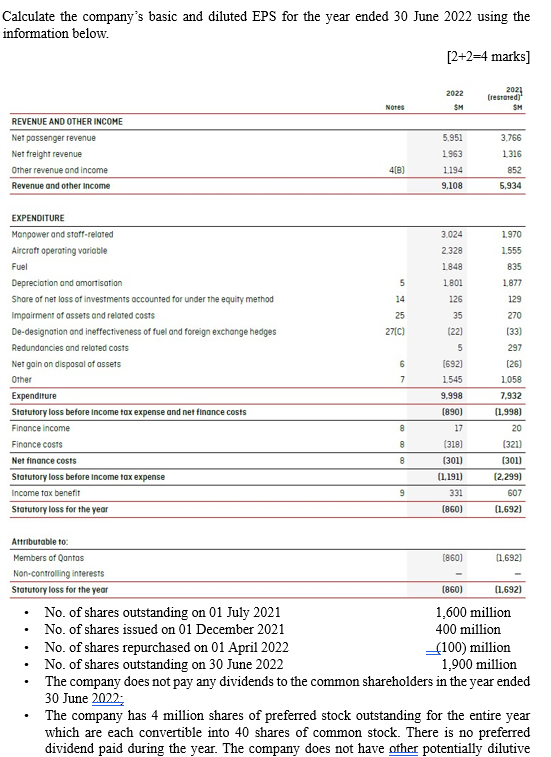

Calculate the company's basic and diluted EPS for the year ended 30 June 2022 using the information below. REVENUE AND OTHER INCOME Net passenger

Calculate the company's basic and diluted EPS for the year ended 30 June 2022 using the information below. REVENUE AND OTHER INCOME Net passenger revenue Net freight revenue Other revenue and income Revenue and other Income [2+2=4 marks] 2022 2021 (restored) Notes SM SM 5,951 3,766 1963 1,316 4[B] 1.194 852 9,108 5,934 EXPENDITURE Manpower and staff-related Aircraft operating variable 3.024 1.970 2.328 1.555 Fuel 1848 835 Depreciation and amortisation 5 1801 1,877 Share of net loss of investments accounted for under the equity method 14 126 129 Impairment of assets and related costs 25 35 270 De-designation and ineffectiveness of fuel and foreign exchange hedges Redundancies and related costs 27[C] (22) [33] 5 297 Net gain on disposal of assets 6 (692) [26] Other 7 1.545 1058 Expenditure 9,998 7,932 Statutory loss before Income tax expense and net finance costs (890) (1,998) Finance income 8 17 20 Finance costs 8 (318) (321) Net finance costs 8 (301) (301) Statutory loss before income tax expense (1.191) (2,299) Income tax benefit 9 331 607 Statutory loss for the year (860) (1,692) Attributable to: Members of Qantas Non-controlling interests Statutory loss for the year . No. of shares outstanding on 01 July 2021 No. of shares issued on 01 December 2021 No. of shares repurchased on 01 April 2022 No. of shares outstanding on 30 June 2022 [860] [1,692) (860) (1,692) 1,600 million 400 million (100) million 1,900 million The company does not pay any dividends to the common shareholders in the year ended 30 June 2022; The company has 4 million shares of preferred stock outstanding for the entire year which are each convertible into 40 shares of common stock. There is no preferred dividend paid during the year. The company does not have other potentially dilutive

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started