Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the components of the change in Return on Net Operating Assets (RNOA.) i. Change in core sales PM at previous asset turnover level ii.

Calculate the components of the change in Return on Net Operating Assets (RNOA.)

i. Change in core sales PM at previous asset turnover level

ii. Change due to change in asset turnover

iii. Change due to change in unusual items

iv. Discuss the drivers of change in RNOA

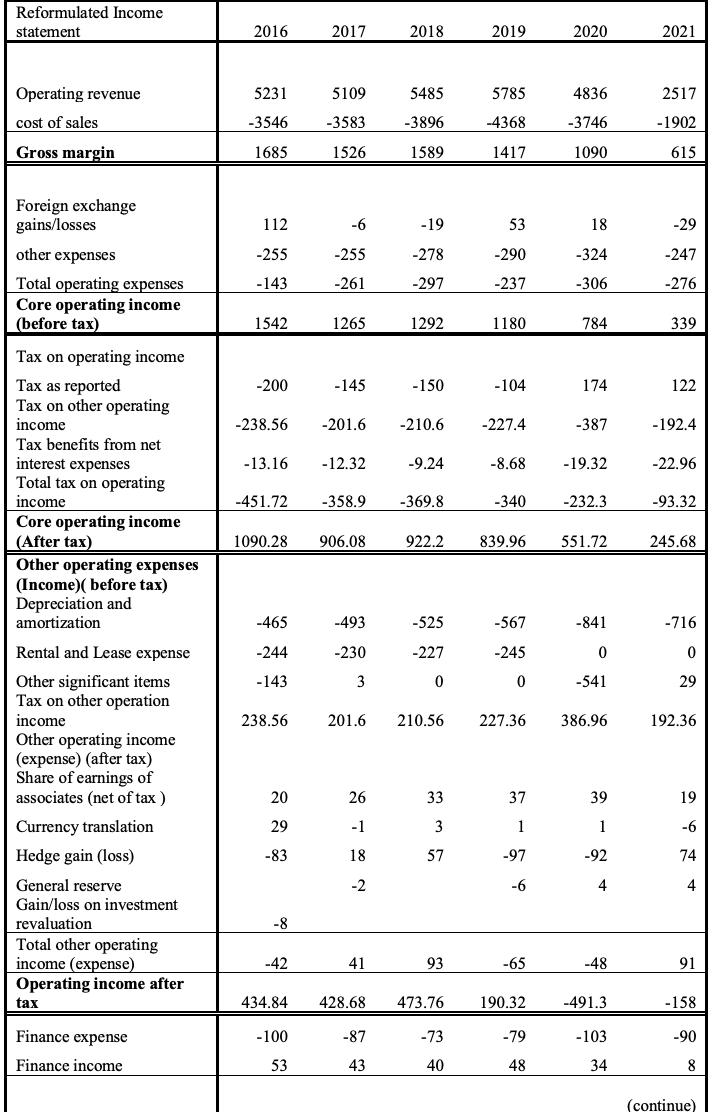

Reformulated Income statement Operating revenue cost of sales Gross margin Foreign exchange gains/losses other expenses Total operating expenses Core operating income (before tax) Tax on operating income Tax as reported Tax on other operating income Tax benefits from net interest expenses Total tax on operating income Core operating income (After tax) Other operating expenses (Income)( before tax) Depreciation and amortization Rental and Lease expense Other significant items Tax on other operation income Other operating income (expense) (after tax) Share of earnings of associates (net of tax ) Currency translation Hedge gain (loss) General reserve Gain/loss on investment revaluation Total other operating income (expense) Operating income after tax Finance expense Finance income 2016 5231 -3546 1685 112 -255 -143 1542 -200 -13.16 -451.72 1090.28 -465 -244 -143 238.56 -238.56 -201.6 20 29 -83 -8 -42 2017 -100 53 5109 5485 -3583 -3896 1526 1589 -6 -255 -261 1265 -145 -12.32 906.08 -493 -230 3 26 -1 18 -2 2018 41 434.84 428.68 -358.9 -369.8 -19 -278 -297 -87 43 1292 -150 -9.24 -525 -227 0 -210.6 -227.4 33 3 57 2019 5785 -4368 1417 93 53 -290 -237 201.6 210.56 227.36 1180 922.2 839.96 -73 40 -104 -8.68 -340 -567 -245 0 37 1 -97 -6 -65 473.76 190.32 -79 48 2020 4836 -3746 1090 18 -324 -306 784 174 -387 -19.32 -232.3 551.72 -841 0 -541 386.96 39 1 -92 4 -48 -491.3 -103 34 2021 2517 -1902 615 -29 -247 -276 339 122 -192.4 -22.96 -93.32 245.68 -716 0 29 192.36 19 -6 74 4 91 -158 -90 8 (continue)

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started