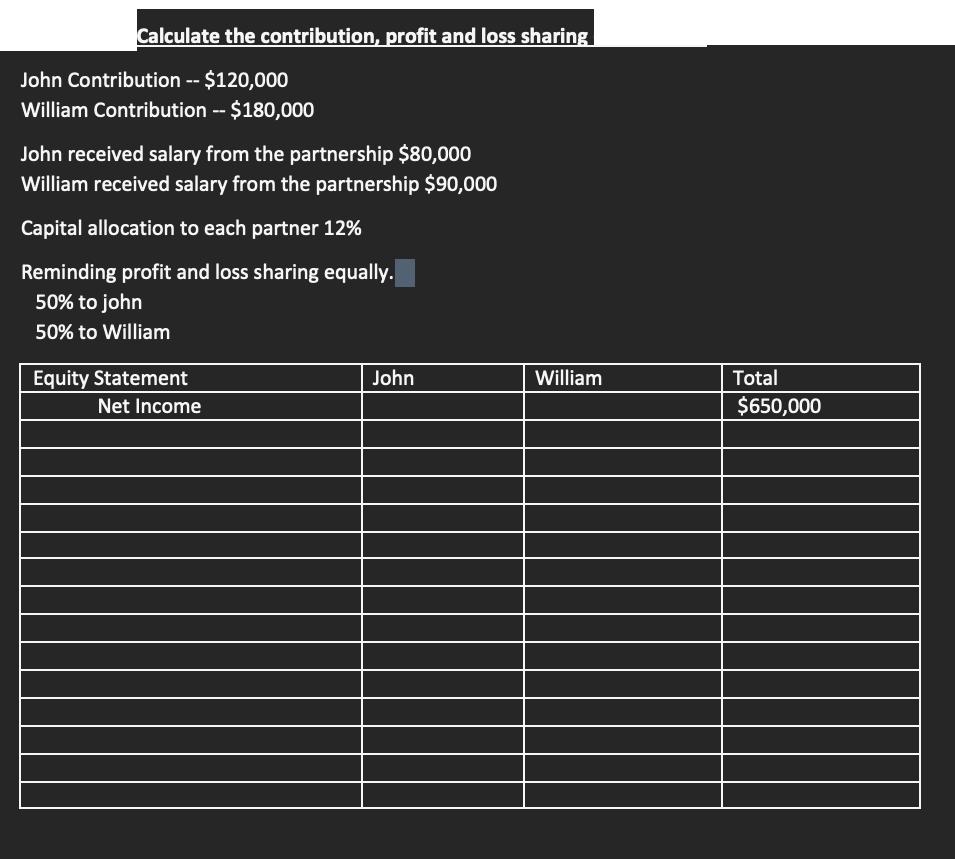

Question: Calculate the contribution, profit and loss sharing John Contribution -- $120,000 William Contribution-- $180,000 John received salary from the partnership $80,000 William received salary

Calculate the contribution, profit and loss sharing John Contribution -- $120,000 William Contribution-- $180,000 John received salary from the partnership $80,000 William received salary from the partnership $90,000 Capital allocation to each partner 12% Reminding profit and loss sharing equally. 50% to john 50% to William Equity Statement Net Income John William Total $650,000

Step by Step Solution

There are 3 Steps involved in it

C Net income Less Salary John William D Capital allocation John 12000012 Willi... View full answer

Get step-by-step solutions from verified subject matter experts