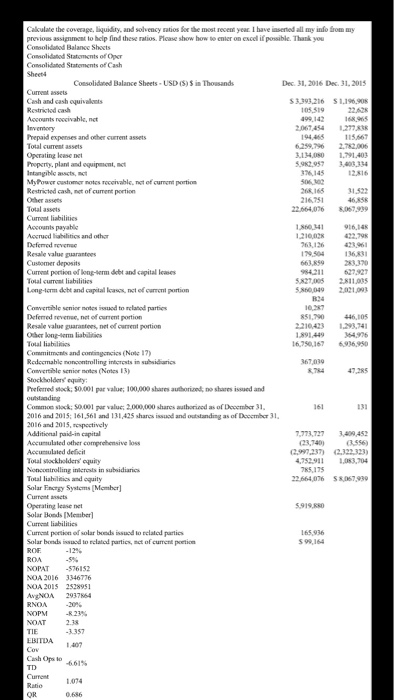

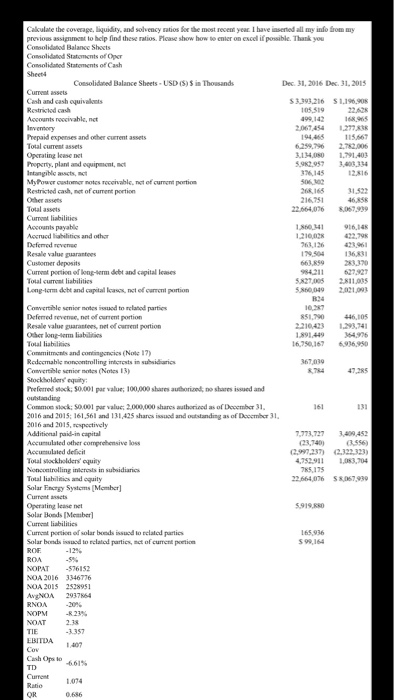

Calculate the coverage, liquity, and solvency ratios. This is for Tesla. No more info should be required but this is everything I have solved for already. Picture is clear enough to read just may need to be slightly zoomed in on. All numbers necessary to find these 3 ratios should be included in the picture.

Calculate the coverage, liquity, and solvency ratios. This is for Tesla. No more info should be required but this is everything I have solved for already. Picture is clear enough to read just may need to be slightly zoomed in on. All numbers necessary to find these 3 ratios should be included in the picture.

Calculate the coverape, liquidity, and solvency atios fo the most recen year I have inserted all my info from my previous assignment to help find these ratios. Plcase show how to enier on escel if possible. Thank you Consolidatod Balance Consolidted Statements of Cash Sheet4 Consolidaned Balance Sheets-USD (3) in Thossands Dec. 31, 2016 Dec. 31, 2013 Current assets Cash and cash oquivalents Restrictod cash ecounts roocivahle, net 3.393 216 S1.196.908 22628 168.965 067454 1277838 05,519 99 14 Prepaid expenses and other current assets Total current assets Operating lease net Property, pland and equipment, mot Intangible mots, mos tyPower oustomer notes receivable, nat of cument pertion Restricted cash, net of cument portion O-her assets Total assets Curront liabilities 194 465 156 6299,7% 2,082,006 134,080 1.791.403 982.95703,334 12816 76,145 218,165 216751 1.522 22.664,076 067 939 841 916148 422,798 423.961 136.831 663,859 23370 4211 627927 82700 2811035 ccounts payable ocrued labilitics and othr 1210,028 63,126 79.504 Resale value guarantees Customer deposits Current portion oflong-erm debt and capital leases Total current liabilities Long-term debt and capital lcass, net of curent portion 860,049 2021.0 R24 0.287 851,790 Convertible senior motcs isued to relatod parties Deferred revense, net of current portion Resale value puarastees, net of current portion Ober long-m labiliis 446,105 210423 123,74 1.891,449 s49% 16,750,167 96950 Commitments and contingencies (Note 17) Redcemahle noncontrolling inticrosts in subsidarios Convertible senior motcs (Notes 13 tockholders equity Preferred stock $0.001 par value; 100,000 shares authorized no shares issued and 67,039 8784 47,285 161 Common slock: S0.001 par valuc 2000,000shares authoriced as of December 31 2016 and 2015; 161,56l and 131,425 sharcs issuod and outstanding as of Docembcr 31 2016 and 2015, respectively Additional paid-in capital ,773,727 3,409452 3556 2997 237) 2.322 323) 4,752911 03,704 23,740 Accumulated deicit Total stockholders' equty 785,175 Total liabilitics and oquity olar Fncrgy Systems (Mamher 22,664,076 SsD67,939 olar Bonds Measber] Curneat liabilities Cumont portion of solar boods issund to rclatcod partics olar bonds issuod to rclatod partics, net of cument poetion 165,936 5 99,164 NOPAT -576152 NOA 2016 3346776 gNOA 2937864 NOPM -K23% 1407 Cash Ops lo-661% 1074 OR Calculate the coverape, liquidity, and solvency atios fo the most recen year I have inserted all my info from my previous assignment to help find these ratios. Plcase show how to enier on escel if possible. Thank you Consolidatod Balance Consolidted Statements of Cash Sheet4 Consolidaned Balance Sheets-USD (3) in Thossands Dec. 31, 2016 Dec. 31, 2013 Current assets Cash and cash oquivalents Restrictod cash ecounts roocivahle, net 3.393 216 S1.196.908 22628 168.965 067454 1277838 05,519 99 14 Prepaid expenses and other current assets Total current assets Operating lease net Property, pland and equipment, mot Intangible mots, mos tyPower oustomer notes receivable, nat of cument pertion Restricted cash, net of cument portion O-her assets Total assets Curront liabilities 194 465 156 6299,7% 2,082,006 134,080 1.791.403 982.95703,334 12816 76,145 218,165 216751 1.522 22.664,076 067 939 841 916148 422,798 423.961 136.831 663,859 23370 4211 627927 82700 2811035 ccounts payable ocrued labilitics and othr 1210,028 63,126 79.504 Resale value guarantees Customer deposits Current portion oflong-erm debt and capital leases Total current liabilities Long-term debt and capital lcass, net of curent portion 860,049 2021.0 R24 0.287 851,790 Convertible senior motcs isued to relatod parties Deferred revense, net of current portion Resale value puarastees, net of current portion Ober long-m labiliis 446,105 210423 123,74 1.891,449 s49% 16,750,167 96950 Commitments and contingencies (Note 17) Redcemahle noncontrolling inticrosts in subsidarios Convertible senior motcs (Notes 13 tockholders equity Preferred stock $0.001 par value; 100,000 shares authorized no shares issued and 67,039 8784 47,285 161 Common slock: S0.001 par valuc 2000,000shares authoriced as of December 31 2016 and 2015; 161,56l and 131,425 sharcs issuod and outstanding as of Docembcr 31 2016 and 2015, respectively Additional paid-in capital ,773,727 3,409452 3556 2997 237) 2.322 323) 4,752911 03,704 23,740 Accumulated deicit Total stockholders' equty 785,175 Total liabilitics and oquity olar Fncrgy Systems (Mamher 22,664,076 SsD67,939 olar Bonds Measber] Curneat liabilities Cumont portion of solar boods issund to rclatcod partics olar bonds issuod to rclatod partics, net of cument poetion 165,936 5 99,164 NOPAT -576152 NOA 2016 3346776 gNOA 2937864 NOPM -K23% 1407 Cash Ops lo-661% 1074 OR

Calculate the coverage, liquity, and solvency ratios. This is for Tesla. No more info should be required but this is everything I have solved for already. Picture is clear enough to read just may need to be slightly zoomed in on. All numbers necessary to find these 3 ratios should be included in the picture.

Calculate the coverage, liquity, and solvency ratios. This is for Tesla. No more info should be required but this is everything I have solved for already. Picture is clear enough to read just may need to be slightly zoomed in on. All numbers necessary to find these 3 ratios should be included in the picture.