Question

Calculate the cumulative one-year repricing gap (CGAP) for FYE 2022 under the following assumptions: Balances with Central Banks are interest free, amounts due from banks

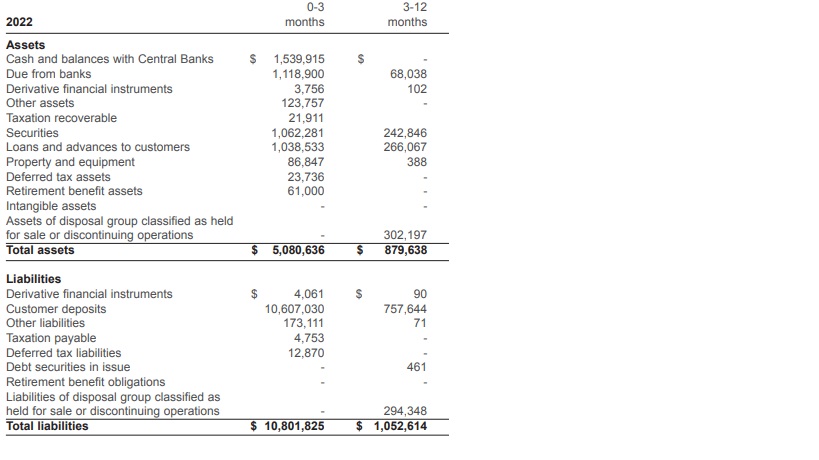

Calculate the cumulative one-year repricing gap (CGAP) for FYE 2022 under the following assumptions: Balances with Central Banks are interest free, amounts due from banks all carry fixed rates, 60% of loans and advances are rate sensitive, 25% of deposits and 50% of investment securities and 100% debt securities in issue are rate sensitive. Refer to the table on page 132 of the annual report for the appropriate inputs. (7 marks) 6. Calculate the gap ratio. Based on this ratio, will net interest income rise or fall if interest rates rise? (3 marks) 7. Calculate the dollar impact on net interest income of a 2% rise in interest rates.

\begin{tabular}{|c|c|c|c|c|} \hline 2022 & & \begin{tabular}{r} 03 \\ months \end{tabular} & & \begin{tabular}{r} 312 \\ months \end{tabular} \\ \hline \multicolumn{5}{|l|}{ Assets } \\ \hline Cash and balances with Central Banks & $ & 1,539,915 & \$ & - \\ \hline Due from banks & & 1,118,900 & & 68,038 \\ \hline Derivative financial instruments & & 3,756 & & 102 \\ \hline Other assets & & 123,757 & & - \\ \hline Taxation recoverable & & 21,911 & & \\ \hline Securities & & 1,062,281 & & 242,846 \\ \hline Loans and advances to customers & & 1,038,533 & & 266,067 \\ \hline Property and equipment & & 86,847 & & 388 \\ \hline Deferred tax assets & & 23,736 & & - \\ \hline Retirement benefit assets & & 61,000 & & - \\ \hline Intangible assets & & - & & - \\ \hline \begin{tabular}{l} Assets of disposal group classified as held \\ for sale or discontinuing operations \end{tabular} & & = & & 302,197 \\ \hline Total assets & $ & 5,080,636 & $ & 879,638 \\ \hline \multicolumn{5}{|l|}{ Liabilities } \\ \hline Derivative financial instruments & $ & 4,061 & $ & 90 \\ \hline Customer deposits & & 10,607,030 & & 757,644 \\ \hline Other liabilities & & 173,111 & & 71 \\ \hline Taxation payable & & 4,753 & & - \\ \hline Deferred tax liabilities & & 12,870 & & - \\ \hline Debt securities in issue & & - & & 461 \\ \hline Retirement benefit obligations & & - & & - \\ \hline \begin{tabular}{l} Liabilities of disposal group classified as \\ held for sale or discontinuing operations \end{tabular} & & = & & 294,348 \\ \hline Total liabilities & $ & 10,801,825 & $ & 1,052,614 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started