Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the cumulative translation adjustment for this U.S. MNC, translating the balance sheet and income statement of a French subsidiary, which keeps its books in

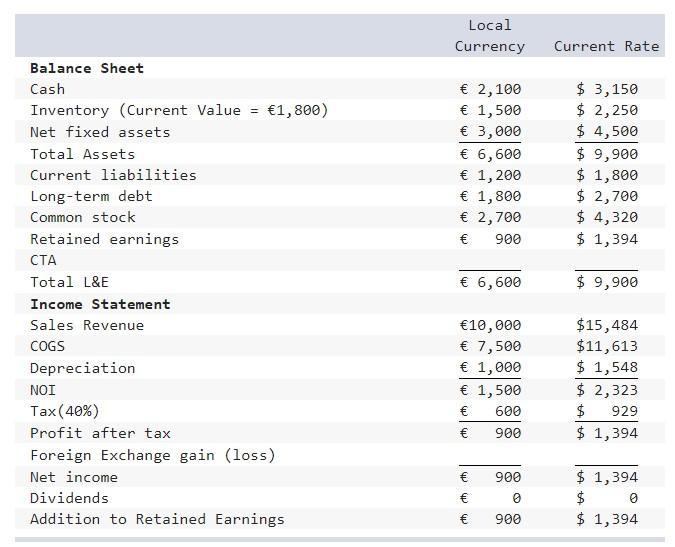

Calculate the cumulative translation adjustment for this U.S. MNC, translating the balance sheet and income statement of a French subsidiary, which keeps its books in euro, but that is translated into U.S. dollars using the current rate method, the reporting currency of the U.S. MNC. The subsidiary is at the end of its first year of operation. The historical exchange rate is $1.60/€1.00 and the most recent exchange rate is $1.50/€.

Please provide a formula or a break down on how you come up with the answer.

Balance Sheet Cash Inventory (Current Value = 1,800) Net fixed assets Total Assets Current liabilities Long-term debt Common stock Retained earnings CTA Total L&E Income Statement Sales Revenue COGS Depreciation NOI Tax (40%) Profit after tax Foreign Exchange gain (loss) Net income Dividends Addition to Retained Earnings Local Currency Current Rate 2,100 1,500 3,000 6,600 1,200 1,800 2,700 900 6,600 10,000 7,500 1,000 1,500 600 900 900 0 900 th th $ 3,150 $ 2,250 $ 4,500 $ 9,900 $ 1,800 $ 2,700 $ 4,320 $ 1,394 $ 9,900 $15,484 $11,613 $ 1,548 $ 2,323 $ 929 $ 1,394 $ 1,394 $ 0 $ 1,394

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started