Answered step by step

Verified Expert Solution

Question

1 Approved Answer

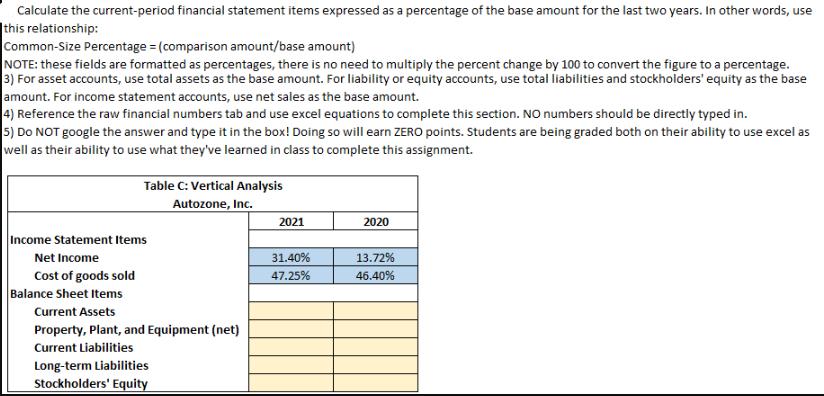

Calculate the current-period financial statement items expressed as a percentage of the base amount for the last two years. In other words, use this

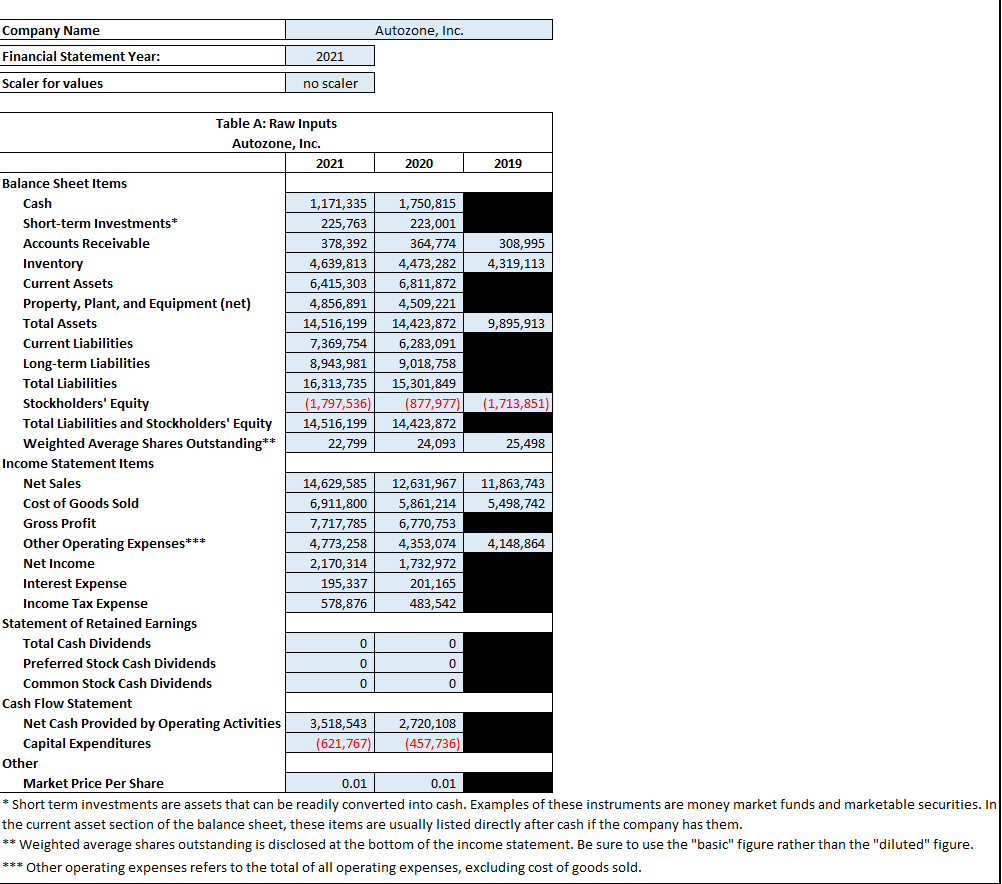

Calculate the current-period financial statement items expressed as a percentage of the base amount for the last two years. In other words, use this relationship: Common-Size Percentage = (comparison amount/base amount) NOTE: these fields are formatted as percentages, there is no need to multiply the percent change by 100 to convert the figure to a percentage. 3) For asset accounts, use total assets as the base amount. For liability or equity accounts, use total liabilities and stockholders' equity as the base amount. For income statement accounts, use net sales as the base amount. 4) Reference the raw financial numbers tab and use excel equations to complete this section. NO numbers should be directly typed in. 5) Do NOT google the answer and type it in the box! Doing so will earn ZERO points. Students are being graded both on their ability to use excel as well as their ability to use what they've learned in class to complete this assignment. Table C: Vertical Analysis Autozone, Inc. Income Statement Items Net Income Cost of goods sold Balance Sheet Items Current Assets Property, Plant, and Equipment (net) Current Liabilities Long-term Liabilities Stockholders' Equity 2021 2020 31.40% 13.72% 47.25% 46.40% Company Name Financial Statement Year: Scaler for values 2021 no scaler Autozone, Inc. Table A: Raw Inputs Autozone, Inc. 2021 2020 2019 Balance Sheet Items Cash Short-term Investments* Accounts Receivable Inventory Current Assets 1,171,335 225,763 1,750,815 223,001 378,392 364,774 308,995 4,639,813 4,473,282 4,319,113 6,415,303 6,811,872 Property, Plant, and Equipment (net) 4,856,891 4,509,221 Total Assets Current Liabilities 14,516,199 14,423,872 9,895,913 7,369,754 6,283,091 Long-term Liabilities 8,943,981 9,018,758 Total Liabilities 16,313,735 15,301,849 Stockholders' Equity (1,797,536) (877,977) (1,713,851) Total Liabilities and Stockholders' Equity 14,516,199 14,423,872 Weighted Average Shares Outstanding** 22,799 24,093 25,498 Income Statement Items Net Sales Cost of Goods Sold Gross Profit *** Other Operating Expenses* Net Income Interest Expense 14,629,585 12,631,967 11,863,743 6,911,800 5,861,214 5,498,742 7,717,785 6,770,753 4,773,258 4,353,074 4,148,864 2,170,314 1,732,972 195,337 201,165 578,876 483,542 Income Tax Expense Statement of Retained Earnings Total Cash Dividends Preferred Stock Cash Dividends Common Stock Cash Dividends 0 0 0 0 0 0 Cash Flow Statement Net Cash Provided by Operating Activities 3,518,543 Capital Expenditures (621,767) 2,720,108 (457,736) Other Market Price Per Share 0.01 0.01 * Short term investments are assets that can be readily converted into cash. Examples of these instruments are money market funds and marketable securities. In the current asset section of the balance sheet, these items are usually listed directly after cash if the company has them. ** Weighted average shares outstanding is disclosed at the bottom of the income statement. Be sure to use the "basic" figure rather than the "diluted" figure. *** Other operating expenses refers to the total of all operating expenses, excluding cost of goods sold.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Income Statement Items Net Income 2021 RAWB30 Net Income for 2021 RAWB29 Net Sales for 2021 1160 370...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664306507cf48_952986.pdf

180 KBs PDF File

664306507cf48_952986.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started