Answered step by step

Verified Expert Solution

Question

1 Approved Answer

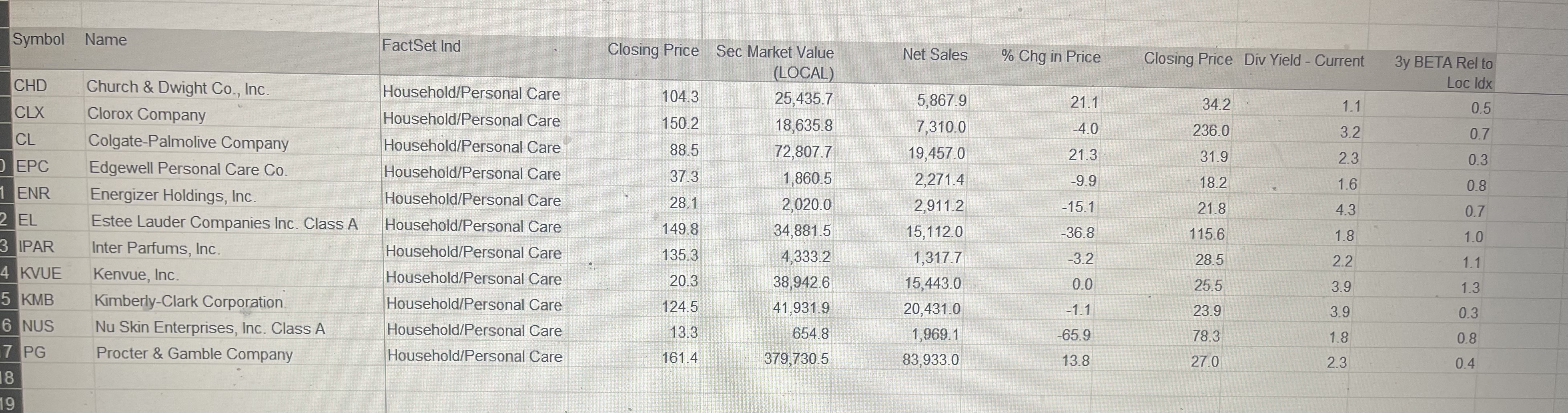

Calculate the data highlighted in green, based on 3 portfolios containing your companies using 3 different weightings. Equal weighting Market value weighting ( assumes the

Calculate the data highlighted in green, based on portfolios containing your companies using different weightings.

Equal weighting

Market value weighting

assumes the investor invests an equal of her assets in each stock

Company Net Sales weighting

assumes the investor's allocation to each stock is that stock's market capitalization as a of the entire portfolio's market capitalizationassumes the investor's allocation to each stock is that stock's Net Sales as a of the Net Sales of all stocks in the portfolio combined

There are items to calculate for each of the portfolios. You'll get mark for each correct answer. Maximum marks

NOTE: For each portfolio's Treynor Ratio calculation use the Price Change as the portfolio return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started