Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the depreciation expense for 2018 In 2015, Lyra Co. acquired land containing ore for a total cost of P60,000,000. Immovable tangible equipment costs

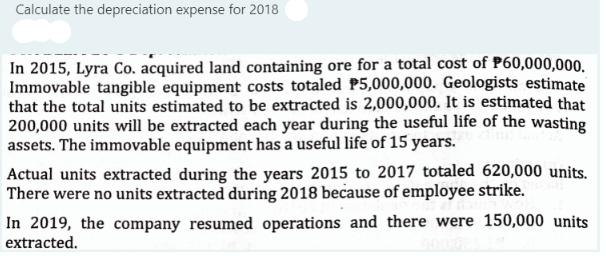

Calculate the depreciation expense for 2018 In 2015, Lyra Co. acquired land containing ore for a total cost of P60,000,000. Immovable tangible equipment costs totaled P5,000,000. Geologists estimate that the total units estimated to be extracted is 2,000,000. It is estimated that 200,000 units will be extracted each year during the useful life of the wasting assets. The immovable equipment has a useful life of 15 years. Actual units extracted during the years 2015 to 2017 totaled 620,000 units. There were no units extracted during 2018 because of employee strike. In 2019, the company resumed operations and there were 150,000 units extracted.

Step by Step Solution

★★★★★

3.36 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the depreciation expense for 2018 we need to determine the carrying amount of the wasti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started