Answered step by step

Verified Expert Solution

Question

1 Approved Answer

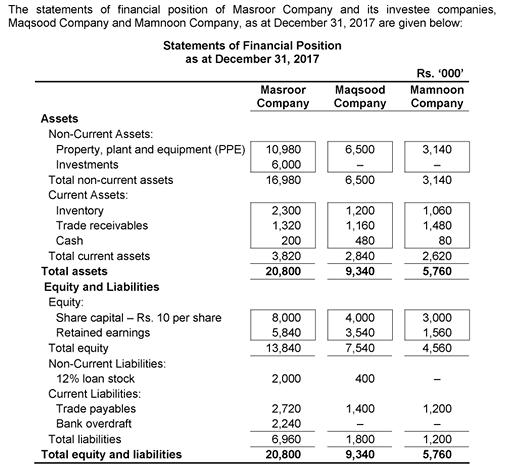

The statements of financial position of Masroor Company and its investee companies, Maqsood Company and Mamnoon Company, as at December 31, 2017 are given

The statements of financial position of Masroor Company and its investee companies, Maqsood Company and Mamnoon Company, as at December 31, 2017 are given below: Assets Non-Current Assets: Property, plant and equipment (PPE) Investments Statements of Financial Position as at December 31, 2017 Total non-current assets Current Assets: Inventory Trade receivables Cash Total current assets Total assets Equity and Liabilities Equity: Share capital - Rs. 10 per share Retained earnings Total equity Non-Current Liabilities: 12% loan stock Current Liabilities: Trade payables Bank overdraft Total liabilities Total equity and liabilities Masroor Company 10,980 6,000 16,980 2,300 1,320 200 3,820 20,800 8,000 5,840 13,840 2,000 2,720 2,240 6,960 20,800 Maqsood Company 6,500 6,500 1,200 1,160 480 2,840 9,340 4,000 3,540 7,540 400 1,400 1,800 9,340 Rs. '000' Mamnoon Company 3,140 3,140 1,060 1,480 80 2,620 5,760 3,000 1,560 4,560 I 1,200 1,200 5,760 Required: Prepare, in a format suitable for inclusion in the annual report of the Masroor Group, the consolidated statement of financial position as at December 31, 2017.

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a What is the total equity of Masroor Company and its investee companies as at December 31 2017 The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started