Answered step by step

Verified Expert Solution

Question

1 Approved Answer

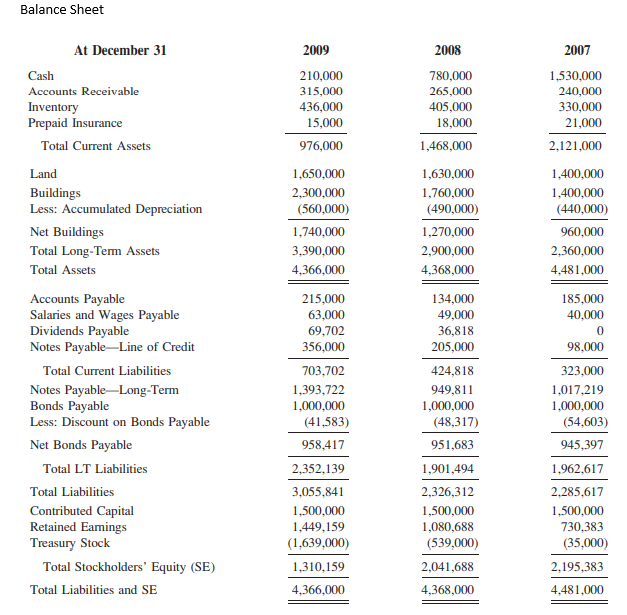

Calculate the dollar amount of dividends that were declared during 2009 based on following statements. Balance Sheet 2007 2008 780,000 265,000 405,000 18,000 1,468,000 1,530,000

Calculate the dollar amount of dividends that were declared during 2009 based on following statements.

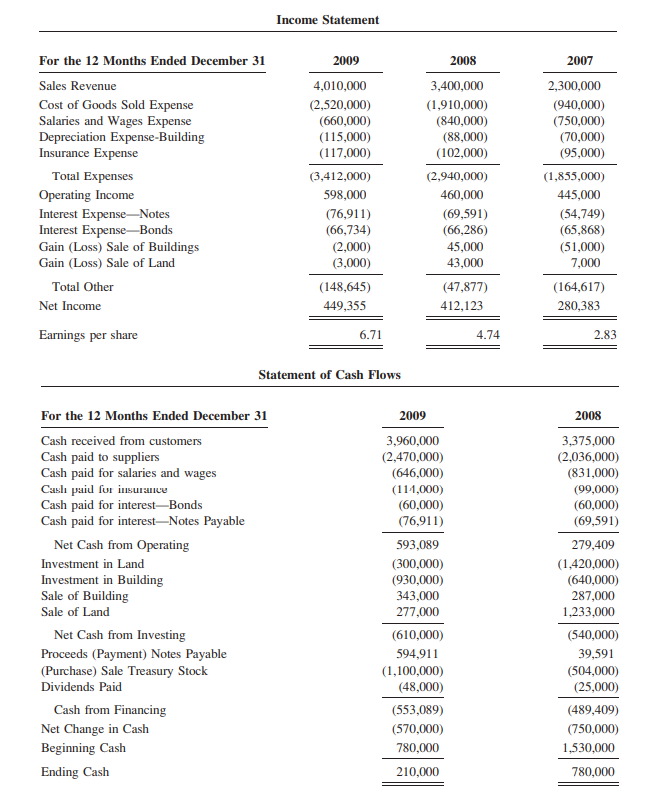

Balance Sheet 2007 2008 780,000 265,000 405,000 18,000 1,468,000 1,530,000 240,000 330,000 21,000 2,121,000 1,400,000 1,400,000 (440,000) 960,000 2,360,000 4,481,000 At December 31 Cash Accounts Receivable Inventory Prepaid Insurance Total Current Assets Land Buildings Less: Accumulated Depreciation Net Buildings Total Long-Term Assets Total Assets Accounts Payable Salaries and Wages Payable Dividends Payable Notes Payable-Line of Credit Total Current Liabilities Notes Payable-Long-Term Bonds Payable Less: Discount on Bonds Payable Net Bonds Payable Total LT Liabilities Total Liabilities Contributed Capital Retained Eamings Treasury Stock Total Stockholders' Equity (SE) Total Liabilities and SE 2009 210,000 315,000 436,000 15,000 976,000 1,650,000 2,300,000 (560,000) 1,740,000 3,390,000 4,366,000 215,000 63.000 69,702 356,000 703,702 1,393,722 1,000,000 (41,583) 958,417 2,352,139 3,055,841 1,500,000 1,449,159 (1,639,000) 1,310,159 1,630,000 1,760,000 (490,000) 1,270,000 2,900,000 4,368,000 134,000 49,000 36,818 205,000 424,818 949,811 1,000,000 (48,317) 951,683 1,901,494 2,326,312 1,500,000 1,080,688 (539,000) 2,041,688 4,368,000 185,000 40,000 0 98,000 323,000 1,017,219 1,000,000 (54,603) 945,397 1,962,617 2,285,617 1,500,000 730,383 (35,000) 2,195,383 4,481,000 4,366,000 Income Statement 2008 For the 12 Months Ended December 31 Sales Revenue Cost of Goods Sold Expense Salaries and Wages Expense Depreciation Expense-Building Insurance Expense Total Expenses Operating Income Interest Expense-Notes Interest Expense-Bonds Gain (Loss) Sale of Buildings Gain (Loss) Sale of Land Total Other Net Income Earnings per share 2009 4,010,000 (2,520,000) (660,000) (115,000) (117,000) 3,412,000) 598,000 (76,911) (66,734) (2,000) (3,000) (148,645) 449,355 3,400,000 (1,910,000) (840,000) (88,000) (102,000) (2,940,000) 460,000 (69,591) (66,286) 45,000 43,000 (47,877) 412,123 2007 2,300,000 (940,000) (750,000) (70,000) (95,000) (1,855,000) 445,000 (54,749) (65,868) (51,000) 7,000 (164,617) 280,383 6.71 4.74 2.83 Statement of Cash Flows 2008 For the 12 Months Ended December 31 Cash received from customers Cash paid to suppliers Cash paid for salaries and wages Casil paid for insurance Cash paid for interest-Bonds Cash paid for interest-Notes Payable Net Cash from Operating Investment in Land Investment in Building Sale of Building Sale of Land Net Cash from Investing Proceeds (Payment) Notes Payable (Purchase) Sale Treasury Stock Dividends Paid Cash from Financing Net Change in Cash Beginning Cash Ending Cash 2009 3,960,000 (2,470,000) (646,000) (114,000) (60,000) (76,911) 593,089 (300,000) (930,000) 343,000 277,000 (610,000) 594,911 (1,100,000) (48,000) (553,089) (570,000) 780,000 210,000 3,375,000 (2,036,000) (831,000) (99,000) (60,000) (69,591) 279,409 (1,420,000) (640,000) 287,000 1,233,000 (540,000) 39,591 (504,000) (25,000) (489,409) (750,000) 1,530,000 780,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started