Answered step by step

Verified Expert Solution

Question

1 Approved Answer

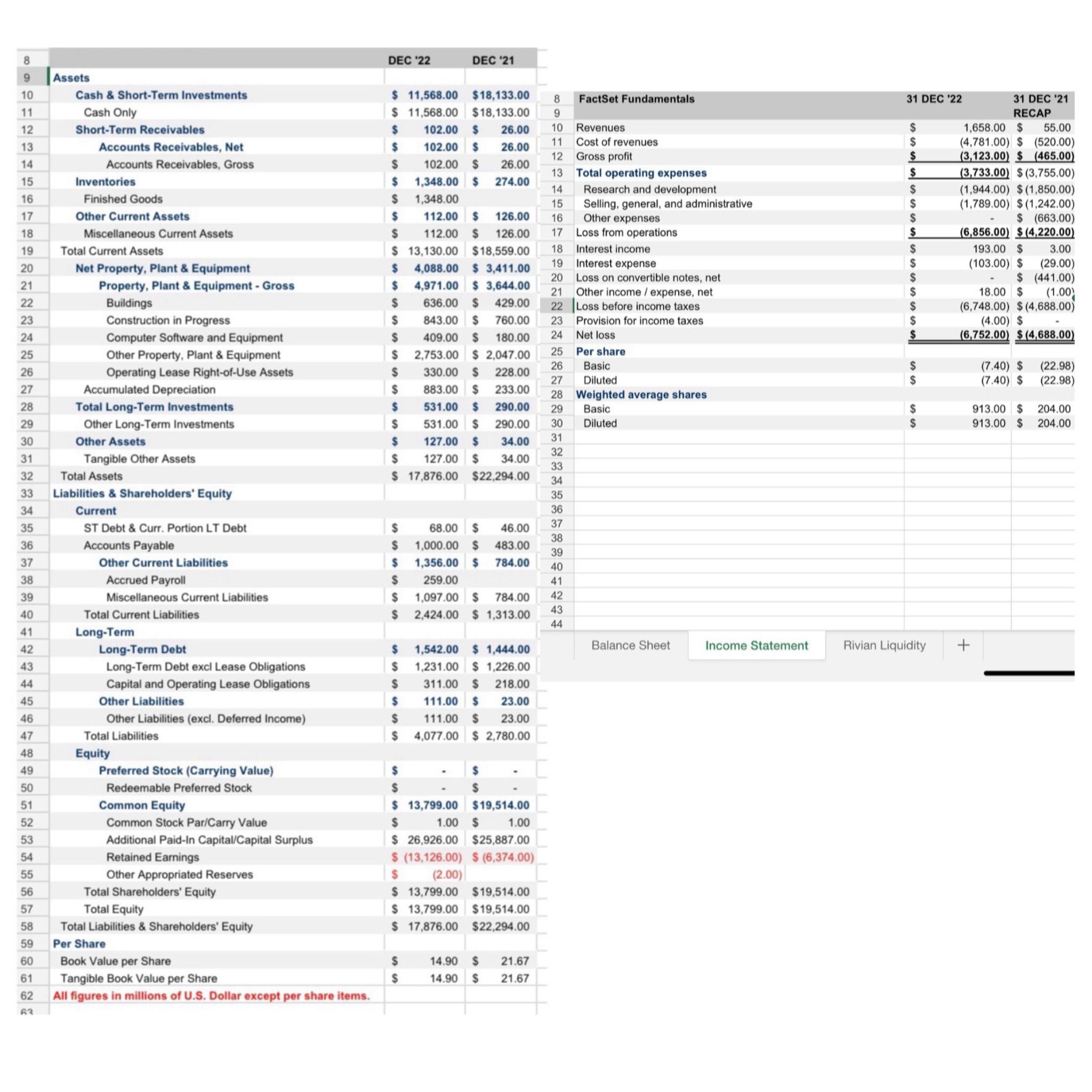

Calculate the DPO: Days Payable Outstanding 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26

Calculate the DPO: Days Payable Outstanding

8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 Assets Cash & Short-Term Investments Cash only Short-Term Receivables Accounts Receivables, Net Accounts Receivables, Gross Inventories Finished Goods Other Current Assets Miscellaneous Current Assets Total Current Assets Net Property, Plant & Equipment Property. Plant & Equipment Gross Buildings Construction in Progress Computer Software and Equipment Other Property. Plant & Equipment Operating Lease Right-of-Use Assets Accumulated Depreciation Total Long-Term Investments Other Long-Term Investments Other Assets Tangible Other Assets Total Assets Liabilities & Shareholders' Equity Current ST Debt & Cum Portion LT Debt Accounts Payable Other Current Liabilities Accrued Payroll Miscellaneous Current Liabilities Total Current Liabilities Long-Term Long-Term Debt Long-Term Debt excl Lease Obligations Capital and Operating Lease Obligations Other Liabilities Other Liabilities (excl. Deferred Income) Total Liabilities Equity Preferred Stock (Carrying Value) Redeemable Preferred Stock Common Equity Common Stock Par/Carry Value Additional Paid-ln CapitaVCapital Surplus Retained Earnings Other Appropriated Reserves Total Shareholders' Equity Total Equity Total Liabilities & Shareholders' Equity Per Share Book Value per Share Tangible Book Value per Share All figures in millions of U.S. Dollar except per share items. DEC '22 11,568.00 11,568.00 102.00 102.00 102.00 1,348.00 s 1,348.00 112.00 s 112.00 13,130.00 4,088.00 4,971.00 s 636.00 s 843.00 s 409.00 2,753.00 s 330.00 883.00 531.00 s 531.00 127.00 s 127.00 s 17,876.00 s 68.00 1,000.00 1,356.00 s 259.00 s 1.097.oo S 2,424.00 1,542.00 s 1231.00 311.00 111.00 111.00 4.077.00 13,799.00 s 1.00 s 26,926.00 $ (13,126.00) S (200) 13,799.00 13,799.00 17,876.00 14.90 14.90 DEC '21 $18,133.00 $18,133.00 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 OFactSet Fundamentals Revenues Cost of revenues Gross profit Total operating expenses Research and development Selling, general, and administrative Other expenses Loss from operations Interest income Interest expense Loss on convertible notes. net Other income / expense. net Loss before income taxes Provision for income taxes Net loss Per share Basic Diluted Weighted average shares 31 DEC '22 s s 26.00 26.00 26.00 274.00 126.00 126.00 1,658.00 (4,781.00) (3.123.00) (3.733.00) (1 ,944.00) (1,789.00) (6.856.00) 193,00 (103.00) 18,00 (6,748.00) (4.00) $ (7.40) $ (7.40) $ 913.00 $ 913.00 $ 31 DEC '211 RECAp $ 55.00 $ (520.00) (465.00) $ (3,755.00) $ (1.850.00) $ (1242.00) $ (663.00) $ (4,220.00) 3.00 $ (29.00) $ (441.00) (1.00\ $ (4,688.00) s 18.559.00 $ 3,411.00 $ 364400 s 429.00 s 760.00 s 180.00 s 2.047.oo s 228.00 233.00 290.00 s 290.00 34.00 s 34.00 $22,294.00 S 46.00 s 483.00 784.00 s 784.00 1,313.00 $ 1,444 00 s 122600 s 218.00 23.00 23.00 s 2.780.oo $19,514.00 s 1.00 $25,887.00 s (6.374.00) $19,514.00 $19,514.00 $22,294.00 (22.98) (22.98) 204.00 204.00 Basic Diluted Balance Sheet Income Statement Rivian Liquidity s 21.67 21.67

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started