Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the equivalent annual benefit (or cost) for each group of machines (Behemoth and Shikari). Based on such calculations, which machines should Mr. Moore buy,

Calculate the equivalent annual benefit (or cost) for each group of machines (Behemoth and Shikari). Based on such calculations, which machines should Mr. Moore buy, Behemoth or Shikari? is this decision reliable? if not, why?

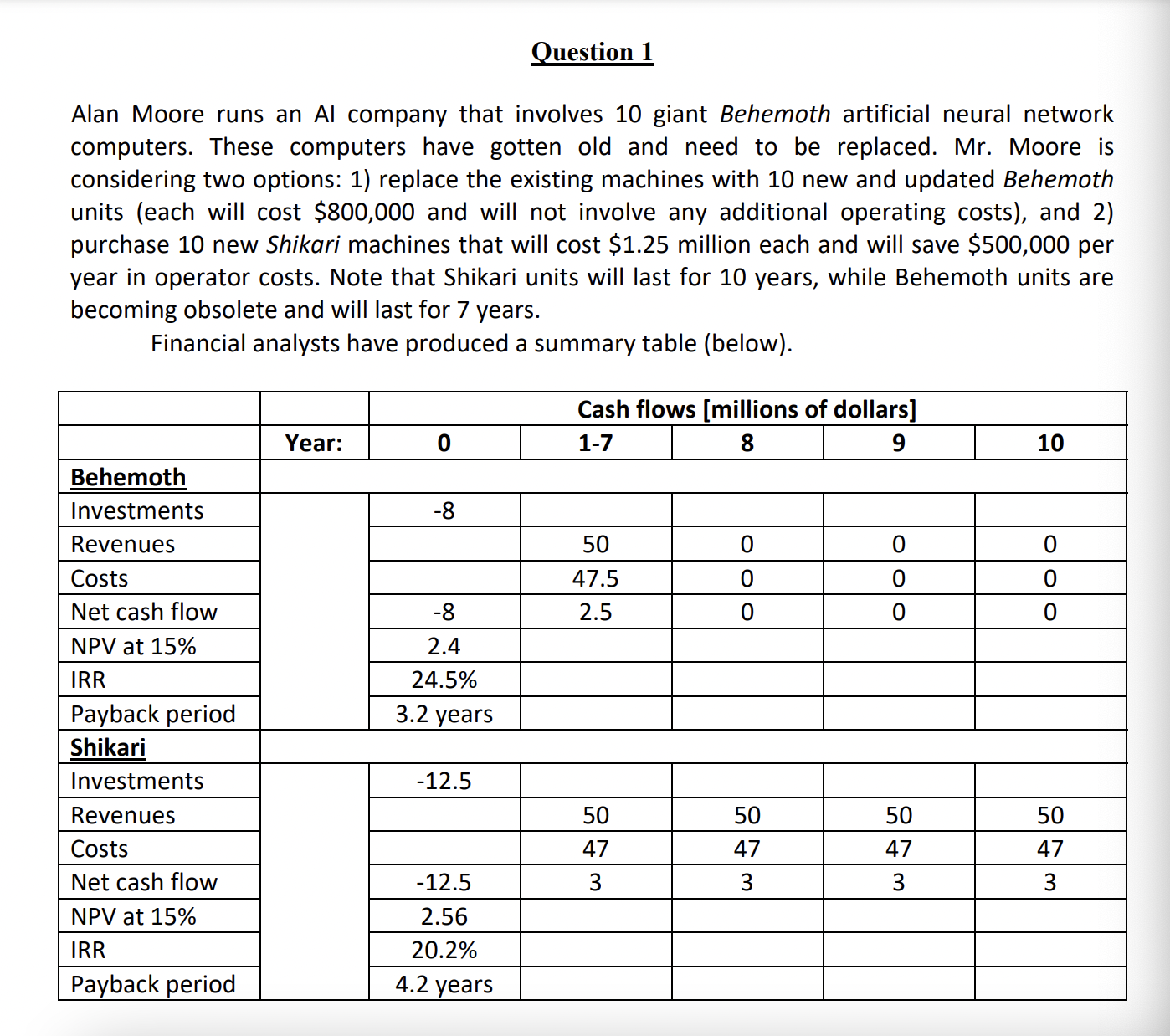

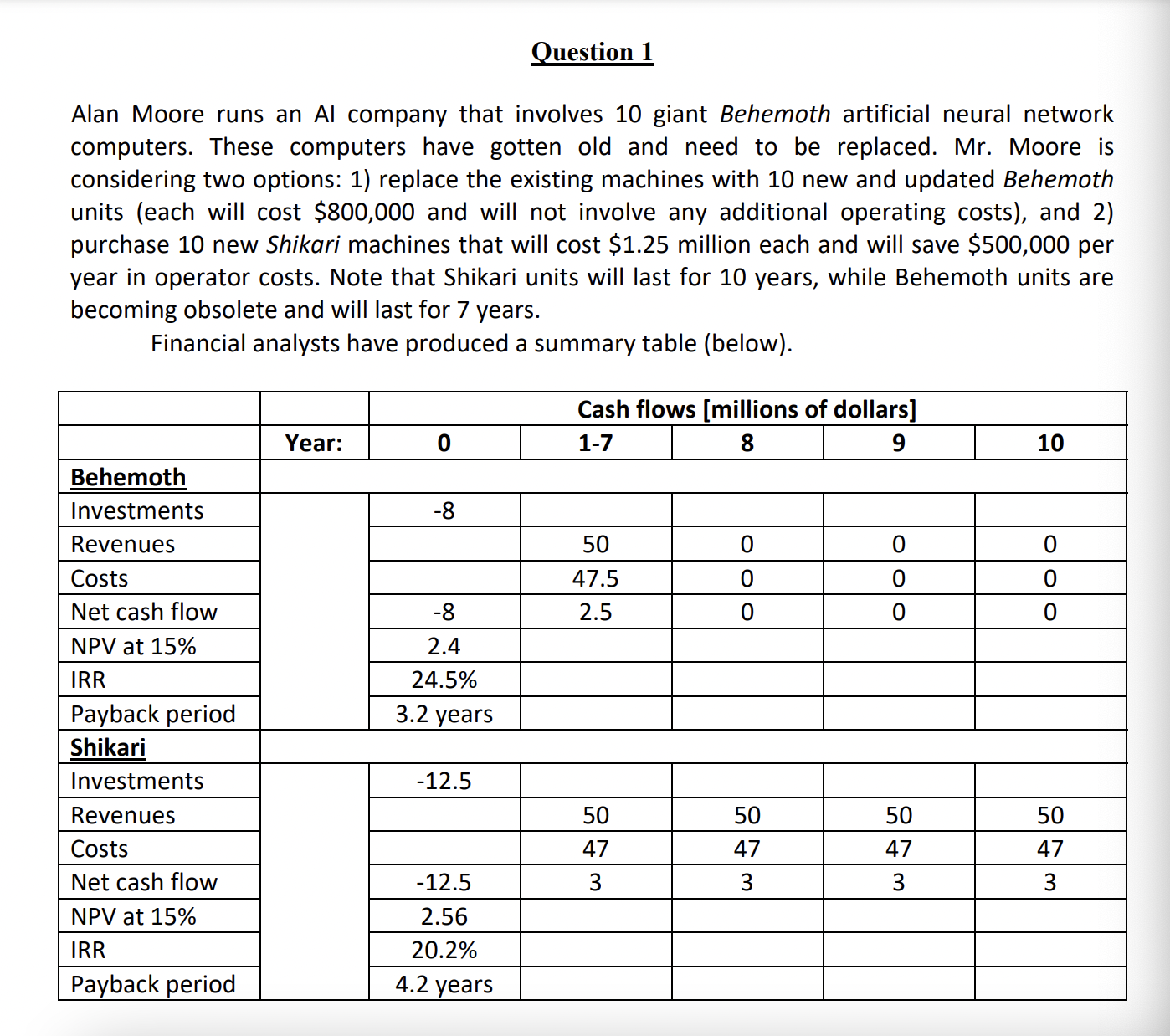

Question 1 Alan Moore runs an Al company that involves 10 giant Behemoth artificial neural network computers. These computers have gotten old and need to be replaced. Mr. Moore is considering two options: 1) replace the existing machines with 10 new and updated Behemoth units (each will cost $800,000 and will not involve any additional operating costs), and 2) purchase 10 new Shikari machines that will cost $1.25 million each and will save $500,000 per year in operator costs. Note that Shikari units will last for 10 years, while Behemoth units are becoming obsolete and will last for 7 years. Financial analysts have produced a summary table (below). Cash flows [millions of dollars] Year: 0 1-7 8 10 Behemoth Investments -8 Revenues 50 0 0 0 Costs 47.5 0 0 0 Net cash flow -8 2.5 0 0 0 NPV at 15% 2.4 IRR 24.5% Payback period 3.2 years Shikari Investments -12.5 Revenues 50 50 50 50 Costs 47 47 47 47 Net cash flow -12.5 3 3 3 3 NPV at 15% 2.56 IRR 20.2% Payback period 4.2 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the equivalent annual benefit or cost for each group of machines we need to determine the annual cash flows for each option For the Behem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started